Outlook on November 16:

Analytical overview of major pairs on the H1 TF:

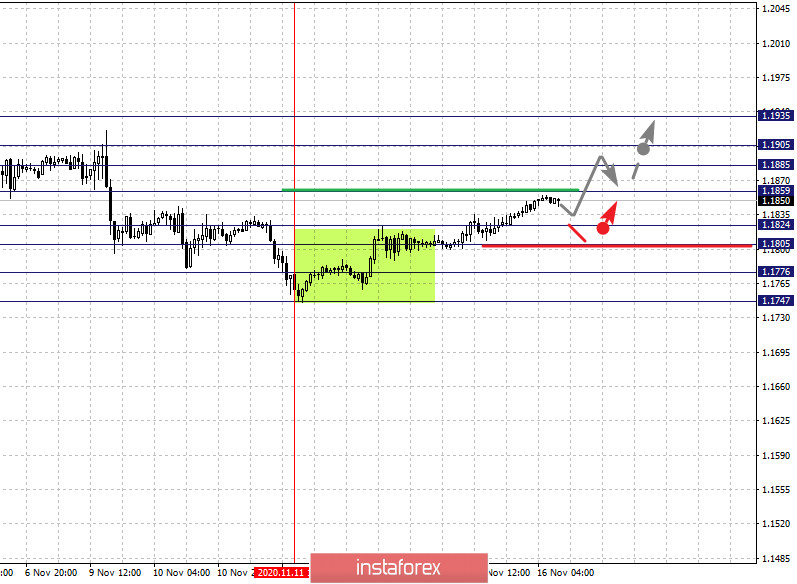

The key levels for the euro/dollar pair are 1.1935, 1.1905, 1.1885, 1.1859, 1.1824, 1.1805, 1.1776 and 1.1747. The price here is forming a potential for the upward trend from November 11. Now, the pair is expected to continue rising after breaking through the level of 1.1859. In this case, the goal is 1.1885. Meanwhile, there is a short-term growth and consolidation in the range of 1.1885 - 1.1905. For the potential value for the top, we consider the level of 1.1935. Upon reaching which, a downward pullback can be expected.

A short-term decline, in turn, is possible in the range of 1.1824 - 1.1805. If the last value breaks down, it will lead to a deep correction. The goal here is 1.1776, which is the key support for the top.

The main trend is an upward structure from November 4, the formation of a local structure from November 11

Trading recommendations:

Buy: 1.1860 Take profit: 1.1885

Buy: 1.1906 Take profit: 1.1935

Sell: 1.1824 Take profit: 1.1805

Sell: 1.1803 Take profit: 1.1776

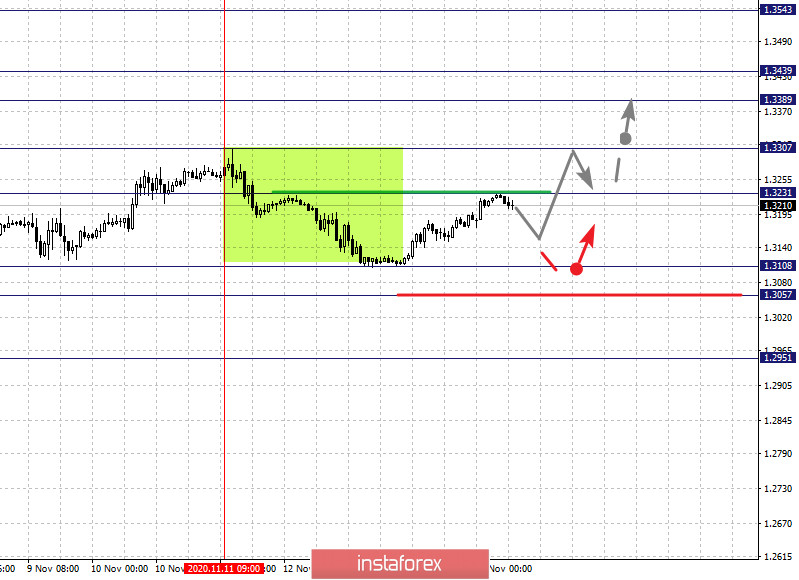

The key levels for the pound/dollar pair are 1.3439, 1.3389, 1.3307, 1.3231, 1.3108, 1.3057 and 1.2951. Here, the price is in a deep correction from the upward trend of November 2. The growth of the pair is expected to continue after the level of 1.3231 breaks down. In this case, the goal is 1.3307 and there is consolidation near this level. If this goal breaks down, it will lead to a strong growth. The next goal is 1.3389. For the potential value for the top, we consider the level of 1.3439. Upon reaching which, consolidation and downward pullback is expected.

