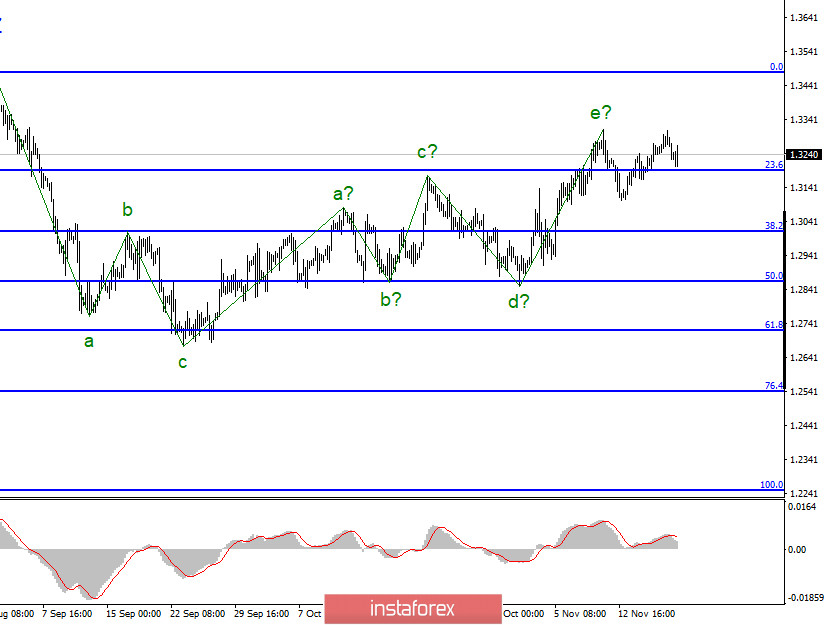

The construction of the upward trend section continues but the wave marking takes a complex form and may become more complicated several times. The section of the trend that began on September 23 has taken a five-wave form but it is not pulsed and may already be completed. Thus, the construction of a new three-wave section of the trend, or perhaps a more complex descending wave structure, could already begin. A successful attempt to break through the maximum of wave e may lead to its complication or complication of the entire upward section of the trend.

The lower chart clearly shows the a-b-c-d-e waves of the uptrend section. This section may already be completed. If this is true, then the decline in quotes will continue from the current levels with targets located near the 29th figure and below. At the same time, the section that began on September 23 may take on an even longer form. Wave e may become more complex and take a pronounced five-wave form.

For the Pound/Dollar instrument, everything continues to depend on the news background on the Brexit negotiations. Unfortunately, the markets are not happy because there is still no information. The negotiations were supposed to end first on October 15, then on November 15, then on November 18. Today is the 19th and there is still no update on the current status of negotiations. I cannot say that the market just stands still without this information. However, I cannot deny that this information is very important and can have a strong impact on the movement of the instrument in the coming days and weeks. If both sides admit that it is impossible to conclude an agreement (at least in these conditions), this may not affect the British Pound in the best way. I have already said that the lack of official information generates a huge amount of speculation and guesses from the media, various publications, experts, and pseudo-experts. As a result, the market is only getting confused and it is becoming even more difficult to understand what is really happening. According to the latest information, it will finally be known what will happen to the negotiations tomorrow. However, this does not erase the possibility that Michel Barnier or David Frost may announce that they will be negotiating for a few more days on Friday.

Inflation in the UK rather unexpectedly pleased the markets. The British Pound even grew slightly on the information about an increase in inflation to 0.7%. But Andrew Bailey's speech once again did not provide any information for reflection. Thus, in general, market activity is now quite low.

General conclusions and recommendations:

The Pound-Dollar instrument resumed building an uptrend but its last wave could have already ended. Thus, now I recommend looking closely at the sales of the instrument for each signal "down" of the MACD indicator. A new successful attempt to break through the 23.6% Fibonacci level will indirectly indicate that the instrument is ready for a decline with targets located near the calculated levels of 1.3010 and 1.2864, which corresponds to 38.2% and 50.0% for Fibonacci. I recommend waiting for it before opening sales of the tool. A successful attempt to break through the peak of the e wave will lead to more complex wave markings.