Outlook on November 17:

Analytical overview of major pairs on the H1 TF:

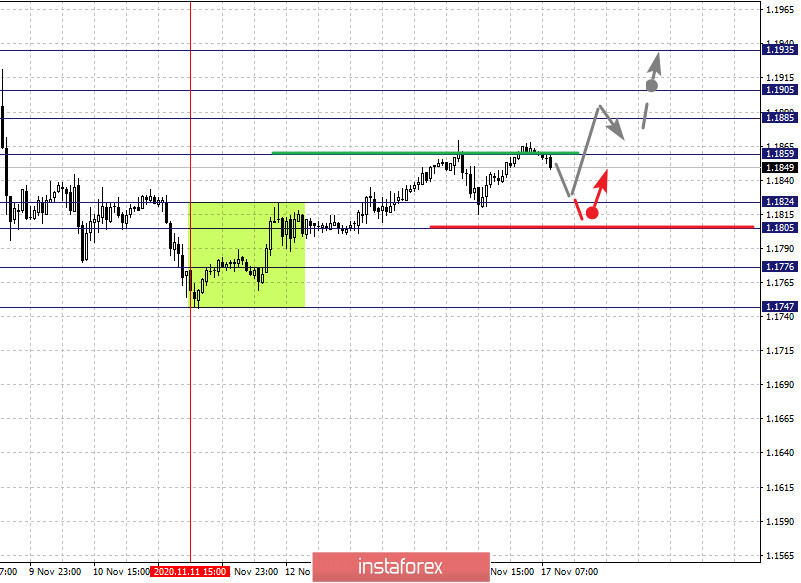

The key levels for the euro/dollar pair are 1.1935, 1.1905, 1.1885, 1.1859, 1.1824, 1.1805, 1.1776 and 1.1747. The rising pattern for November 11 is being followed here. Now, the pair is expected to continue rising after the level of 1.1859 breaks down. In this case, the goal is 1.1885. On the other hand, there is a short-term growth and consolidation in the range of 1.1885 - 1.1905. For the potential value for the top, we consider the level of 1.1935. Upon reaching which, a downward pullback is expected.

A short-term decline, in turn, is possible in the range of 1.1824 - 1.1805. If the last value breaks down, a deep correction will occur. Here, the goal is 1.1776, which is a key support for the top.

The main trend is an upward structure from November 4, the formation of a local structure from November 11

Trading recommendations:

Buy: 1.1860 Take profit: 1.1885

Buy: 1.1906 Take profit: 1.1935

Sell: 1.1824 Take profit: 1.1805

Sell: 1.1803 Take profit: 1.1776

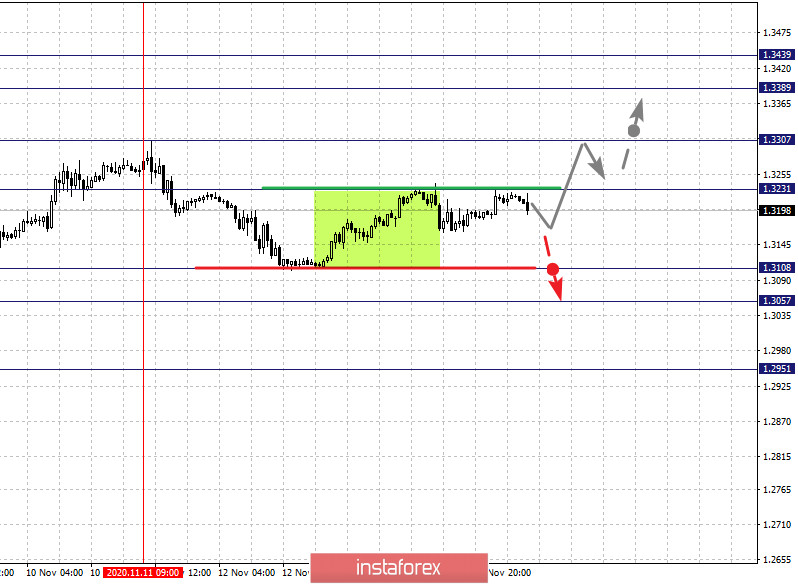

The key levels for the pound/dollar pair are 1.3439, 1.3389, 1.3307, 1.3231, 1.3108, 1.3057 and 1.2951. Here, the price is in a deep correction from the upward trend of November 2. The growth of the pair is expected to continue after the level of 1.3231 breaks down. In this case, the goal is 1.3307 and there is consolidation near this level. If this goal breaks down, it will lead to a strong growth. The next goal is 1.3389. For the potential value for the top, we consider the level of 1.3439. Upon reaching which, consolidation and downward pullback is expected.