Meanwhile, a short-term decline is expected in the range of 1.3108 - 1.3057. Breaking through the last level should be accompanied by a strong decline. The potential goal here is 1.2951.

The main trend is the upward cycle from November 2, deep correction stage

Trading recommendations:

Buy: 1.3231 Take profit: 1.3305

Buy: 1.3309 Take profit: 1.3387

Sell: 1.3106 Take profit: 1.3058

Sell: 1.3055 Take profit: 1.2953

The key levels for the dollar/franc pair are 0.9364, 0.9305, 0.9263, 0.9202, 0.9168, 0.9105 and 0.9063. The development of the rising structure from November 9 is being followed here. Moreover, a short-term growth is possible in the range of 0.9168 - 0.9202. The main trend is expected to continue after the breakdown of 0.9202. In this case, the goal is 0.9263. On the other hand, there is a short-term growth and consolidation in the range of 0.9263 - 0.9305. For the potential value for the top, we consider the level of 0.9364. Upon reaching which, a downward pullback can be expected.

On the other hand, a short-term decline is possible in the range of 0.9105 - 0.9063, breaking through the last value will encourage the development of a downside pattern. In this case, the potential goal is 0.8983.

The main trend is the upward structure from November 9, the correction stage

Trading recommendations:

Buy : 0.9168 Take profit: 0.9201

Buy : 0.9203 Take profit: 0.9260

Sell: 0.9103 Take profit: 0.9065

Sell: 0.9060 Take profit: 0.8995

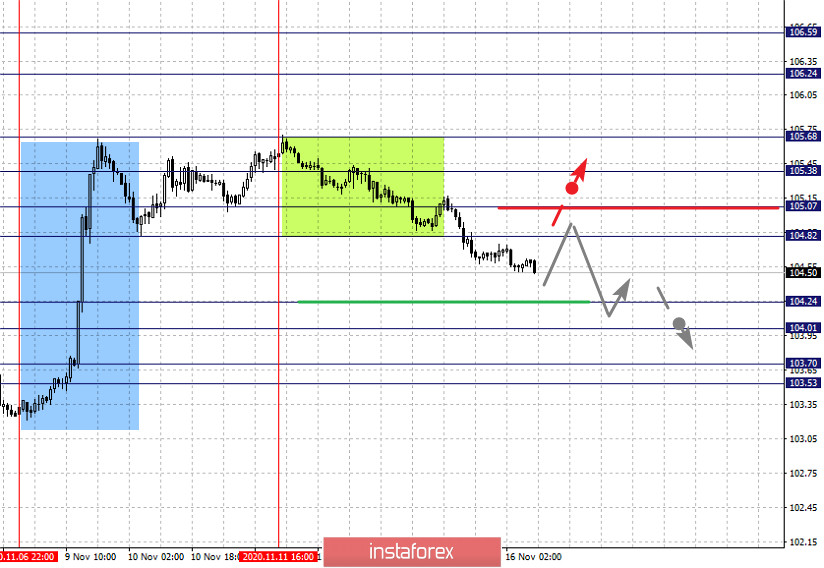

The key levels for the dollar/yen are 105.68, 105.38, 105.07, 104.82, 104.24, 104.01, 103.70 and 103.53. Here, the price is forming a downward structure from November 11. A short-term decline is expected in the range of 104.24 - 104.01. In case of breakdown of the last value, it will lead to a strong movement. The goal is 103.70. For the potential value for the bottom, we consider the level 103.53. Upon reaching which, consolidation and upward pullback is expected.

A short-term growth, in turn, is possible in the range of 104.82 - 105.07. If the last value breaks down, a deep correction will occur. Here, the goal is 105.38, which is the key support for the downward structure. Its breakdown will be conducive to the formation of potential for the upward cycle. In this case, the potential goal is 105.68.

