The dollar was able to strengthen on Thursday as general optimism about vaccines begins to wane. Investors were playing for a more distant future with a cure for coronavirus and global economic recovery. However, the current situation, weighed down by the pandemic, forces market players not to discount protective assets, in particular the dollar. Investors are now confused and don't know what to focus on – the headlines about vaccines or the rate of spread of the coronavirus.

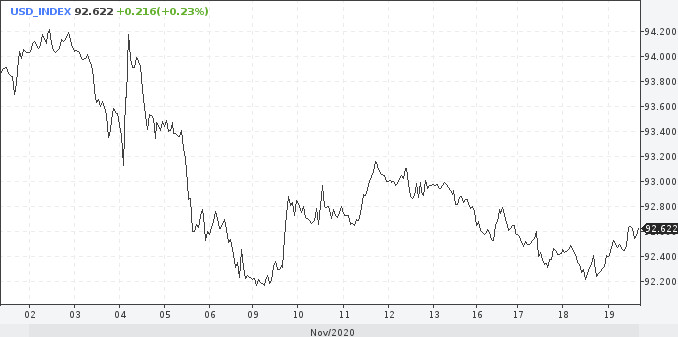

The dollar index remained around 92.55, although it was close to its weakest value since August.

The beneficiaries of the recent decline of the greenback – the Scandinavian currencies and the Australian dollar - have lost strength. The Norwegian and Swedish krona sank 0.3%, while the Australian dollar lost 0.4%.

The dollar is now caught between two opposing forces. The security bet supported it, while new speculation about monetary easing is cutting off the greenback's oxygen. Fiscal stimulus plans are failing, so the Fed may loosen policy further at its December meeting. Two senior officials on Wednesday backed the market's view, with Treasury bonds rising as a result.

Meanwhile, analysts believe that the decline in risky assets is likely to be limited. This downward movement should be perceived as corrective within a broader upward trend, which will eventually resume.

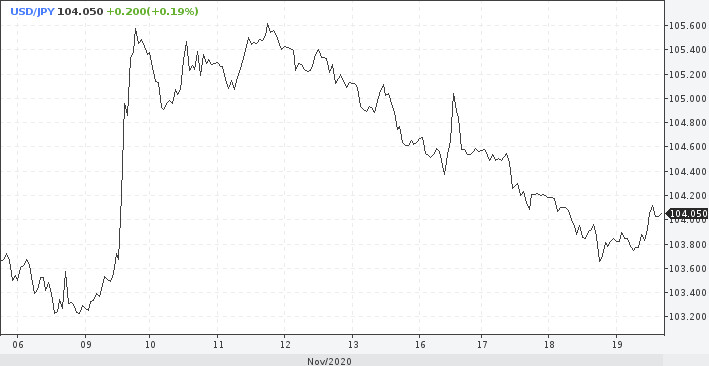

The Japanese yen lost a little against the dollar, being at the border of the 104 mark. However, in the week since the promising results of the vaccine were announced, it has risen by 1.6%.

On Thursday, market players will carefully study a portion of macroeconomic data from the United States. Fresh statistics are a key factor ahead of the Fed's next steps.

Dollar and vaccine

In any case, progress in the pharmaceutical industry is evident, and this will have a significant impact on the exchange rate formation of protective mechanisms, including the dollar. In March, when there was a large-scale increase in the dollar index, there was a situation of complete uncertainty. The actions of Central Banks and the gradual adaptation of economies to new realities led not only to a pullback of the USD but also marked the beginning of a downward trend. Previously, the dollar showed continuous global growth for 10 years, which was broken in July.

The closer success in the fight against the pandemic, the less attractive the dollar becomes. In the meantime, the coronavirus is raging, and new indicators have already overtaken the records of the spring. However, the dollar's devaluation processes are supported by monetary policy easing.

Despite the pressure, the medium-term potential for the dollar's decline will be moderate. Even before the breakdown of the upward trend at levels above 96 points, the opinion on the dynamics of the USD index was based on the current critical US trade deficit. It also took into account the long-term rate of near-zero interest rates of world regulators. At that time, the target of the fall was around the 88 mark, which meant that the dollar would fall by about 9%. Now the forecast has changed for the better for the dollar, it is allowed to decrease by approximately 5%.