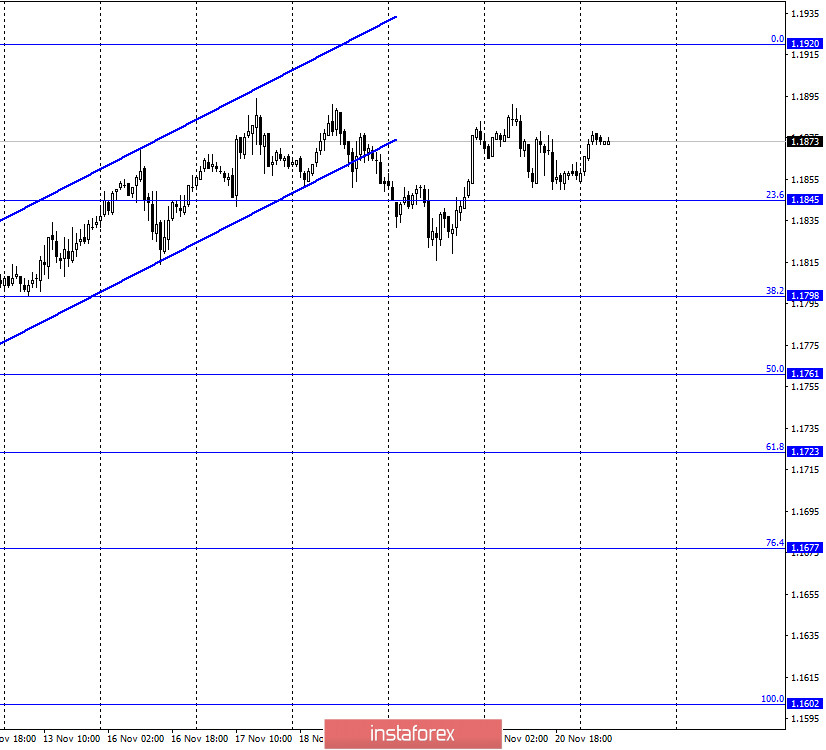

EUR/USD – 1H.

On November 20, the EUR/USD pair traded with a small amplitude, spending the entire day inside the range of 1.1850-1.1890. Thus, the mood of traders now remains "bullish", since the fall in quotes did not begin after fixing under the upward trend corridor. However, the growth process does not continue. It's more like a side corridor with no clear boundaries. On Friday and the weekend, the amount of news was small. Donald Trump's team continues to fight for the election, filing lawsuits in the courts by the dozens or even hundreds. Joe Biden insists on starting the process of transferring power and complains that he can't form his Cabinet, can't get access to budget money that is intended to prepare for the new President, and threatens to sue Trump if he continues not to recognize the election results. Republican Senator from Alaska Lisa Murkowski called on Trump to start the process of transferring power to Joe Biden, saying that Trump had the opportunity to challenge the election results in court, but most courts found the claims of the President's team untenable. So America continues to be in a state where it is impossible to say exactly who will be the next President? There are still no final election results. The electoral college will vote on December 14. A lot of things may change before December 14.

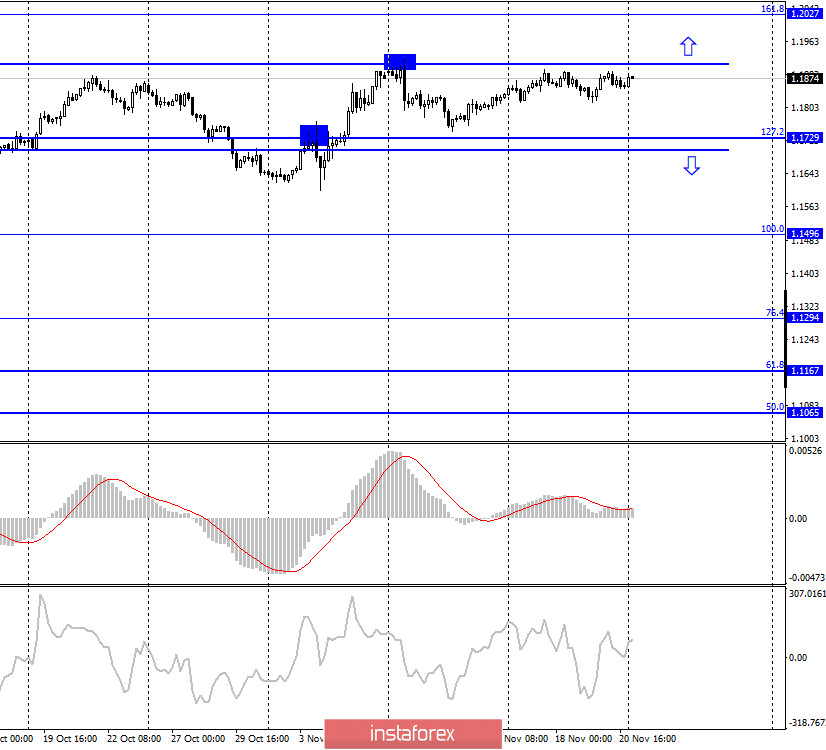

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes continue to trade near the upper border of the sideways trend corridor. The pair's rebound from this border will allow traders to expect a reversal in favor of the US currency and a slight drop in the direction of the corrective level of 127.2% (1.1729). Closing the pair's rate above the corridor will finally work in favor of continuing the growth process in the direction of the corrective level of 161.8% (1.2027).

