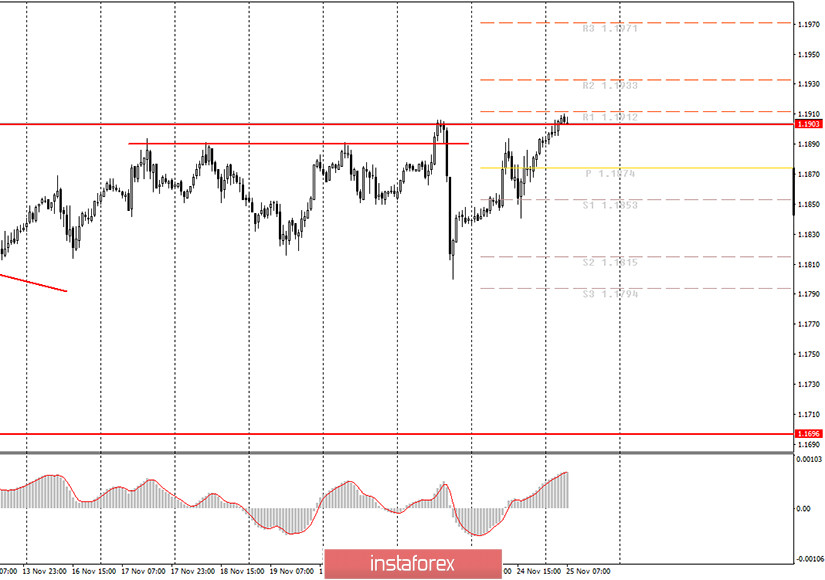

Hourly chart of the EUR/USD pair

The EUR/USD pair rose to the upper line of the 1.1700-1.1900 horizontal channel last night. Quite unexpected. It seems that this time, buyers are determined to break the line in order to try to start a new upward trend. However, the euro/dollar pair is currently at the 1.1903 level. Therefore, it is still too early to talk about overcoming the upper border of the channel. The current situation is quite complex and ambiguous for novice traders. First of all, even if the price overcomes the 1.1903 level in the near future, it will be impossible to open buy positions, since the MACD indicator is at a very high value. Secondly, the upward trend will only be for formality, since there is still no trendline or trend channel to clearly understand that the pair is in a certain trend. Thirdly, we believe that the pair has more chances for falling and, accordingly, a rebound from the 1.1903 level. Fourth, the recent fundamental background is not associated with the dollar's fall. Traders should not have opened any positions overnight, according to yesterday's recommendation, a sell signal from MACD was never formed.

Several quite interesting reports from the United States will be released today. We said that you should pay most attention to reports on GDP and orders for durable goods. These reports can influence the EUR/USD pair's movement today. However, everything will depend on their actual values. If, for example, the GDP in the third estimate grows and exceeds 33.1%, this will be a good chance for the US dollar to rise in price. The same goes for the second important report, which has been too neutral for the past two months. However, the question arises, do traders need macroeconomic statistics now? As you can see, the pair fell by 100 points on Monday, and yesterday it fully recovered from this fall. What are traders reacting to now and why are they trying to withdraw the pair from the horizontal channel, if they were unable to do so during a time when they had a much stronger fundamental background?

Possible scenarios for November 25:

1) Long positions are currently irrelevant. Buyers tried to take the pair above the 1.1903 level, but they did not succeed, which means that it is not recommended to buy the euro right now. Even if the price manages to confidently overcome this level in the next few hours, you are advised to open long positions only after a downward correction and when the MACD indicator discharges to the zero level. Potential targets are resistance levels 1.1933 and 1.1971.

2) Trading for a fall at this time is relevant, since the price has not yet managed to overcome the upper line of the horizontal channel. And since the price continues to be near the upper channel line, we continue to expect a downward reversal. Today we advise you to wait for a new sell signal from the MACD indicator and trade down while aiming for 1.1874 and 1.1853. This recommendation will be in effect if the price does not move above today's high (1.1910) in the coming hours. If the price continues to rise, then it is generally not recommended to open short deals today.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.