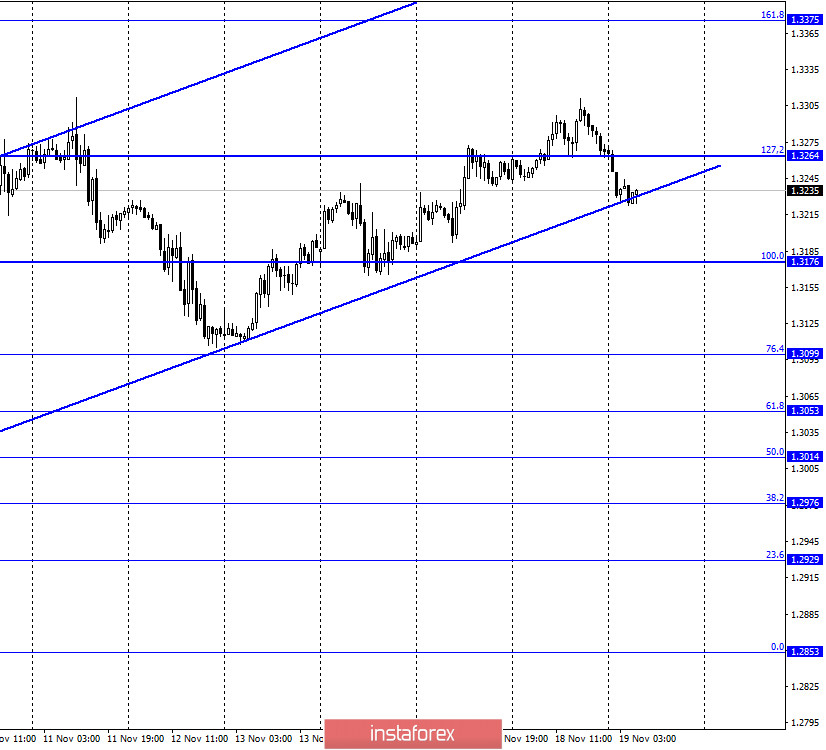

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US dollar and fell to the lower border of the upward trend corridor. Closing the pair's rate under the corridor will work in favor of a further fall of the British dollar in the direction of the corrective level of 100.0% (1.3176). The rebound is in favor of the resumption of growth. Meanwhile, negotiations on the Brexit trade deal continue, but every day we receive information not about the progress in these very negotiations or the timing of their completion, but quite different news. For example, yesterday, it was reported from a senior official that EU leaders have called on the European Commission to develop a clear plan in case a trade deal cannot be reached. Belgium, the Netherlands, and France are reported to be the most concerned. Some other sources say the deal could be agreed in full by November 23. Some say that the negotiations will continue almost until the New Year. However, the facts remain: so far, there is no information about progress in the negotiation process, and there is no positive information. Thus, traders can only wait for Michel Barnier, David Frost, or the top officials of the EU and the UK to make an official statement on the results.

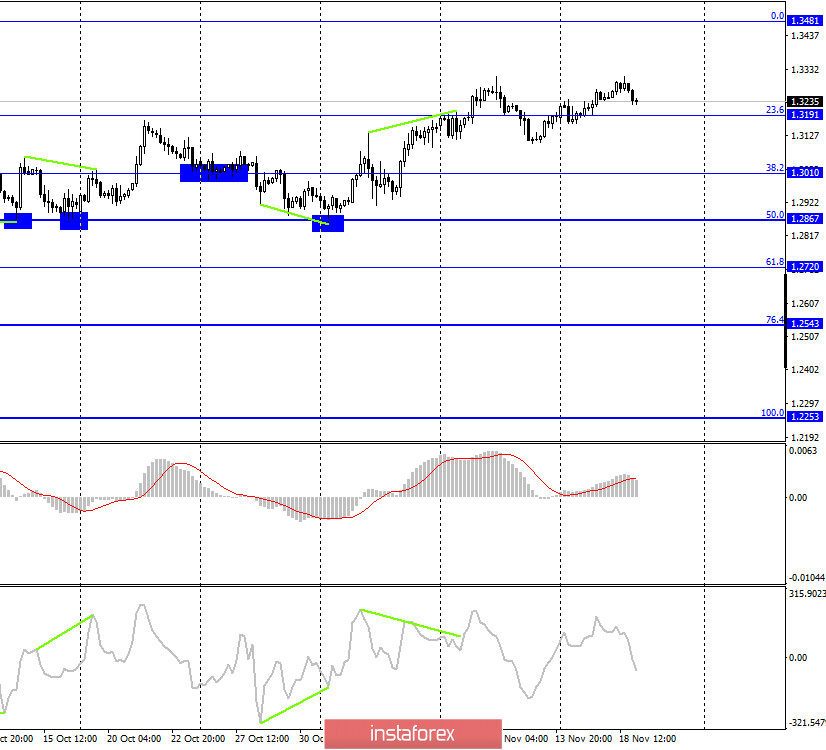

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation above the corrective level of 23.6% (1.3191). Thus, the growth process can be continued towards the next Fibo level of 0.0% (1.3481). There are no emerging divergences today. Closing the pair below the corrective level of 23.6% will allow traders to expect a slight drop in the direction of the corrective level of 38.2% (1.3010). The trend corridor on the hourly chart is important.

