Outlook on November 19:

Analytical overview of major pairs on the H1 TF:

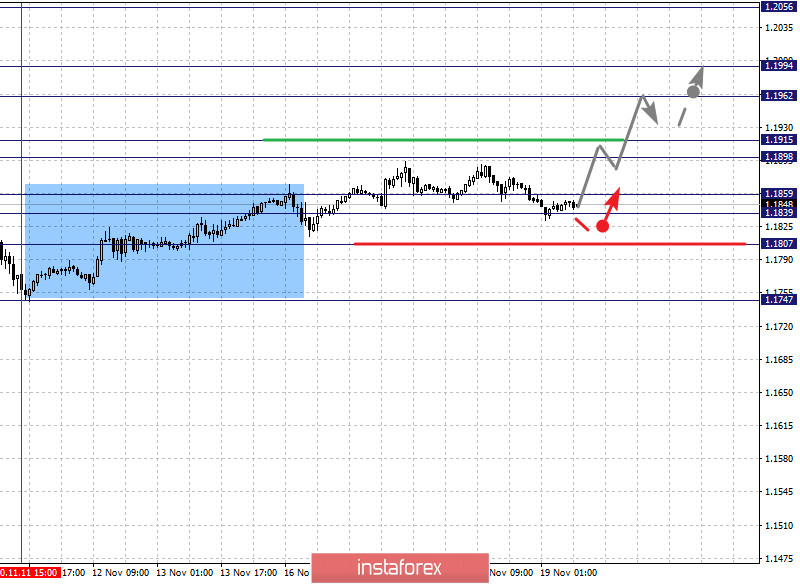

The key levels for the euro/dollar pair are 1.1994, 1.1962, 1.1915, 1.1897, 1.1859, 1.1839, 1.1807 and 1.1747. The rising pattern from November 11 is being followed here. Now, we expect growth to continue after the price passes the noise range 1.1897 - 1.1915. In this case, the goal is 1.1962. For the potential value for the top, we consider the level 1.1994. Upon reaching which, price consolidation and downward pullback is expected.

A short-term decline, in turn, is possible in the range of 1.1859 - 1.1839. If the last value breaks down, it will lead to a deep correction. The goal here is 1.1807, which is a key support for the top.

The main trend is the local structure of November 11

Trading recommendations:

