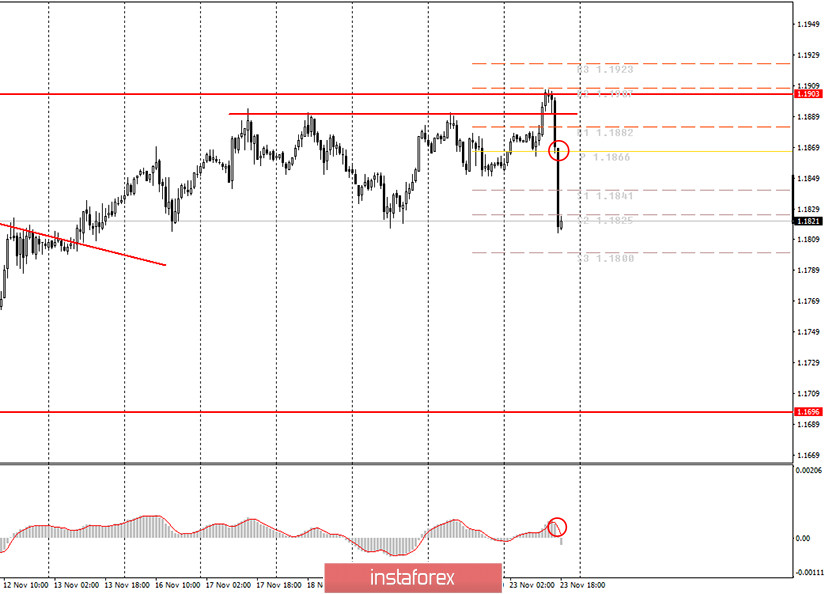

1-hour chart of EUR/USD

In the first half of the trading day, EUR/USD resumed its downward move, surpassed 1.1890 from which it had rebounded three times earlier. Afterwards, the price climbed to 1.1903 which remains the upper border of the trading range. Then, it rebounded in an expected move and took a nosedive. Thus, the currency pair again reversed in the opposite direction at one of the borders of the trading range. I urge beginners not to be confused about this slump because it was not caused by any serious fundamental event. At least, in the recent few hours nothing extraordinary was reported by the mass media. Indeed, what could actually have happened to cause the US dollar gain of 100 pips in 2 hours? I guess this is just the market response to testing the upper border of the trading range. The thing is that most retail traders and large investors rushed to sell the euro at near the upper border of the channel. This accounts for a serious reinforcement of the US dollar. Well, there are no other reasons behind such moves. Perhaps, something will come into play later ...

In the first day of the trading week, the economic calendar contains a few important reports. For example, the eurozone's services PMI fell steeper than expected to 41.3. For your reference, any reading below 50 indicates contraction in the sector. No wonder, a slowdown in any sector stalls expansion of the whole national output. Besides, the eurozone's manufacturing PMI also declined a bit. Unlike the EU, the US reported upbeat data. The US services PMI grew to 57.7 and the manufacturing PMI rose to 56.7. To sum up, these publications today lie behind a slump of the single European currency and growth of the US dollar. Indeed, such data underscores not only trends in business activity but also indicate changes in the US and EU economies in the short term.

On Tuesday, the economic calendar is nearly empty for the EU. Germany is due release a few reports that is one country of 27 EU members. Nevertheless, metrics on Germany's economy could shed light on the overall background of the EU economy. Besides, the US also will not provide any news. Moreover, there is no burning issue to be of vital importance to market participants. The election topic is losing its influence to market sentiment. Investors are less interested in the coronavirus information than earlier. The veto on the 7-year EU budget and the recovery fund is not so thorny because the EU policymakers have plenty of time to settle it.

On November 24, the following scenarios are possible

1)Long positions on EUR/USD still make sense. Today the bulls were trying to push the price above the level of 1.1903, but their efforts were in vain. In means that traders should refrain from buying EUR. Before opening long positions on EUR/USD, it is recommended to wait until a new uptrend emerges again or a downtrend is evidently over.

2)Trading amid the downtrend is reasonable at present because the bias reversed downwards a few days ago. Today the MACD indicator formed a sell signal with a minor delay (it is marked by a circle on the chart). However, even in this case beginners have gained a profit of nearly 55 pips now. I guess this is a decent profit level. So, it would be better to close long deals. New long positions should be opened after the pair corrected upwards a bit.

What's on the chart:

Support and Resistance levels are the levels that are targets when opening buy or sell orders. Take Profit levels can be placed near them.

Red lines are channels or trend lines that display the current trend and show which direction it is preferable to trade now.

Up / down arrows show whether the pair should be traded up or down when reaching or overcoming particular obstacles.

MACD indicator (10,20,3) - a histogram and a signal line. When they are crossed, this signals a market entry. It is recommended for use in combination with trend lines (channels, trend lines).

Important speeches and reports in the economic calendar can greatly influence the movement of the currency pair. Therefore, during their release, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.