Stock America began the new week in high spirits. Optimism comes from news headlines about the vaccine. The vaccination date is gradually shifting forward, and market expectations are shifting accordingly. Mass administration of the drug against the virus is expected to begin in developed countries from the first quarter of 2021.

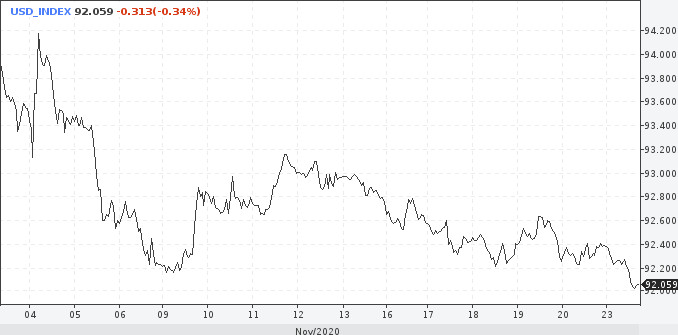

Since the beginning of November, defensive currencies began to exhibit worst performance. The main outsider was the US dollar. The USD index remains close to an important support line around 92, where it is gradually being pushed by the increasing appetite for risk.

Another factor of pressure is the fact that the US is currently discussing a $ 500 billion economic support package. This indicates a smaller volume of government bonds and a weaker demand for dollars from abroad. Thus, the balance of power against the greenback is shifting, setting up further weakening in the coming weeks.

The dollar is expected to test the 92nd mark. This is also supported by the continued optimism in the commodity markets. However, a clear consolidation below this mark just can not happen due to the fact that trading this week is likely to be somewhat sluggish. The USA celebrates Thanksgiving on Thursday, which will smoothly transition into the beginning of the shopping season on Black Friday.

This week's news calendar isn't particularly outstanding. Durable Goods Orders Report, Third Quarter US Growth Release, and Core PCE Inflation Report are due Wednesday. The most important will be the publication of the minutes of the November meeting of the FRS. Traders will scrutinize it for clues about an increase in QE at the December meeting.

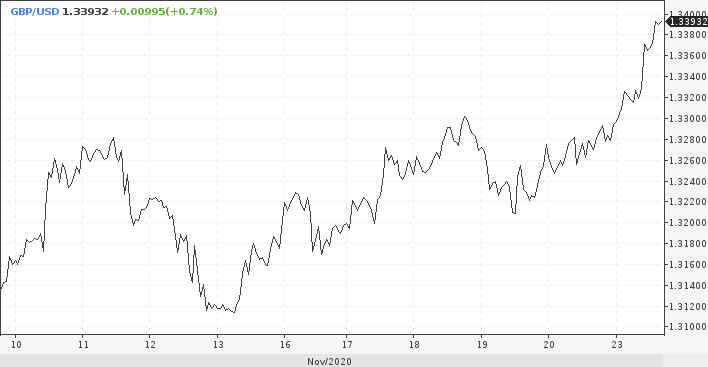

In addition to the factors mentioned above, traders pay attention to significantly stronger macroeconomic indicators of other countries. Demand for New Zealand and Australian dollars, as well as the British pound, is improving. All three currencies share a positive correlation with the demand for risk, and the weakening dollar is the common denominator.

Thus, the NZD / USD pair reached a 2-year high after the release of an impressive retail figure. Over the past five years, the 0.68 - 0.70 range has been an important area of the tug-of-war between buyers and sellers. It is now shifted. If the NZD manages to go above 0.70, then there will be upside potential to the 2016-2018 highs 0.74-0.75. New Zealand has avoided a second wave of the spread of the virus, which means that economic damage will be minimized.

Australia regularly pleases with positive data. Strong numbers on employment growth were joined by strong CBA estimates for manufacturing activity and services. The rise in the AUD / USD pair was more modest, however, the rate is testing 2-year highs.

The pound looks quite attractive now, as it managed to go beyond the 1.33 mark in tandem with the dollar. Yes, Britain has recently been pleased with economic data, but overall the situation cannot be called unconditionally favorable. Friday retail supported the pound's gain, which also responded to news of progress in trade negotiations with the EU. This reduces the risk of leaving the union without a deal.

Note that the 1.33 level is very important for the pound. Sterling has been fighting an unsuccessful fight for the mark for two years. In September, the pound again failed, but the pullback was shallow, which sets up more buying in GBP/USD.