Meanwhile, a short-term decline is expected in the range of 1.3108 - 1.3057. Breaking through the last level should be accompanied by a strong decline. The potential goal here is 1.2951.

The main trend is the upward cycle from November 2, deep correction stage

Trading recommendations:

Buy: 1.3231 Take profit: 1.3305

Buy: 1.3309 Take profit: 1.3387

Sell: 1.3106 Take profit: 1.3058

Sell: 1.3055 Take profit: 1.2953

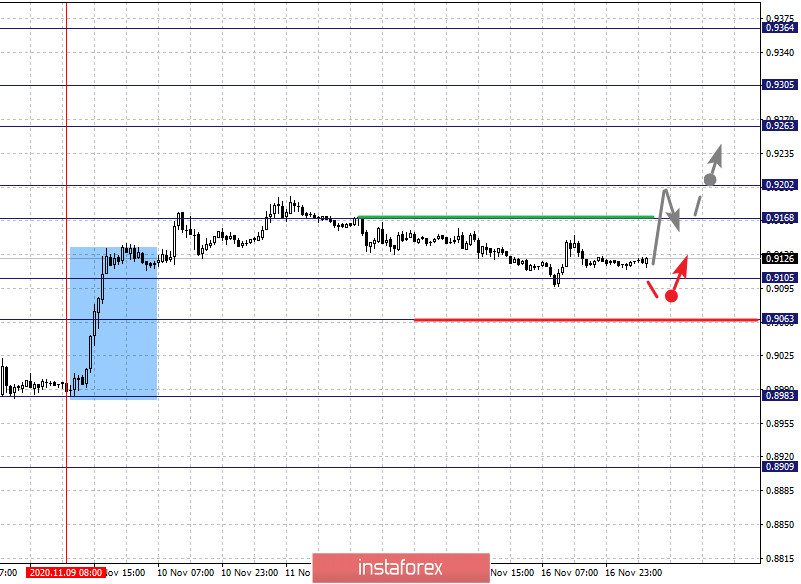

The key levels for the dollar/franc pair are 0.9364, 0.9305, 0.9263, 0.9202, 0.9168, 0.9105 and 0.9063. The development of the rising structure from November 9 is being followed here. Moreover, a short-term growth is possible in the range of 0.9168 - 0.9202. The main trend is expected to continue after the breakdown of 0.9202. In this case, the goal is 0.9263. On the other hand, there is a short-term growth and consolidation in the range of 0.9263 - 0.9305. For the potential value for the top, we consider the level of 0.9364. Upon reaching which, a downward pullback can be expected.

On the other hand, a short-term decline is possible in the range of 0.9105 - 0.9063, breaking through the last value will encourage the development of a downside pattern. In this case, the potential goal is 0.8983.

The main trend is the upward structure from November 9, the correction stage

Trading recommendations:

