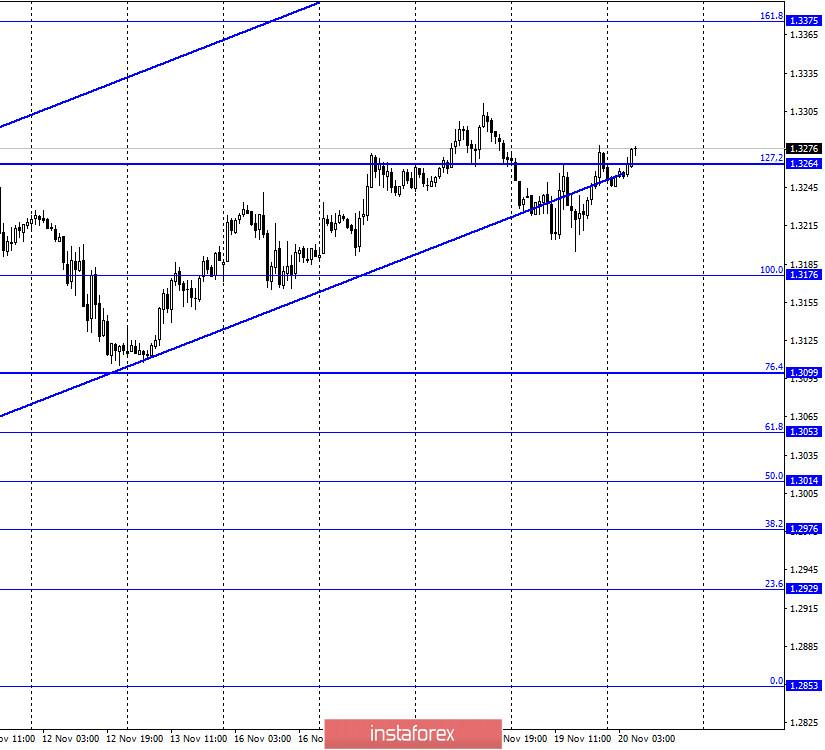

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair were trading very strangely the day before. The pair performed a consolidation under the lower border of the upward trend corridor, but was able to go down after that 20-30 points and performed a reversal in favor of the British, resuming the growth process. Thus, although the graphical analysis indicates a change in the "bullish" mood of traders to "bearish", the process of price growth can now resume in the direction of the corrective level of 161.8% (1.3375). Very interesting is the fact that the UK has again received quite disappointing news regarding the negotiations on a trade agreement between the EU and Britain. This time, one of the members of the negotiating team of Michel Barnier passed a positive test for coronavirus and the negotiations had to be interrupted. Barnier wrote on Twitter that negotiations should resume as soon as possible, but without violating medical protocols. I believe that if the infected person was in contact with other participants in the negotiations, then most likely, the infection is several. Probably, all members of the negotiation process have already passed tests for coronavirus, and today we can get information that several more members are infected. This is very unpleasant news because the time left for Michel Barnier and David Frost is already gone. The talks were supposed to end on November 15-18 in time for the EU summit. However, it is now clear that if they are ever completed, it will not be until next week. Every day the chances of reaching an agreement are less and less, but the British pound continues to grow strangely.

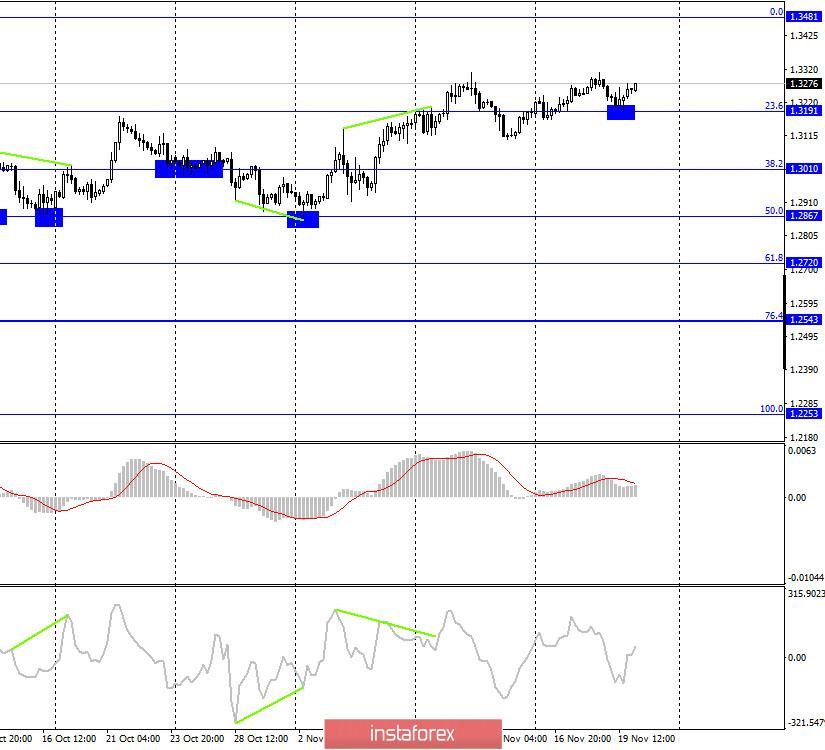

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a rebound from the corrective level of 23.6% (1.3191) and a reversal in favor of the British currency. Thus, the growth process resumed in the direction of the corrective level of 0.0% (1.3481). Today, the divergence is not observed in any indicator. Closing the pair's exchange rate under the Fibo level of 23.6% will work in favor of the US dollar and some fall in the direction of the corrective level of 38.2% (1.3010).