Buy: 1.1915 Take profit: 1.1960

Buy: 1.1963 Take profit: 1.1992

Sell: 1.1859 Take profit: 1.1840

Sell: 1.1837 Take profit: 1.1808

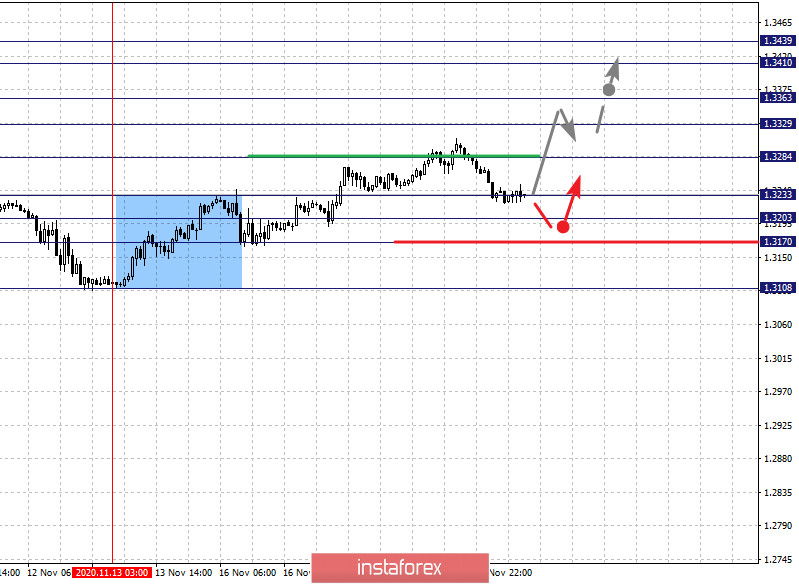

The key levels for the pound/dollar pair are 1.3439, 1.3410, 1.3363, 1.3329, 1.3284, 1.3233, 1.3203, 1.3170 and 1.3108. Here, we are following the rising pattern from November 13. The pair is expected to rise after the level of 1.3284 breaks down. In this case, the goal is 1.3329. On the other hand, there is a short-term growth and consolidation in the range of 1.3329 - 1.3363. Now, if the level of 1.3364 breaks down, a strong upward movement should follow. The goal is 1.3410. At the same time, price consolidation is in the range of 1.3410 - 1.3439, from which a downward pullback is also expected.

Meanwhile, a short-term decline is expected in the range of 1.3233 - 1.3203. In case that the last value breaks down, a deep correction will occur. Here, the goal is 1.3170, which is the key support for the top.

The main trend is the upward structure from November 13

Trading recommendations:

Buy: 1.3284 Take profit: 1.3329

Buy: 1.3364 Take profit: 1.3410

Sell: 1.3233 Take profit: 1.3203

Sell: 1.3202 Take profit: 1.3170

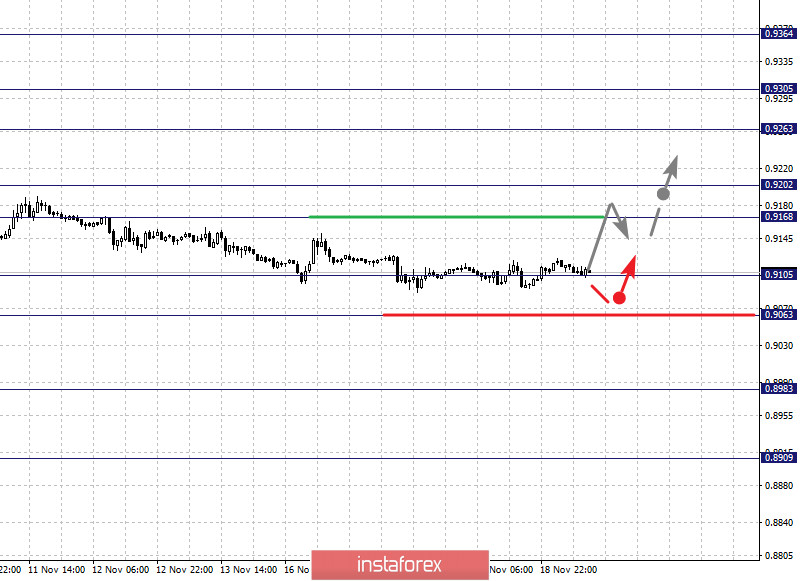

The key levels for the dollar/franc pair are 0.9364, 0.9305, 0.9263, 0.9202, 0.9168, 0.9105 and 0.9063. The price has now entered an equilibrium state. At the same time, short-term growth is possible in the range of 0.9168 - 0.9202. The main trend is expected to continue after the last value breaks down. In this case, the goal is 0.9263. On the other hand, there is a short-term growth and consolidation in the range of 0.9263 - 0.9305. For the potential value for the top, we consider the level of 0.9364. Upon reaching which, a downward pullback can be expected.

On the other hand, a short-term decline is possible in the range of 0.9105 - 0.9063, breaking through the last value will encourage the development of a downside pattern. In this case, the potential goal is 0.8983.

