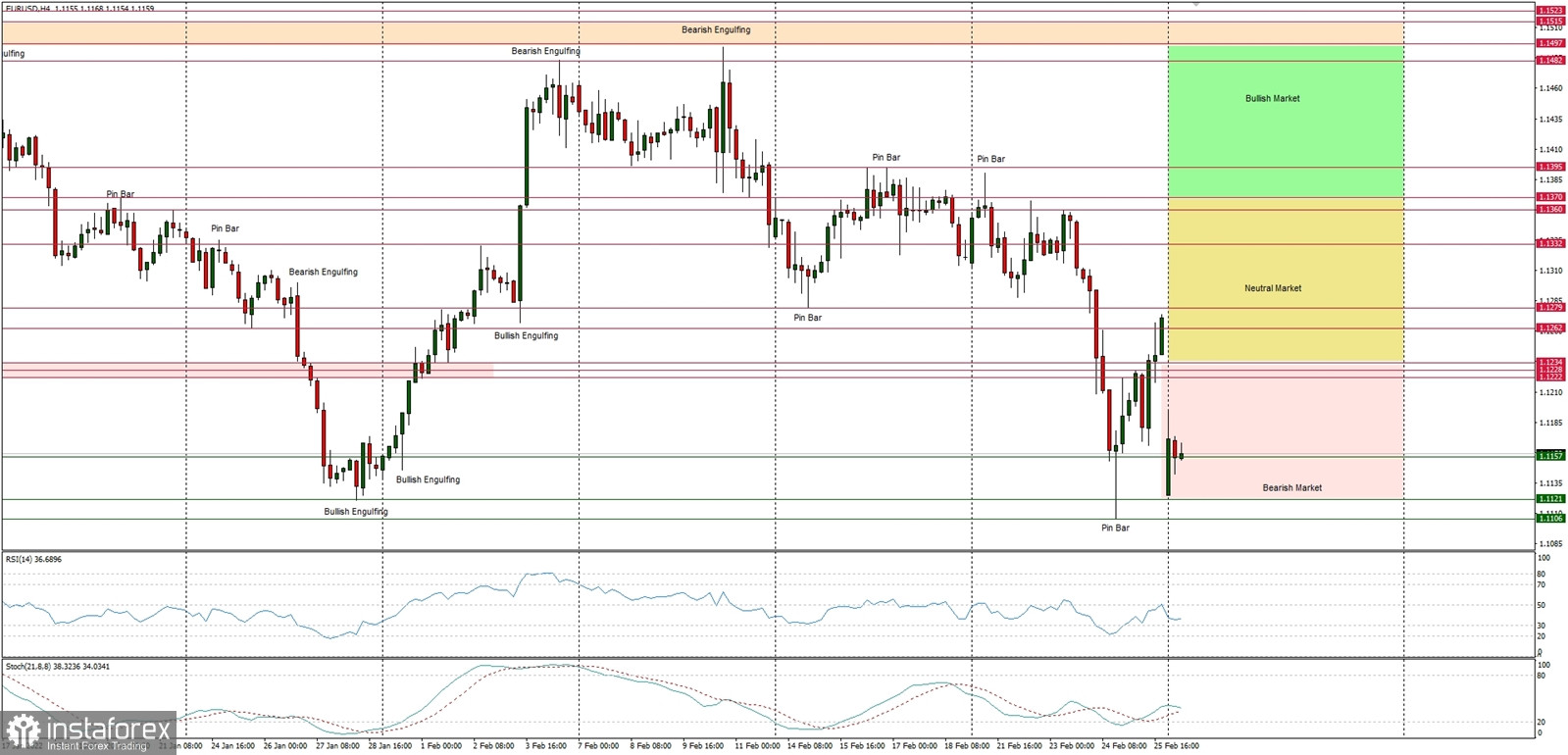

Technical Market Outlook

The EUR/USD pair has gaped down towards the level of 1.1157 on early Monday morning and the bearish pressure might continue. The key short-term supply zone is seen at the level of 1.1222 - 1.1234 and only a sustained breakout above this zone might be considered bullish. On the other hand, any continuation of the down move towards the level of 1.1106 would likely push the Euro lower, targeting the level of 1.1009 or below. The weak and negative momentum supports the short-term bearish outlook on EUR/USD.

Weekly Pivot Points:

WR3 - 1.1620

WR2 - 1.1507

WR1 - 1.1340

Weekly Pivot - 1.1209

WS1 - 1.1053

WS2 - 1.0958

WS3 - 1.0766

Trading Outlook:

The recent big Bullish Engulfing candlestick pattern seen at the weekly time frame chart indicates a strong rebound, but the market is still in control by bears that pushed the price way below the level of 1.1501, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.1106. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1501 and 1.1599, otherwise the bears will push the price lower towards the next long-term target at the level of 1.1166.