The main trend is the formation of the descending structure from November 11

Trading recommendations:

Buy: 104.82 Take profit: 105.05

Buy : 105.08 Take profit: 105.38

Sell: 104.24 Take profit: 104.03

Sell: 104.00 Take profit: 103.70

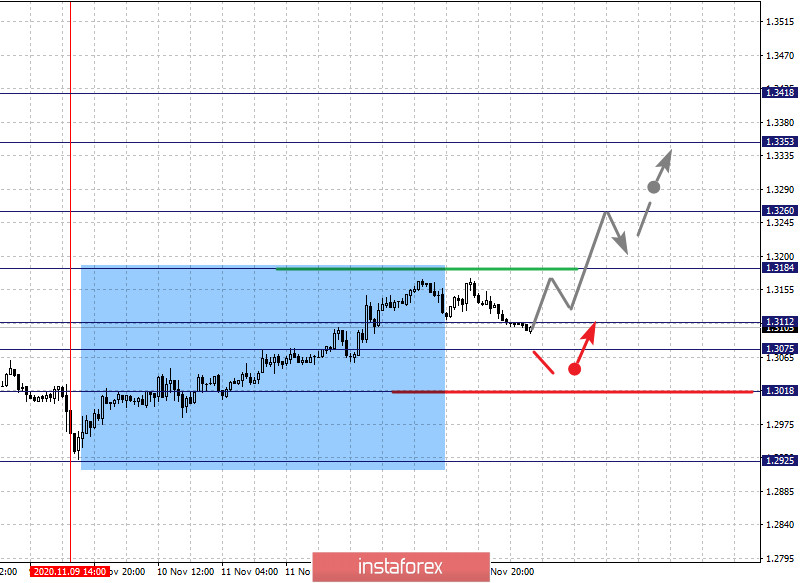

The key levels for the USD/CAD pair are 1.3418, 1.3353, 1.3260, 1.3184, 1.3112, 1.3075, 1.3018 and 1.2925. Here, we are following the formation of the upward structure from November 9. The pair is expected to rise after the level of 1.3184 breaks down. In this case, the goal is 1.3260. Price consolidation is near this level. If this target breaks down, it will lead to the development of a strong growth. The next goal is 1.335. As a potential value for the top, we consider the level of 1.3418. Upon reaching which, consolidation and downward pullback is expected.

Meanwhile, decline is possible in the range of 1.3112 - 1.3075. In case of breakdown of the last value, a deep correction will occur. The potential goal is 1.3018, which is a key support for the top.

The main trend is the upward structure from November 9

Trading recommendations:

Buy: 1.3186 Take profit: 1.3260

Buy : 1.3262 Take profit: 1.3351

Sell: 1.3111 Take profit: 1.3075

Sell: 1.3073 Take profit: 1.3018

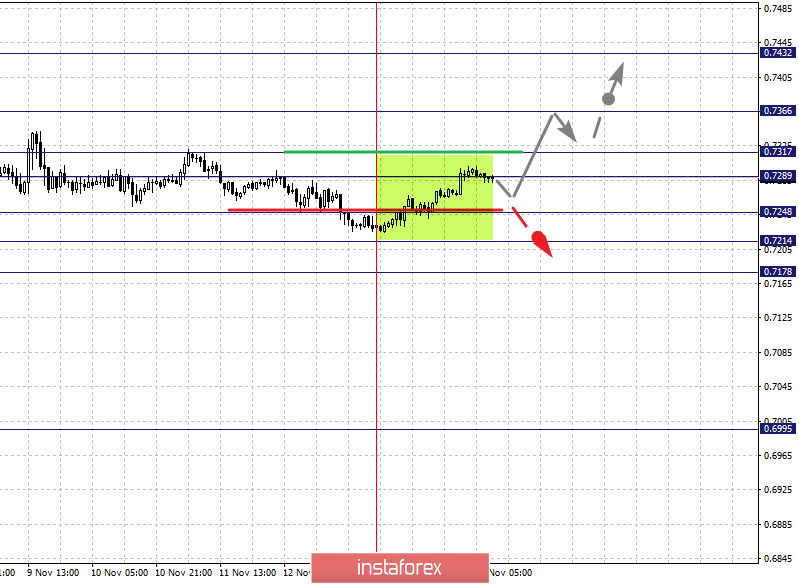

The key levels for the AUD/USD pair are 0.7432, 0.7366, 0.7317, 0.7289, 0.7248, 0.7214 and 0.7178. We continue to monitor the formation of the rising pattern from November 2. At the moment, the price has formed a local potential for the top of November 13. Now, a consolidated movement is expected in the range of 0.7289 - 0.7317. If the last value breaks down, it will lead to a strong rise. Here, the goal is 0.7366 and price consolidation is near this level. For the potential value for the top, we consider the level 0.7432. A downward pullback is likely upon reaching this level.

