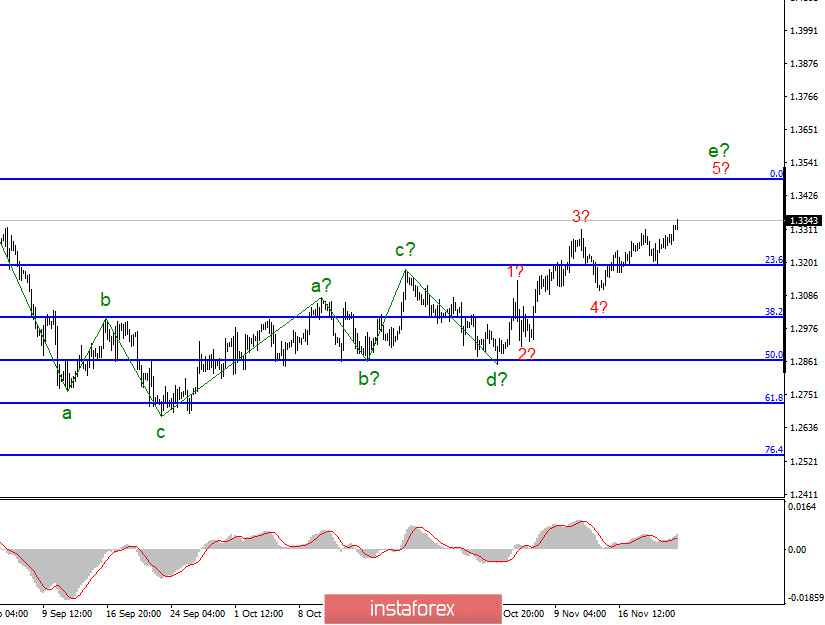

In the most global terms, the construction of the upward trend section continues but the wave marking is taking a complex form and may become even more complicated. The section of the trend that started on September 23 took a five-wave form, but not an impulse one. A successful attempt to break the previous peak indicates that the markets are ready for further purchases of the British pound. The supposed e-wave took a five-wave form.

The lower chart clearly shows the a-b-c-d-e waves of the uptrend section. However, the assumed e-wave took a more complex five-wave form. Nonetheless, even with this complication, it is nearing completion. Thus, another downward correction wave can further confuse the entire wave markup after which the increase will resume. I still expect to build a new downward wave but the high demand for the British dollar continues to complicate the upward trend.

The British pound continues to be in much higher demand than the US dollar and this is the most interesting question on the currency market in recent days and weeks. There is still no information that the UK and the European Union have managed to agree on a trade agreement, but the pound still continues to grow, while completely ignoring any other news from both America and Britain. The EU officials made a statement last Friday that the issues of fishing, competition and state support and dispute resolution between London and Brussels remain controversial. These are the issues that were controversial from the very beginning and caused the most controversy. As we can see, they are still not resolved even though the head of the European Commission Ursula Von Der Leyen assures that progress has been made recently.

Some support for the Briton could be provided by statistics on Friday. Retail sales in October were higher than what is expected in the market. It increased by 1.2% compared to September and excluding fuel by 1.3%. However, there is still no news or reports received from the UK yet and the British pound has already added about 60 basis points. Thus, I believe that statistics have absolutely nothing to do with it now. Markets continue to buy the pound solely on expectations of reaching an agreement on trade relations. I don't see any other reasons. During this week, it should be known for sure whether the deal will be made or not. There are just over 5 weeks left until the end of the year and the final Brexit.

General Conclusions and Recommendations:

The Pound-Dollar instrument has resumed building an upward trend but its last wave is nearing completion. Thus, I recommend that you look now closely at the sales of the instrument as the British is not yet giving clear signals about the end of the upward section of the trend. At the same time, purchases of the instrument are now quite dangerous given the uncertainty associated with the trade deal.