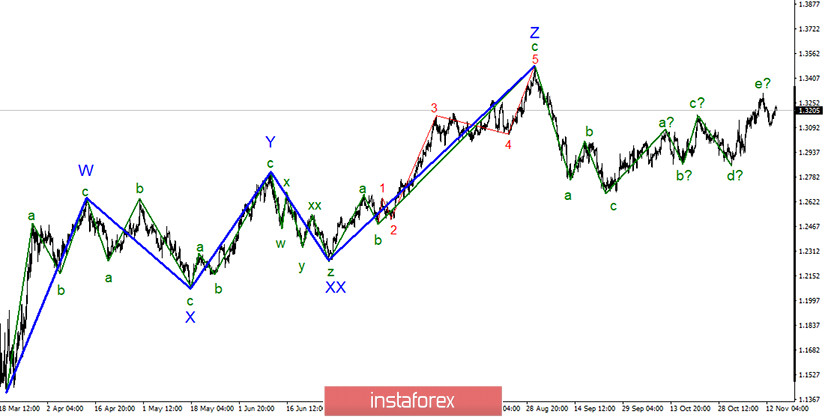

From the global viewpoint, GBP/USD is still developing the upward trend. However, the wave layout is getting more complicated. The trend section, which began on September 23, now consists of five waves. Importantly, this uptrend section does not show obvious momentum and could have been over. Thus, the price could have started a formation of a new three-wave section of the downtrend which could build a more complicated structure. Anyway, the technical picture looks like that.

In the chart of a shorter timeframe, we can clearly see a-b-c-d waves of the uptrend. Hence, this section could have been already completed. If so, GBP/USD could continue its decline from the current levels with targets at near 1.29 and below. At the same time, the section, which began on September 23, could take a more extended shape. Meanwhile, I'm more poised for the scenario of building a series of downward waves. The scenario with complicated structure remains a possibility. A lot will depend on Brexit news.

The market is ready for a formation of the downtrend section. Please be aware that the outlook for the sterling is more complicated than the one for the euro. Indeed, more factors are making impact on the pound sterling than on the euro. So, on the one hand, I still expect a formation of a new downtrend section. On the other hand, traders should take into account a great deal of factors. That's why a wave structure could change and get more intricate. For example, the US is currently dealing with record high coronavirus cases that could deliver a blow to the national economy and the value of the US dollar. So, USD is expected to weaken against EUR. However, the UK is also reporting soaring numbers of COVID-19 cases. Besides, the UK has to solve its own national issues. Brexit is certainly the thorny question. Global investors are closely monitoring the talks with the EU authorities. Another question of major importance is post-Brexit prospects of the UK economy. Last but not least, traders are speculating on further monetary policy of the Bank of England. To sum up, any news on these four vital questions could cause weakness of the sterling. Remarkably, amid the lack of any news, the pound sterling is still enjoying the same demand.

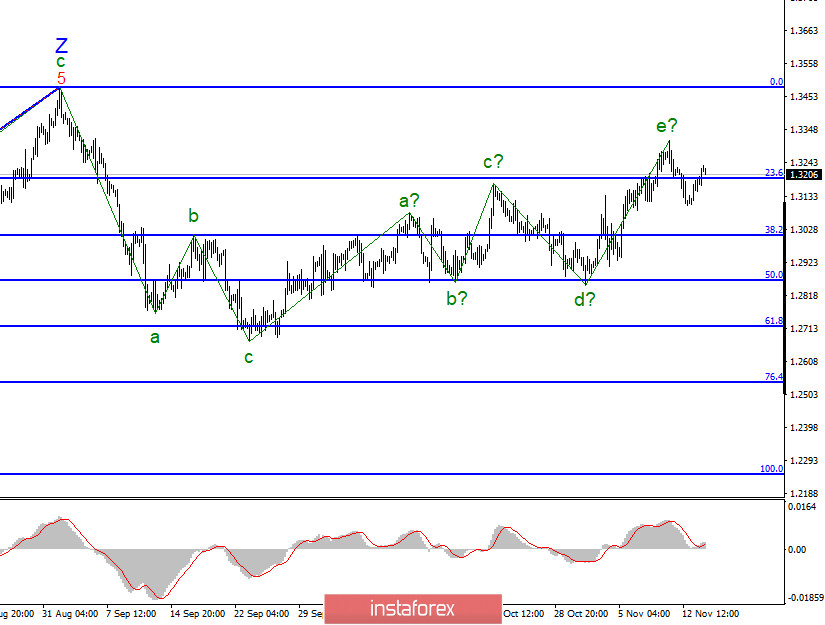

In other words, the best thing to do is to wait for any news to find clues. For example, the deadline of the talks on the trade deal passed yesterday. The next step for London and Brussels is either to extend or terminate the talks. This week, the EU and British negotiators are going to announce their decision. Moreover, they are likely to shed light on the status of the trade deal. This information could either support or subdue notably demand for the sterling. Without any new information, I reckon that GBP/USD is more likely to decline because five upward waves have been already complete.

Conclusions and trading tips

GBP/USD has resumed a formation of the uptrend section. Nevertheless, its last wave could have been already over. At present, I would recommend considering short deals on GBP/USD whenever the MACD indicator generates downward signals. A successful attempt of breaking the level of 23.6% fibo warns that the trading instrument is ready for downward targets located at near 1.3010 and 1.2864 that correspond to 38.2% and 50.0% of the fibo correction.