Recently, the US dollar has been trading in pairs with the single European currency very unevenly, without a clear direction. The price dynamics of the main currency pair is still affected by the ongoing COVID-19 pandemic. So, in the United States of America, the number of deaths from coronavirus has already exceeded 250 thousand people, and therefore New York schools have switched to correspondence education. However, in Europe, the situation with the daily number of infected people, to put it mildly, is far from ideal. This has been repeatedly reported in previous articles, so we will not repeat it.

In general, the US currency is in an uncertain state. On the one hand, the dollar is still in demand as a protective asset, but on the other, fiscal stimulus in the United States, which is delayed due to Donald Trump's non-recognition of the results of the presidential election, puts pressure on the rate of the "American". Against this background, speculation has resumed that the US Federal Reserve (FRS) will further ease its monetary policy by expanding its bond-buying program.

Yesterday's data from the United States on the number of initial applications for unemployment benefits came out worse than forecasts of 707 thousand and amounted to 742 thousand applications. However, market participants decided to ignore this fact, and it did not have a significant impact on the price dynamics of EUR/USD. Today, on the last day of weekly trading, no significant statistics from Europe and the United States are expected, so it is reasonable to assume that the pair's movement will depend on market sentiment and the technical picture.

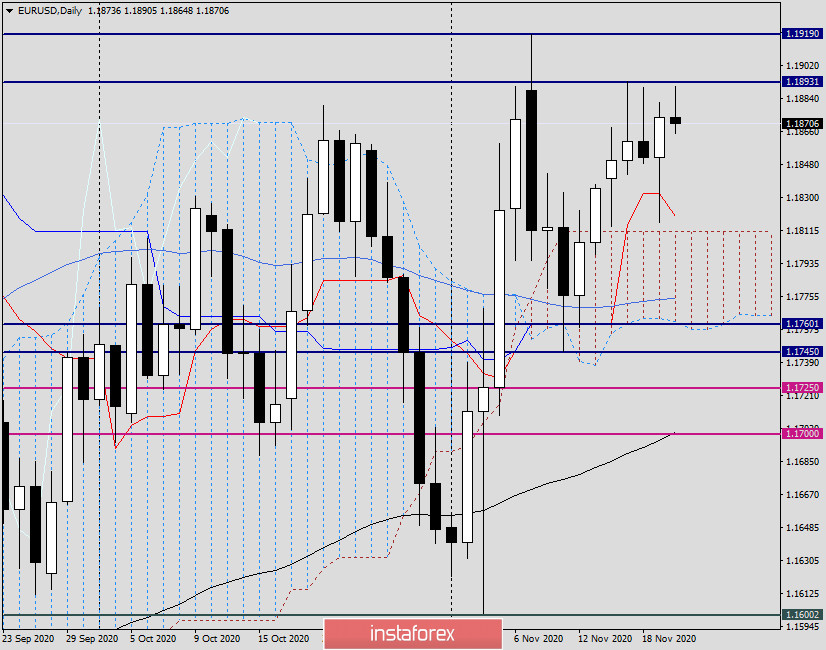

Daily

In yesterday's review of the main currency pair, attention was drawn to the candle for November 18, which could be considered a reversal with good reason. At the same time, the intrigue remained - whether the market will win back this signal. And here again, everything turned out to be very ambiguous. At first, the pair started to decline, but after finding strong support near 1.1816, the downward movement stopped and the quote turned on the rise. As a result, Thursday's trading ended with growth, and the closing price of the session was 1.1873. Today, at the time of writing this article, the upward trend continued and the rate was already rising to 1.1890, which is slightly below the resistance of 1.1893, where the maximum values were shown on November 17-18. Slowly but surely, the pair is getting closer to the most important and largely defining resistance zone of 1.1900-1.1920. Interestingly, after the US presidential election, the quote has not yet managed to rise above 1.1920.

As for yesterday's recommendation to buy EUR/USD on a decline in the area of 1.1835-1.1815, it turned out to be correct. Attempts to break through the red line of the Tenkan Ichimoku indicator were unsuccessful, and it fulfilled its support function. So far, the weekly candle is bullish and the euro/dollar has every chance to end trading on November 16-20 with growth. A very important factor will be the closing price of weekly trading relative to the levels of 1.1900 and 1.1920, but we will talk about this on Monday, taking into account the actual closing of the week.

For those who do not want to take risks and enter the market on the last day of weekly trading, I recommend staying out of the market. For those who want to open positions, I suggest paying attention to the opportunity to buy the EUR/USD pair after short-term declines to the levels of 1.1870, 1.1865, and 1.1860.