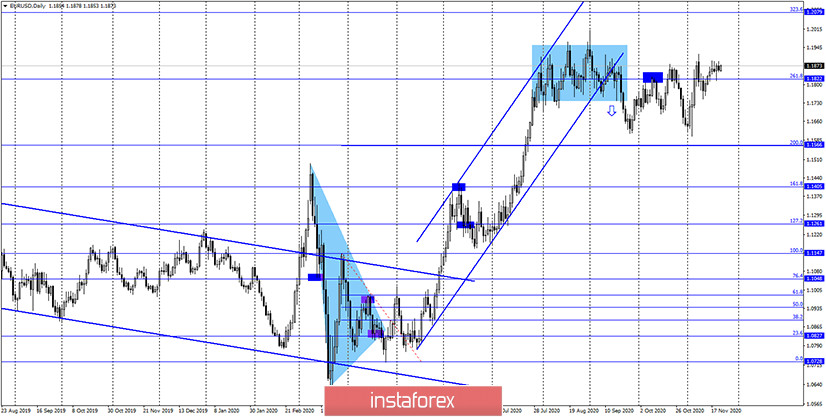

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new consolidation above the corrective level of 261.8% (1.1822). This level remains weak, and I recommend paying more attention now to the lower charts, which respond more quickly to changes in the market, of which there are not many at the moment.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 20, a new speech by Christine Lagarde took place in the European Union, which again did not interest traders. The information background on this day was extremely weak.

News calendar for the United States and the European Union:

EU - index of business activity in the manufacturing sector (09:00 GMT).

EU - index of business activity in the service sector (09:00 GMT).

EU - composite PMI (09:00 GMT).

US - manufacturing PMI (14:45 GMT).

US - services PMI (14:45 GMT).

US - composite PMI (14:45 GMT).

On November 23, the European Union and the United States will release indices of business activity in the manufacturing and services sectors. These reports may slightly affect the mood of traders.

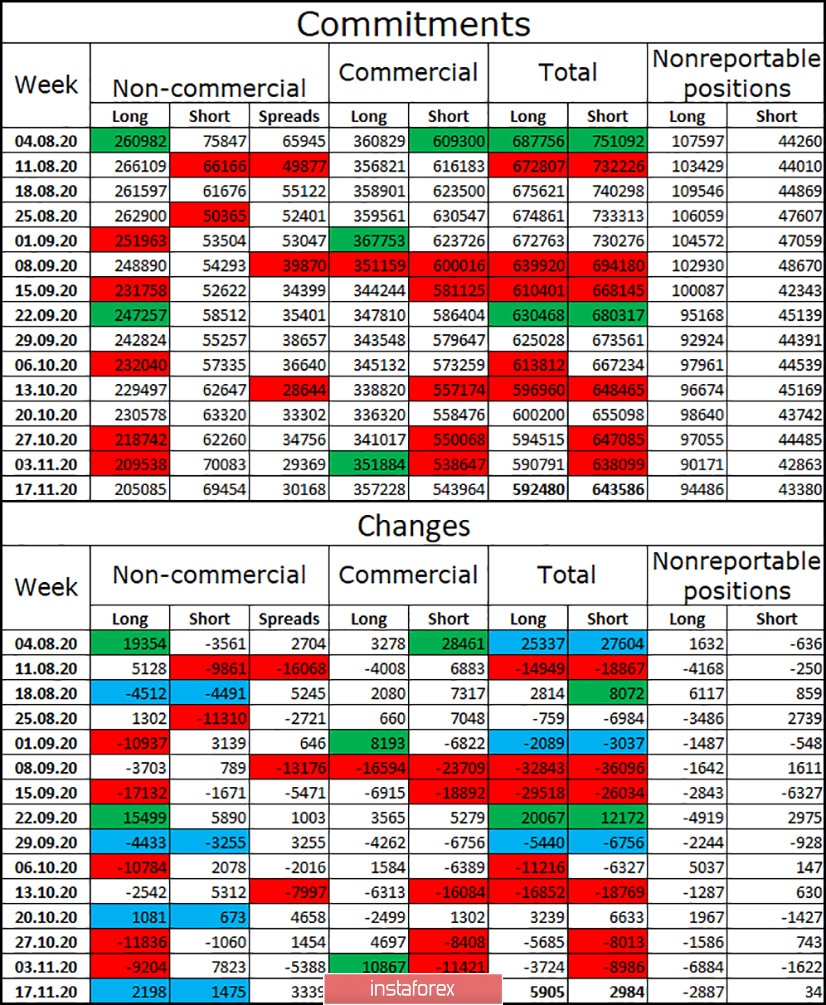

COT (Commitments of Traders) report:

The penultimate COT report was released with some delay, so here I will analyze the changes in two reports at once. Fortunately, there are almost no changes. As well as the price changes of the euro/dollar pair in the last few months, which is visible on the 4-hour chart. Over the last two reporting weeks, the number of long contracts in the hands of the "Non-commercial" category of traders decreased by 4.5 thousand, and the number of short contracts - by 0.5 thousand. During the last reporting week, speculators opened approximately the same number of long and short contracts. Thus, in general, the changes are insignificant. The mood of speculators became a little more "bearish", but again slightly. There are even fewer changes in other categories of traders. The most important thing I would like to note is that the mood of major players is not becoming more "bullish", which means that there are no prerequisites to expect a resumption of the upward trend now.

Forecast for and recommendations for traders:

Today, I recommend selling the euro with targets of 1.1798 and 1.1761, if there is a rebound from the upper border of the side corridor on the 4-hour chart or a close under the level of 23.6% (1.1845) on the hourly chart. Purchases of the pair will be possible with a target of 1.2027 if it is fixed above the side corridor on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.