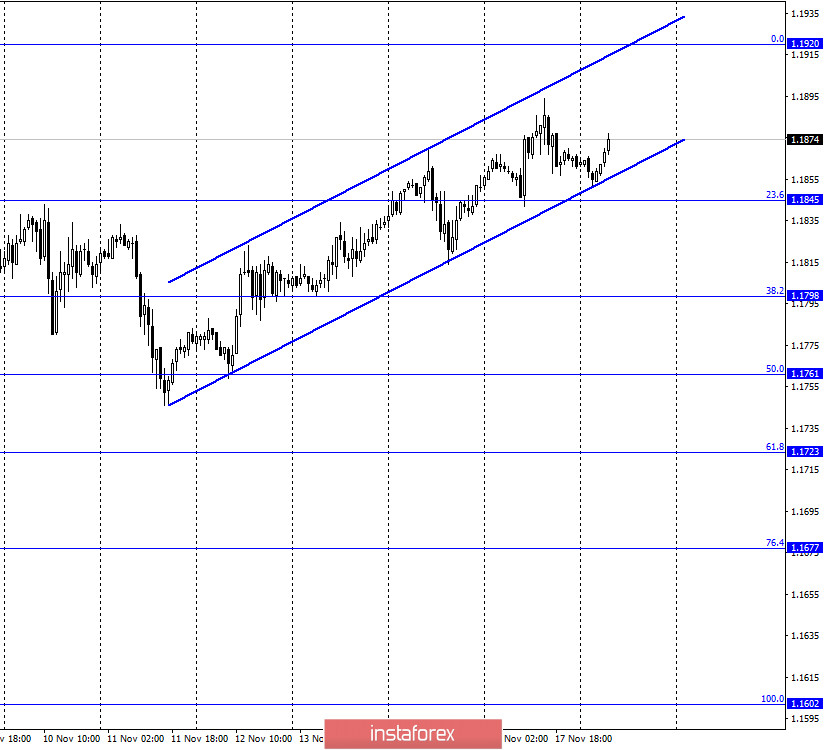

EUR/USD – 1H.

On November 17, the EUR/USD pair fell to the lower border of the upward trend corridor, rebounded from it, and resumed the growth process in the direction of the corrective level of 0.0% (1.1920). Thus, the "bullish" mood of traders remains. Meanwhile, news came from the European Union, where everything has been relatively calm recently if you do not take into account the coronavirus. Yesterday, it became known that EU members Poland and Hungary used their right to veto the adoption of the budget for 2021-2027 and the fund for economic recovery from the COVID-2019 pandemic. The total amount of funds to be distributed is almost 2 trillion euros. And this money, which is very necessary for business and the unemployed, is now hanging in the air. The problem is that under current EU law, certain countries may be fined and cut funding from the budget and other programs if any violations of the principles of democracy and the rule of law are found. In other words, the EU insists that full democracy be preserved within each member state and that there is not a single hint of totalitarianism or abuse of power. These claims were made several times in Poland and Hungary, where the largest parties, according to the EU, tried to establish control over the media, the courts and violated the principle of democracy in every possible way. Well, the authorities of the accused countries, in turn, decided not to approve the budget and the fund, since if desired, the EU may not get anything from these sources at all. Krakow and Budapest require a review of the current legislation that allows you to leave the offending country without funding.