The main trend is an equilibrium state

Trading recommendations:

Buy : 0.9168 Take profit: 0.9201

Buy : 0.9203 Take profit: 0.9260

Sell: 0.9103 Take profit: 0.9065

Sell: 0.9060 Take profit: 0.8995

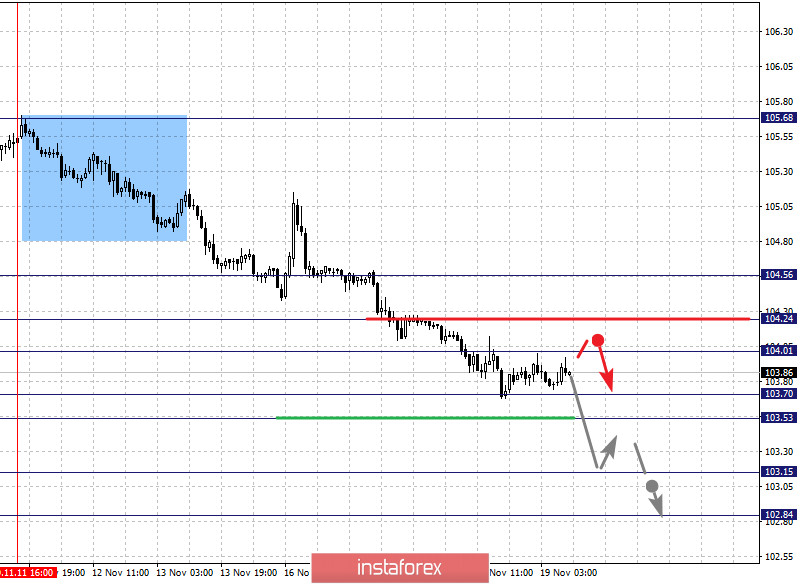

The key levels for the dollar/yen are 104.56, 104.24, 104.01, 103.70, 103.53, 103.15 and 102.84. Here, the development of the downward trend from November 11 is being followed. Moreover, a short-term decline is expected in the range of 103.70 - 103.53. If the last value breaks down, it will lead to a strong movement. The next goal is 103.15. For the potential value below, we consider the level 102.84. Upon reaching which, price consolidation and upward pullback is expected.

A short-term growth, on the other hand, is possible in the range of 104.01 - 104.24. Breaking through the last value will lead to a deep correction. Here, the goal is 104.56, which is the key support for the downward structure.

The main trend is the descending structure from November 11

Trading recommendations:

Buy: 104.01 Take profit: 104.22

Buy : 104.26 Take profit: 104.55

Sell: 103.70 Take profit: 103.54

Sell: 103.51 Take profit: 103.15

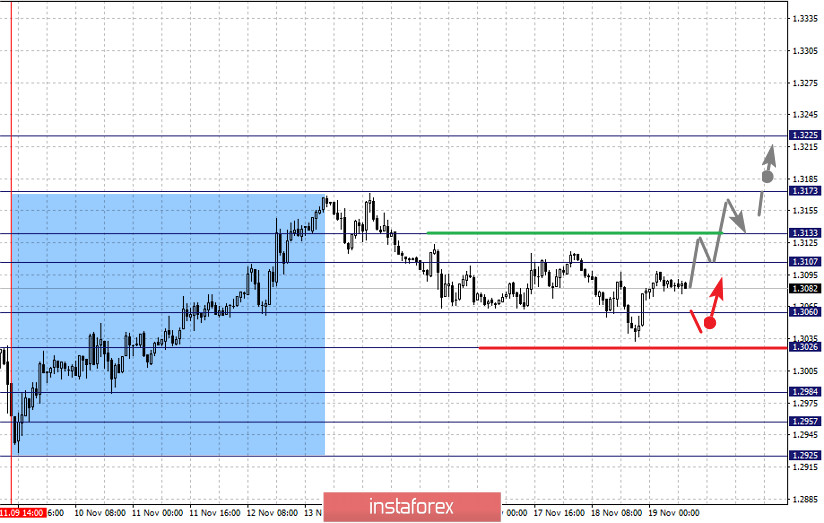

The key levels for the USD/CAD pair are 1.3225, 1.3173, 1.3133, 1.3107, 1.3060, 1.3026, 1.2984, 1.2957 and 1.2925. The price here is in the correction zone from the rising structure of November 9. The range of 1.3060 - 1.3026 is the key support for the upside, in which a short-term decline and consolidation are expected. If the last value breaks down, it will lead to the development of a strong decline. The goal here is 1.2984. Meanwhile, there is a short-term decline and consolidation in the range of 1.2984 - 1.2957. For the potential value for the bottom, we have the level of 1.2925. Upon reaching which, an upward pullback can be expected.