In turn, a short-term decline is expected in the range of 0.7248 - 0.7214. If the last value breaks down, a deep correction will occur. Here, the target is 0.7178, which is the key support for the top.

The main trend is the upward cycle from November 2

Trading recommendations:

Buy: 0.7319 Take profit: 0.7365

Buy: 0.7368 Take profit: 0.7431

Sell : 0.7246 Take profit : 0.7216

Sell: 0.7212 Take profit: 0.7180

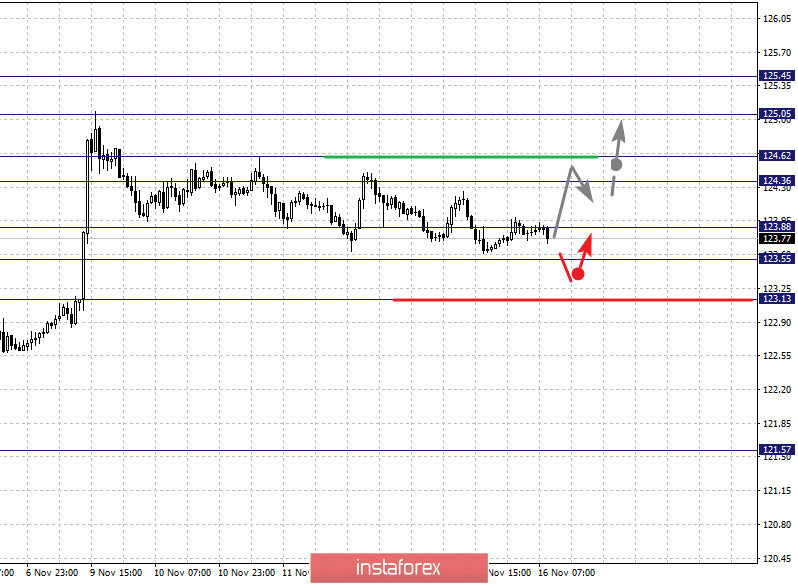

The key levels for the euro/yen pair are 125.45, 125.05, 124.62, 124.36, 123.88, 123.55 and 123.13. The rising pattern from October 30 is being followed here. At the moment, the price is in correction. On the other hand, a short-term increase is expected in the range of 124.36 - 134.62. If the last value breaks down, it will lead to the level of 125.05. For the potential value for the top, we consider the level of 125.45. Price consolidation is expected near this level.

A short-term decline is possible in the range of 123.88 - 123.55 and breaking through the last value will lead to a deep correction. The goal here is 123.13, which is the key support level for the top.

The main trend is the upward structure from October 30, the correction stage

Trading recommendations:

Buy: 124.36 Take profit: 124.61

Buy: 124.64 Take profit: 125.03

Sell: 123.88 Take profit: 123.57

Sell: 123.53 Take profit: 123.15

The key levels for the pound/yen pair are 141.43, 140.36, 139.86, 139.15, 138.72, 137.54, 136.86, 136.47 and 135.44. Here, we are following the upward pattern of October 30. The price is currently in correction. Now, growth is expected to continue after the price passes the noise range 138.72 - 139.15. In this case, the goal is 139.86. On the other hand, there is a short-term rise and consolidation in the range of 139.86 - 140.36. For the potential value for the top, we consider the level 141.43. The movement to which is expected after the breakdown of 140.36.

The development of the downward pattern from November 11 is possible after the level of 137.54 breaks down. In this case, the goal is 136.86. In turn, price consolidation is in the range of 136.86 - 136.47. For the potential value for the bottom, we consider the level of 135.44. An upward pullback is expected upon reaching this level.

The main trend is the upward structure from October 30, deep correction stage

Trading recommendations:

Buy: 139.15 Take profit: 139.85

Buy: 139.88 Take profit: 140.34

Sell: 137.54 Take profit: 136.86

Sell: 136.44 Take profit: 135.50