Buy : 0.9168 Take profit: 0.9201

Buy : 0.9203 Take profit: 0.9260

Sell: 0.9103 Take profit: 0.9065

Sell: 0.9060 Take profit: 0.8995

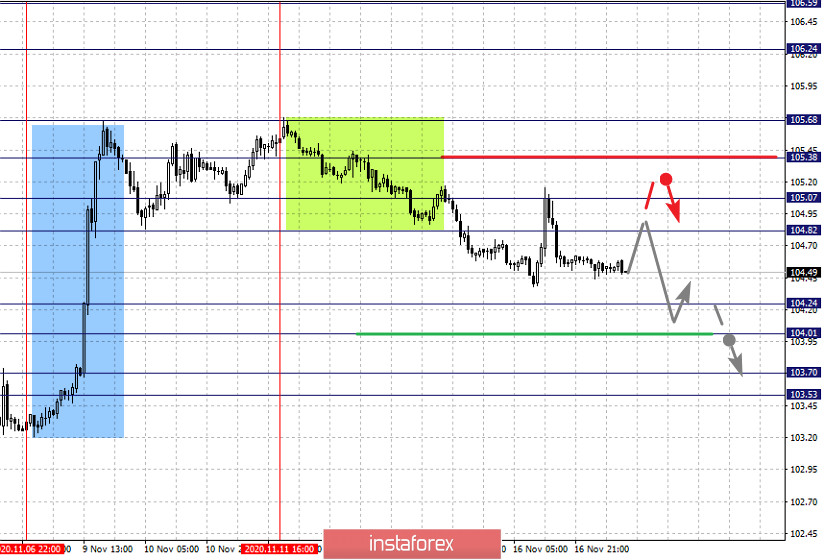

The key levels for the dollar/yen are 105.68, 105.38, 105.07, 104.82, 104.24, 104.01, 103.70 and 103.53. Here, the price is forming a downward structure from November 11. A short-term decline is expected in the range of 104.24 - 104.01. In case of breakdown of the last value, it will lead to a strong movement. The goal is 103.70. For the potential value for the bottom, we consider the level 103.53. Upon reaching which, consolidation and upward pullback is expected.

A short-term growth, in turn, is possible in the range of 104.82 - 105.07. If the last value breaks down, a deep correction will occur. Here, the goal is 105.38, which is the key support for the downward structure. Its breakdown will be conducive to the formation of potential for the upward cycle. In this case, the potential goal is 105.68.

The main trend is the formation of the descending structure from November 11

Trading recommendations:

Buy: 104.82 Take profit: 105.05

Buy : 105.08 Take profit: 105.38

Sell: 104.24 Take profit: 104.03

Sell: 104.00 Take profit: 103.70

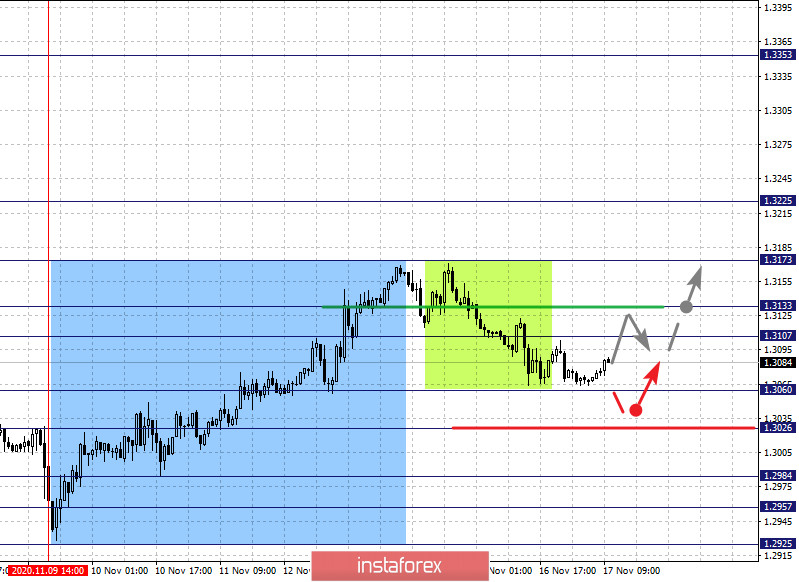

The key levels for the USD/CAD pair are 1.3225, 1.3173, 1.3133, 1.3107, 1.3060, 1.3026, 1.2984, 1.2957 and 1.2925. The price here is in the correction zone from the rising structure of November 9. The range of 1.3060 - 1.3026 is the key support for the upside, in which a short-term decline and consolidation are expected. If the last value breaks down, it will lead to the development of a strong decline. The goal here is 1.2984. Meanwhile, there is a short-term decline and consolidation in the range of 1.2984 - 1.2957. For the potential value for the bottom, we have the level of 1.2925. Upon reaching which, an upward pullback can be expected.