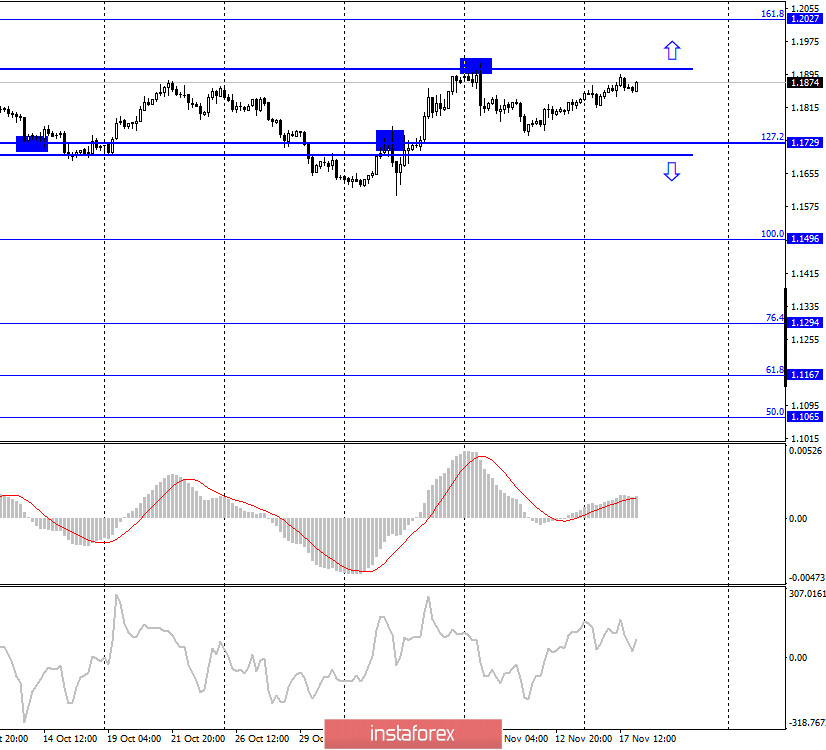

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes continue to grow in the direction of the upper border of the 1.1907 side corridor. A new rebound of quotes from this line will again work in favor of the US currency and some fall in the direction of the corrective level of 127.2% (1.1729). Fixing the pair's rate above the side corridor will significantly increase the probability of further growth towards the next corrective level of 161.8% (1.2027).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new reversal in favor of the European currency and fixed above the corrective level of 261.8% (1.1822). This level remains weak, and I recommend paying more attention to the lower charts, which respond more quickly to changes in the market.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 17, a new speech by Christine Lagarde took place in the European Union, which did not interest traders as much as the speech the day before. There was also a report on retail sales in the United States, which also did not interest traders.

News calendar for the United States and the European Union:

EU - consumer price index (10:00 GMT).

On November 18, the EU calendar shows only the inflation report, and in America - there is not a single entry for today. Thus, the information background may be very weak today.

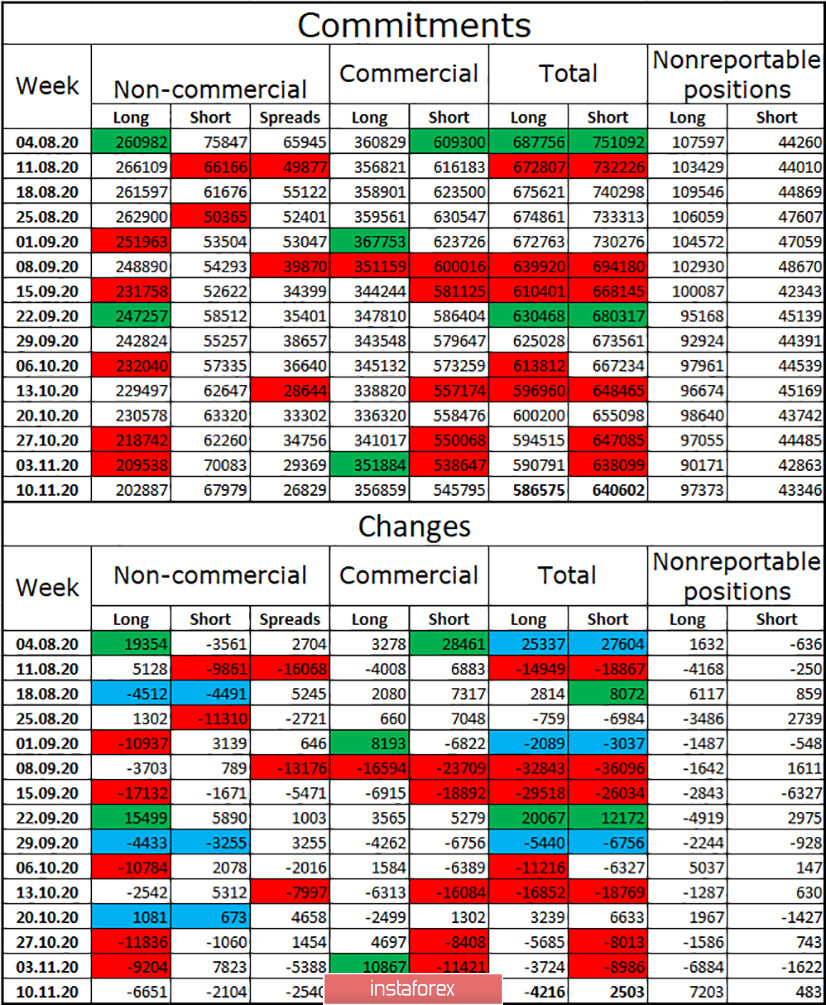

COT (Commitments of Traders) report:

The latest COT report was released with some delay. The most important category of "Non-commercial" traders got rid of another 6.6 thousand long contracts during the reporting week (-9.2 thousand a week earlier), so speculators continue to close contracts for the purchase of the European currency. However, they also closed 2.1 thousand short-contracts. However, despite this, the strengthening of the "bearish" mood continues in the most important category of traders. Based on this, I conclude that the European currency is falling, but recent months show that the euro is not falling. However, the total number of long contracts in the hands of speculators continues to decline, while short contracts continue to grow. Therefore, no other conclusions can be drawn now.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with targets of 1.1798 and 1.1761 if the closing is performed under the ascending corridor on the hourly chart. Purchases of the pair will be possible with a target of 1.2027 if it is fixed above the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.