Now, a short-term growth is possible in the range of 1.3107 - 1.3133. If the last value breaks down, it will encourage the formation of a local pattern for an upward trend. In this case, the potential goal is 1.3173, which is a key resistance for the top.

The main trend is the upward structure from November 9, correction stage

Trading recommendations:

Buy: 1.3107 Take profit: 1.3131

Buy : 1.3135 Take profit: 1.3172

Sell: 1.3060 Take profit: 1.3028

Sell: 1.3024 Take profit: 1.2985

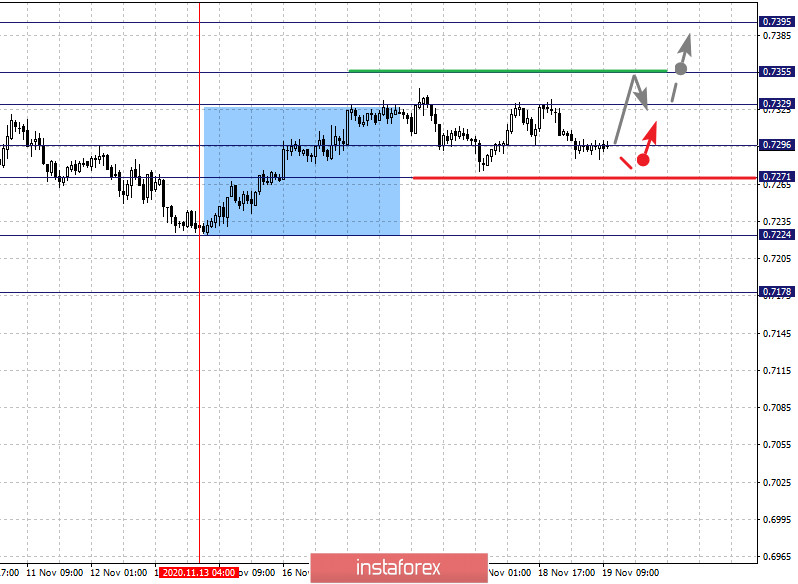

The key levels for the AUD/USD pair are 0.7395, 0.7355, 0.7329, 0.7296, 0.7271, 0.7224 and 0.7178. Here, we are following the local bullish pattern from November 13. Moreover, a short-term growth is expected in the range of 0.7329 - 0.7355. If the last value breaks down, it will lead us to the potential goal, that is, the level of 0.7395. Upon reaching which, price consolidation is expected.

A short-term decline, in turn, is expected in the range of 0.7296 - 0.7271. Here, breaking through the last value will favor the development of a downward trend. In this case, the first target is 0.7224. For the potential value for the bottom, the level of 0.7178 can be considered. Upon reaching which, price consolidation is likely.

The main trend is an upward cycle from November 2, local structure from November 13

Trading recommendations:

Buy: 0.7329 Take profit: 0.7354

Buy: 0.7356 Take profit: 0.7395

Sell : 0.7296 Take profit : 0.7272

Sell: 0.7270 Take profit: 0.7226

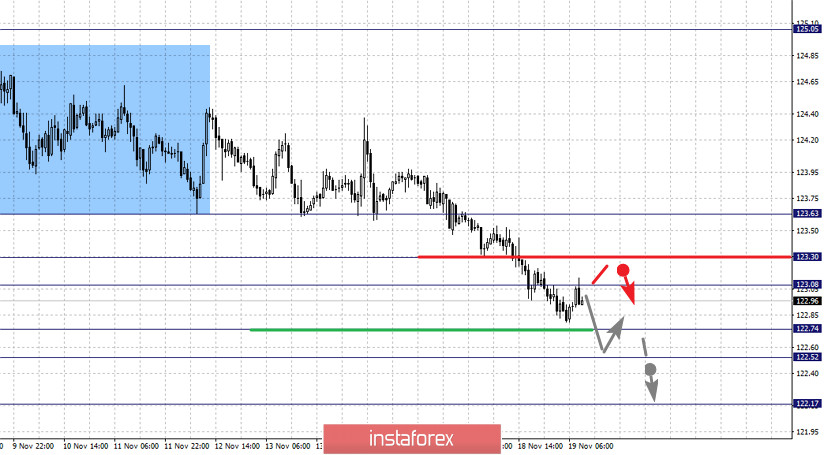

The key levels for the euro/yen pair are 123.63, 123.30, 123.08, 122.74, 122.52 and 122.17. The downward pattern from November 9 is being followed here. Now, we expect a short-term decline to continue in the range of 122.74 - 122.52. In case that the last value breaks down, it will lead us to the next potential goal, which is the level of 122.17. Upon reaching which, price consolidation and upward pullback is expected.

A short-term growth, in turn, is possible in the range of 123.08 - 123.30. If the last value breaks down, a deep correction will emerge. The potential goal is 123.63, which is the key support for the downward pattern. Before it, we expect the formation of initial conditions for the upward cycle.

The main trend is the downward cycle from November 9

Trading recommendations:

Buy: 123.08 Take profit: 123.30

Buy: 123.33 Take profit: 123.60

Sell: 122.74 Take profit: 122.54

Sell: 122.50 Take profit: 122.20

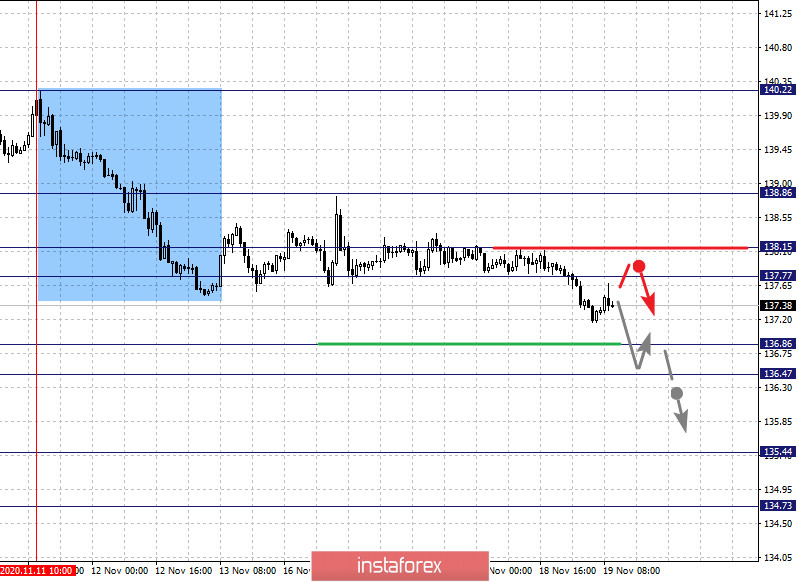

The key levels for the pound/yen pair are 138.86, 138.15, 137.77, 136.86, 136.47, 135.44 and 134.73. Here, we are following the development of the downward pattern from November 11. At the same time, a short-term decline is expected in the range of 136.86 - 136.47. A breakdown of the last value should be accompanied by a strong decline to the level of 135.44, wherein price consolidation can be expected. For the potential value for the bottom, we consider the level of 134.73. A correction is likely from this level.

On the other hand, a short-term growth is possible in the range of 137.77 - 138.15. fIf the last value breaks down, a deeper movement will occur. The goal here is 138.86, which is a key support for the downward pattern.

The main trend is the descending structure from November 11

Trading recommendations:

Buy: 137.77 Take profit: 138.13

Buy: 138.17 Take profit: 138.85

Sell: 136.86 Take profit: 136.48

Sell: 136.45 Take profit: 135.50