Now, a short-term growth is possible in the range of 1.3107 - 1.3133. If the last value breaks down, it will encourage the formation of a local pattern for an upward trend. In this case, the potential goal is 1.3173, which is a key resistance for the top.

The main trend is the upward structure from November 9, the correction stage

Trading recommendations:

Buy: 1.3107 Take profit: 1.3131

Buy : 1.3135 Take profit: 1.3172

Sell: 1.3060 Take profit: 1.3028

Sell: 1.3024 Take profit: 1.2985

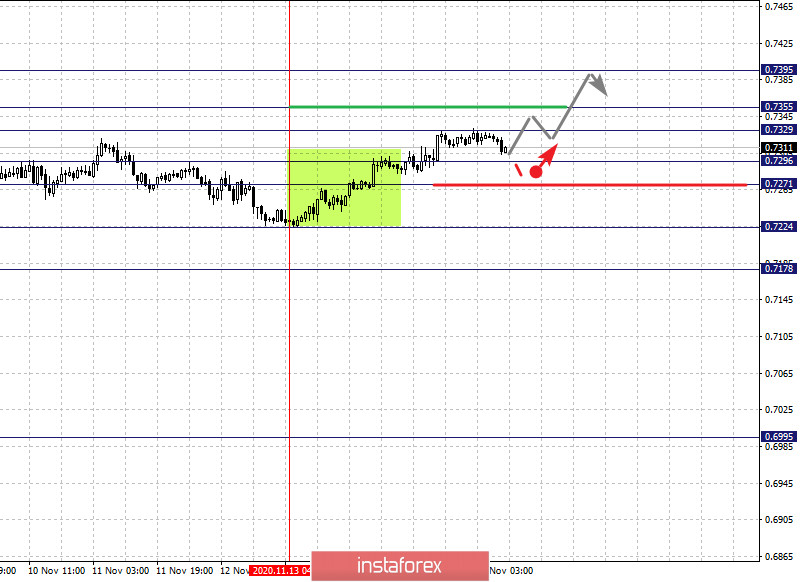

The key levels for the AUD/USD pair are 0.7395, 0.7355, 0.7329, 0.7296, 0.7271, 0.7224 and 0.7178. Here, we are following the local bullish pattern from November 13. Moreover, a short-term growth is expected in the range of 0.7329 - 0.7355. If the last value breaks down, it will lead us to the potential goal, that is, the level of 0.7395. Upon reaching which, price consolidation is expected.

A short-term decline, in turn, is expected in the range of 0.7296 - 0.7271. Here, breaking through the last value will favor the development of a downward trend. In this case, the first target is 0.7224. For the potential value for the bottom, the level of 0.7178 can be considered. Upon reaching which, price consolidation is likely.

The main trend is an upward cycle from November 2, local structure from November 13

Trading recommendations:

Buy: 0.7329 Take profit: 0.7354

Buy: 0.7356 Take profit: 0.7395

Sell : 0.7296 Take profit : 0.7272

Sell: 0.7270 Take profit: 0.7226

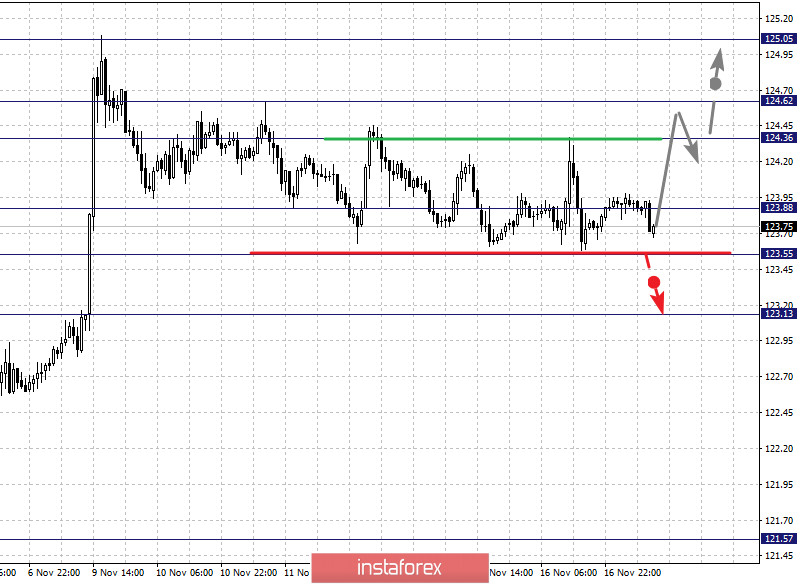

The key levels for the euro/yen pair are 125.45, 125.05, 124.62, 124.36, 123.88, 123.55 and 123.13. The rising pattern from October 30 is being followed here. At the moment, the price is in correction. On the other hand, a short-term increase and consolidation is expected in the range of 124.36 - 124.62. If the last value breaks down, it will lead us to the next level of 125.05. For the potential value for the top, we consider the level of 125.45. Price consolidation is expected near this level.

A consolidated movement is possible in the range of 123.88 - 123.55, breaking through the last value will lead to a deep correction. Here, the goal is 123.13, which is the key support for the top.

The main trend is the upward structure from October 30, the correction stage

Trading recommendations:

Buy: 124.36 Take profit: 124.61

Buy: 124.64 Take profit: 125.03

Sell: 123.88 Take profit: 123.57

Sell: 123.53 Take profit: 123.15

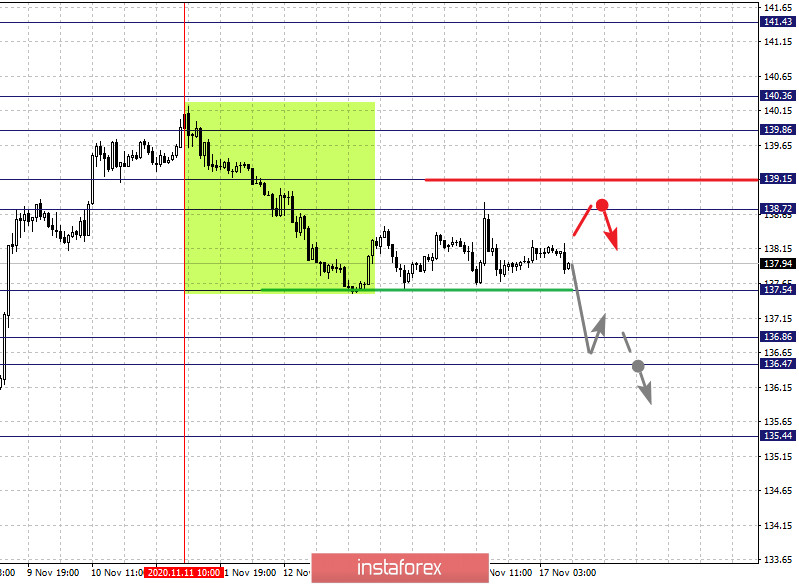

The key levels for the pound/yen pair are 141.43, 140.36, 139.86, 139.15, 138.72, 137.54, 136.86, 136.47 and 135.44. Here, we are watching the upward cycle from October 30.The price is currently in deep correction and is forming a potential for the low from November 11. Now, we expect the pair to continue rising after the price passes the noise range of 138.72 - 139.15. In this case, the goal is 139.86. Meanwhile, there is a short-term growth as well as consolidation in the range of 139.86 - 140.36. As a potential value for the top, we consider the level 141.43. The movement to which is expected after breaking through the level of 140.36.

The development of the downward pattern from November 11 is possible after the level of 137.54 breaks down. In this case, the goal is 136.86. In turn, price consolidation is in the range of 136.86 - 136.47. For the potential value for the bottom, we consider the level of 135.44. An upward pullback is expected upon reaching this level.

The main trend is the upward structure from October 30, deep correction stage

Trading recommendations:

Buy: 139.15 Take profit: 139.85

Buy: 139.88 Take profit: 140.34

Sell: 137.54 Take profit: 136.86

Sell: 136.44 Take profit: 135.50