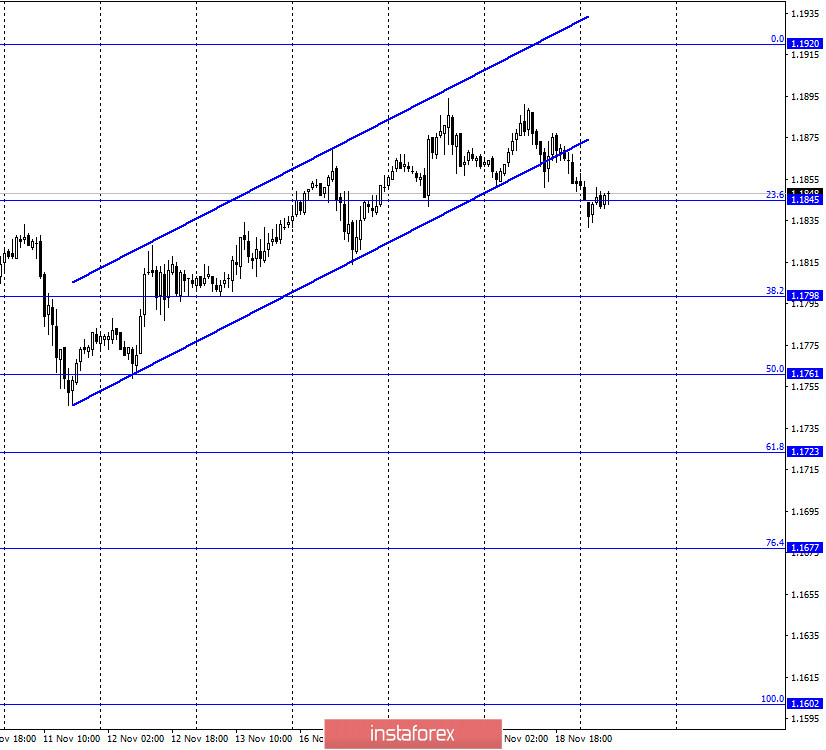

EUR/USD – 1H.

On November 18, the EUR/USD pair performed a reversal in favor of the US currency and consolidated under the upward trend corridor. Thus, the mood of most traders changed from "bullish" to "bearish". Fixing the pair's exchange rate under the Fibo level of 23.6% (1.1845) will increase the probability of a further fall in quotes in the direction of the next corrective level of 38.2% (1.1798). The US dollar started to grow the day before, however, it is extremely difficult to conclude that there were any serious reasons for this. Both in the European Union and America, everything has remained unchanged in recent weeks. In the EU, yesterday, there was news about Poland and Hungary blocking the draft budget for 2021-2027 and the recovery fund. However, I believe that this is not a problem and the parties will agree, as they did before. The situation with the coronavirus is not getting worse or better either in America or in the European Union. News about the creation of at least two COVID vaccines is not particularly important yet, since mass vaccination of the population will still not begin until a few months later. This means that the whole world still has to go through a difficult winter. Well, in America, a new package of assistance to the economy has not been adopted, and many believe that it will not be adopted as long as Donald Trump remains in the White House. The US President still does not recognize the election results, considering them rigged. However, no convincing evidence is presented, so the lawsuits in various courts of his team are mostly rejected, and the recount of votes in several states does not give any significant results for Trump.