GBP/USD – Daily.

On the daily chart, the pair's quotes continue to grow in the direction of the corrective level of 100.0% (1.3513). However, when trading a pair, I recommend paying more attention to the lower charts. They are now more informative.

GBP/USD – Weekly.

v

v

On the weekly chart, the pound/dollar pair completed a new close above the lower downward trend line, although a false breakout of this line followed earlier. In recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

There were no important economic reports in the UK on Thursday. And the news about the interruption of negotiations did not have a strong impression on traders.

News calendar for the United States and the United Kingdom:

UK - changes in retail trade volume with and without fuel costs (07:00 GMT).

On November 20, the UK calendar has a relatively important retail report, while the US calendar has nothing. At the same time, I will wait for news from the talks between London and Brussels.

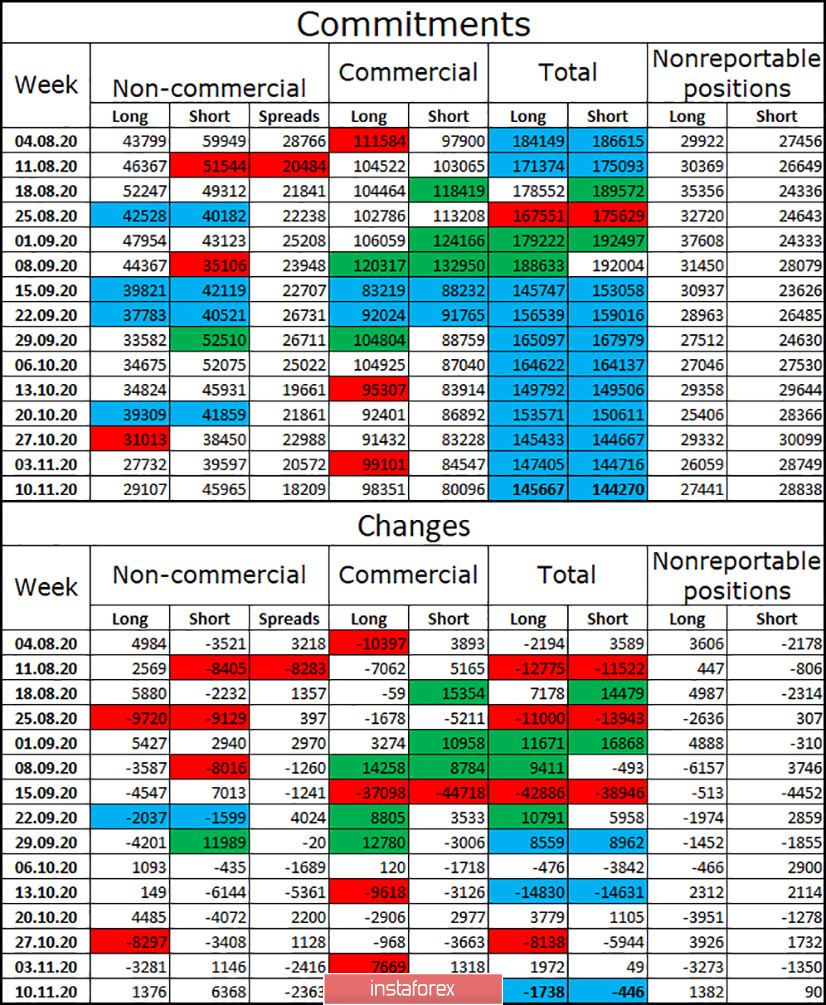

COT (Commitments of Traders) report:

The latest COT report on the British pound showed that the mood of the "Non-commercial" category of traders became even more "bearish" during the reporting week. Speculators this time opened 1.4 thousand long-contracts, but at the same time increased 6.4 thousand short-contracts. The British pound as a whole has continued to grow in recent weeks despite COT reports. However, the latest COT report suggests that the British currency is about to fall. I also note an almost equal number of open long and short contracts for all categories of traders and a fairly small total number of contracts in the hands of the "Non-commercial" category. This means that speculators are not eager to deal with the pound right now.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.3010, if the close is made under the level of 23.6% (1.3191) on the 4-hour chart. I recommend being careful with purchases of the pair now, as the quotes have been fixed under the trend corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.