Crypto Industry News:

The European Union Parliament is delaying the vote on the framework to regulate cryptocurrencies over mining concerns.

Member of the European Parliament's economic committee Stefan Berger said the government body has canceled the vote on the cryptocurrency markets framework (MiCA), due on Monday. Berger said parliament needs to clarify the "proof of work issue" in discussions with stakeholders to ensure a proper legal framework, adding that some may misinterpret the proposal as a cryptocurrency ban.

"The discussion on MiCA indicates that parts of the draft report may be misinterpreted and understood as a proof-of-work prohibition," Berger said. "It would be disastrous for the European Parliament to send the wrong signal to vote under the circumstances."

MiCA, first introduced to the European Commission in September 2020 and adopted by the European Council in November 2021, aimed to "create a regulatory framework for the crypto asset market that supports innovation and captures the potential of crypto assets in a way that maintains financial stability and protects investors ". As rapporteur for this vote - the person designated to report on its progress - Berger said he canceled the vote without specifying when it could be rescheduled.

Pressure to clarify may be due to reports that the leaked MiCA project proposed a ban on the use of cryptocurrencies in the EU due to their energy use. If the draft were passed, the regulatory proposal would replace all current national cryptocurrency frameworks for EU member states without having to amend the regulations individually, which could potentially lead to a mining ban.

Many lawmakers and regulators in the EU are calling for a ban on mining as crypto space grows and the effects of climate change become more visible. The Swedish financial regulator and the Swedish Environmental Protection Agency called for a mining ban in November, which was criticized by some industry leaders.

Technical Market Outlook

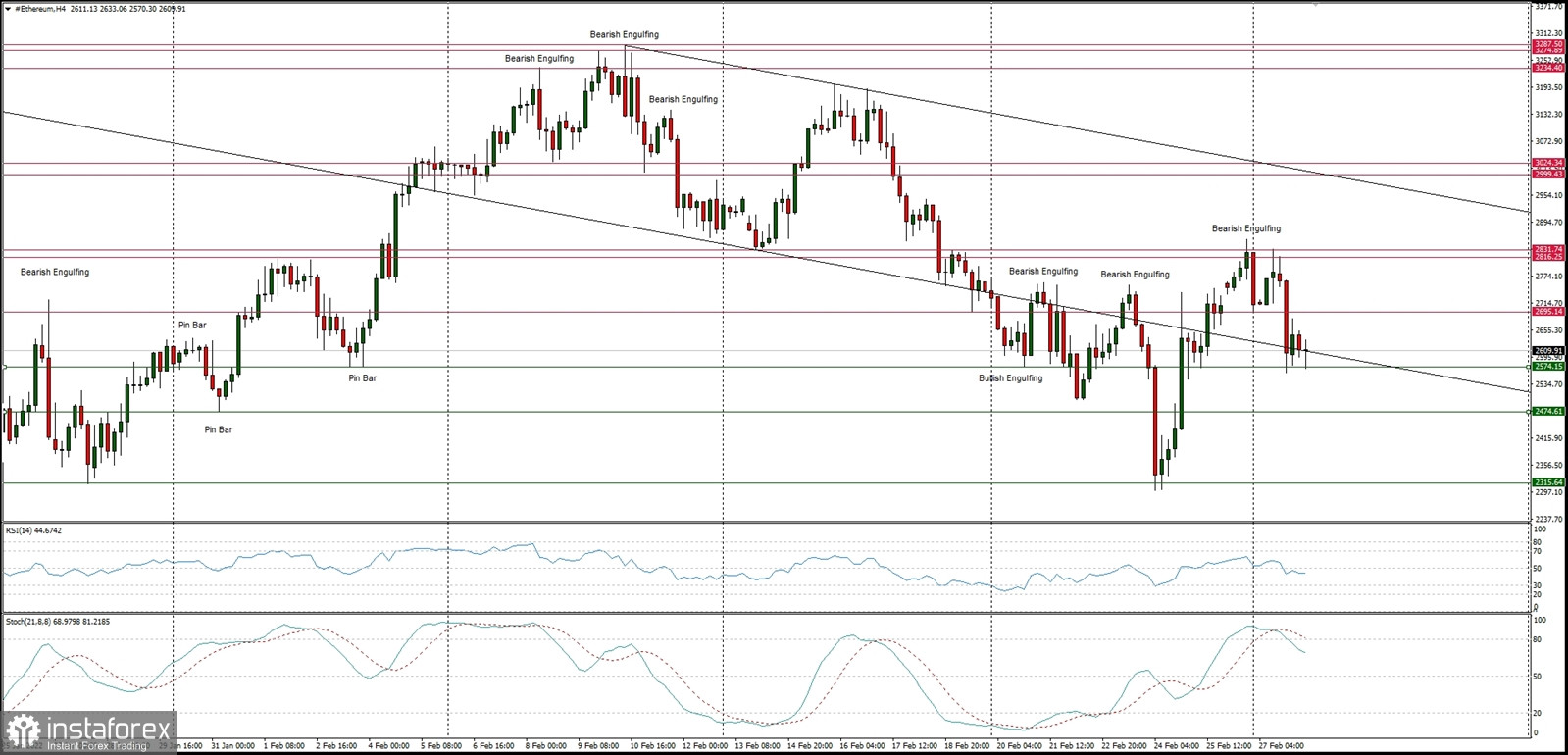

The ETH/USD pair has been rejected from the level of $2,831 again, however, the market is behaving steady. The local low was made at the level of $2,560 and since then the market is consolidating in a narrow range between the levels of $2,574 - $2,690. The momentum remains neutral. The target for bulls is seen at the level of $2,999 and $3,024. The other technical support is located at $2,574, $2,474 and $2,315.

Weekly Pivot Points:

WR3 - $3,411

WR2 - $3,141

WR1 - $2,874

Weekly Pivot - $2,577

WS1 - $2,325

WS2 - $2,017

WS3 - $1,770

Trading Outlook:

The market is bouncing after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,436 is the next key technical resistance for bulls. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.