GBP/USD – Daily.

On the daily chart, the pair's quotes continue to grow in the direction of the corrective level of 100.0% (1.3513). However, when trading a pair, I recommend paying more attention to the lower charts. They are now more informative.

GBP/USD – Weekly.

On the weekly chart, the pair GBP/USD has performed a new close above the upper descending trend line, however, it was followed by a false breakout of this line. In recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

On Wednesday, Andrew Bailey spoke in the UK, however, traders again did not pay attention to this event, as there was nothing important in the words of the Governor of the Bank of England. Inflation in the UK slightly exceeded traders' expectations, which only slightly affected demand for the British dollar, which rose slightly in the morning but then began to fall.

News calendar for the US and the UK:

US - number of initial and repeated applications for unemployment benefits (13:30 GMT).

On November 19, there are almost no significant events in the UK and US calendars. The information background will be extremely weak today. Unless there is important news from participants in the Brexit negotiation process.

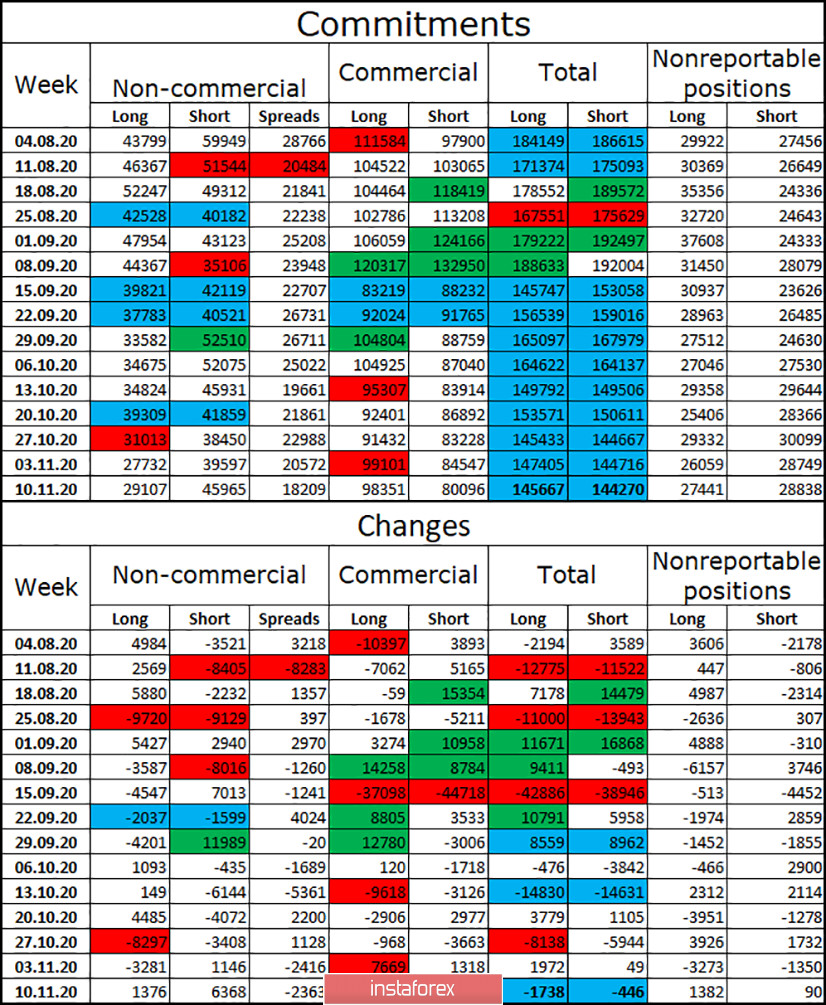

COT (Commitments of Traders) report:

The latest COT report on the British pound showed that the mood of the "Non-commercial" category of traders became even more "bearish" during the reporting week. Speculators this time opened 1.4 thousand long-contracts, but at the same time increased 6.4 thousand short-contracts. The British pound as a whole has continued to grow in recent weeks despite COT reports. However, the latest COT report suggests that the British currency is about to fall. I also note an almost equal number of open long and short contracts for all categories of traders and a fairly small total number of contracts in the hands of the "Non-commercial" category. This means that speculators are not eager to deal with the pound right now.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with targets of 1.3176 and 1.3099 if the closing is performed under the ascending corridor on the hourly chart. I recommend buying the pair if the quotes perform a rebound from the lower limit of the corridor on the hourly chart with the goal of 1.3375.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.