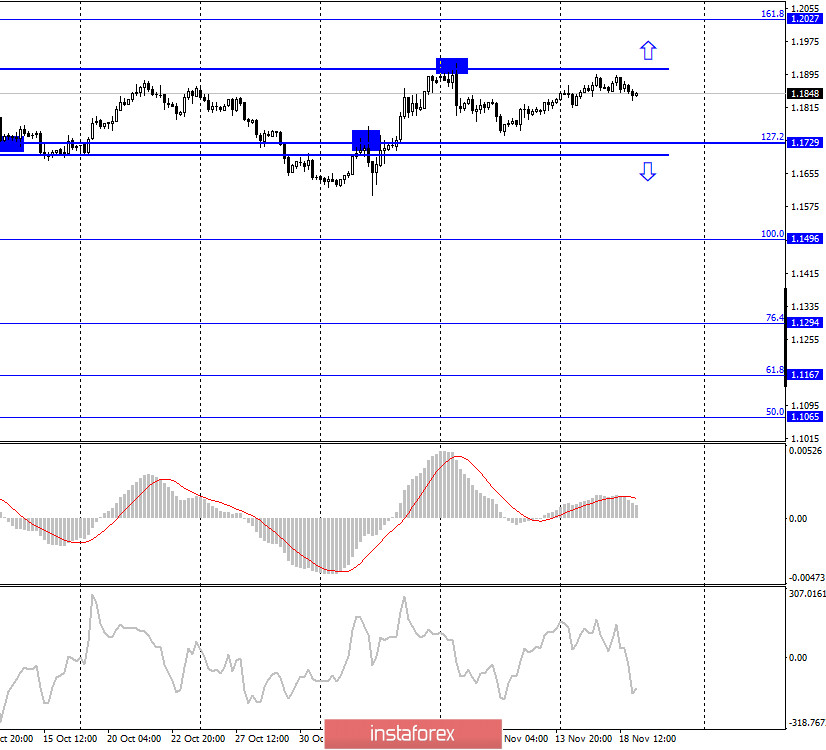

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes near the upper border of the side corridor performed a reversal in favor of the US dollar and began the process of falling in the direction of the corrective level of 127.2% (1.1729). Fixing the pair's rate above the side corridor will work in favor of the EU currency and resume growth in the direction of the corrective level of 161.8% (1.2027).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new reversal in favor of the European currency and fixed above the corrective level of 261.8% (1.1822). This level remains weak, and I recommend paying more attention now to the lower charts, which respond more quickly to changes in the market.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 18, the European Union released its October inflation report. The consumer price index remained at a negative value, however, the European currency began to fall based on graphical reasons, and not because of the information background.

The news calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (08:00 GMT).

EU - ECB President Christine Lagarde will deliver a speech (10:00 GMT).

US - number of initial and repeated applications for unemployment benefits (13:30 GMT).

EU - ECB President Christine Lagarde will deliver a speech (15:15 GMT).

On November 19, the European Union calendar includes three speeches by ECB President Christine Lagarde, and in America - only a report on applications for unemployment benefits. More important, of course, are Lagarde's speeches.

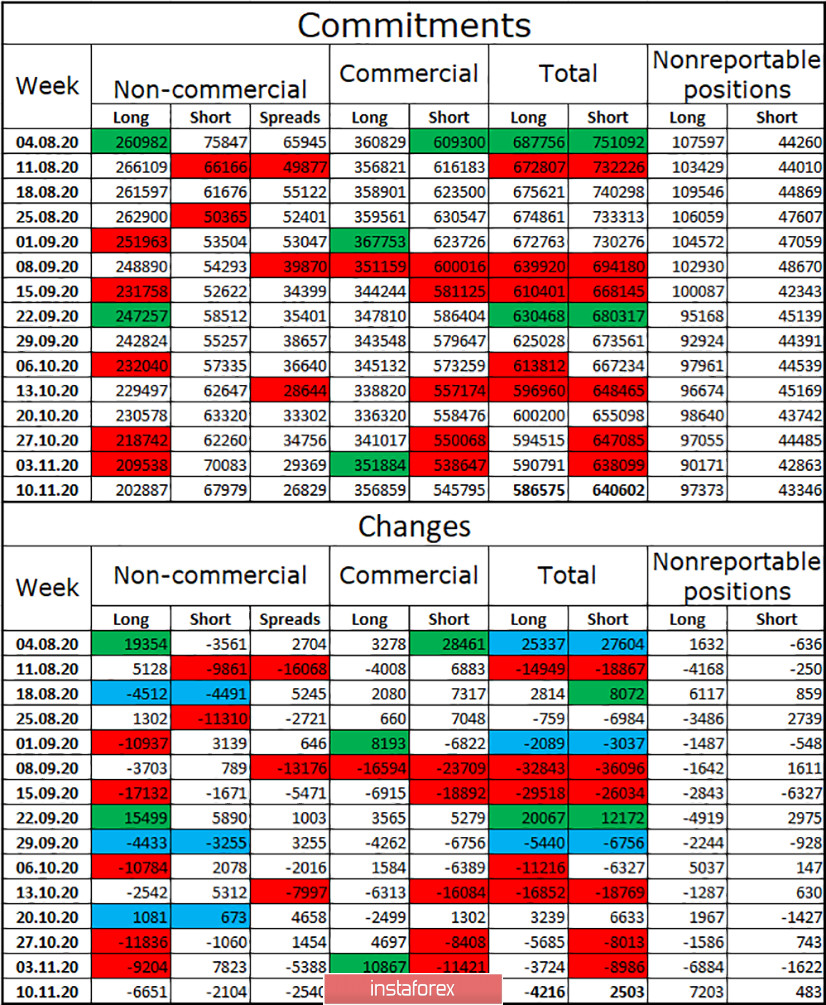

COT (Commitments of Traders) report:

The latest COT report was released with some delay. The most important category of "Non-commercial" traders got rid of another 6.6 thousand long contracts during the reporting week (-9.2 thousand a week earlier), so speculators continue to close contracts for the purchase of the European currency. However, they also closed 2.1 thousand short-contracts. However, despite this, the strengthening of the "bearish" mood continues in the most important category of traders. Based on this, I conclude that the European currency is falling, but recent months show that the euro is not falling. Nevertheless, the total number of long contracts in the hands of speculators continues to decline, while short contracts continue to grow. Therefore, no other conclusions can be drawn now.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend selling the euro currency with targets of 1.1798 and 1.1761, if the close is made at the level of 23.6% (1.1845) on the hourly chart. Purchases of the pair will be possible with a target of 1.2027 if it is fixed above the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.