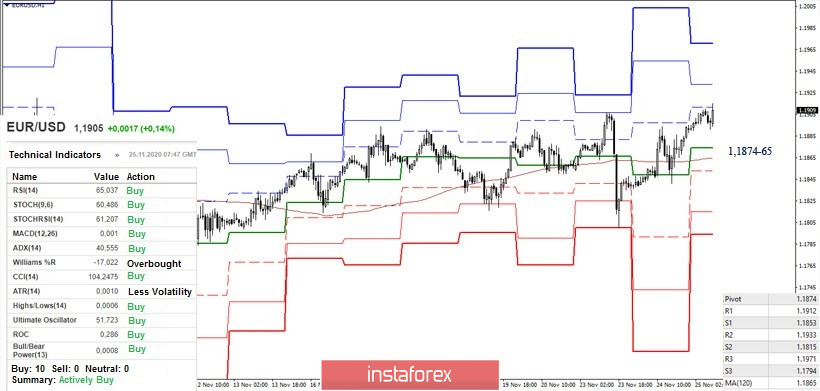

EUR / USD

Bulls are currently insisting on continuing the growth. Now, there is an ongoing attack for the limit of 1.1881-1.1929 (historical level + 100% target development for the breakdown of the H4 cloud). If they break through this level and consolidate, it will open the way to the next pivot point 1.2011-18 (high extremum + upper limit of the monthly cloud). Today, the daily Tenkan, which is located at 1.1857, and the daily cloud (1.1812 - 1.1761), strengthened by the weekly short-term trend still serve as the nearest support levels, in case that the bearish mood returns.

There is an attempt to restore the upward trend in the smaller time frames. The resistance of the previous high extremum (1.1906) is now supported by the first resistance level (1.1912). A consolidation above which will allow us to leave the correction zone. The next upward pivot points for the intraday will be R2 (1.1933) and R3 (1.1971).

On the other hand, the key support levels are focused around 1.1874-65 (center pivot + weekly long-term trend) today. Working below these levels will contribute to the return of bearish moods. The benchmarks that we can consider will be 1.1853 - 1.1815 - 1.1794. In the current situation, these supports are strengthened by bigger time frames, which increases the importance of breaking through them.

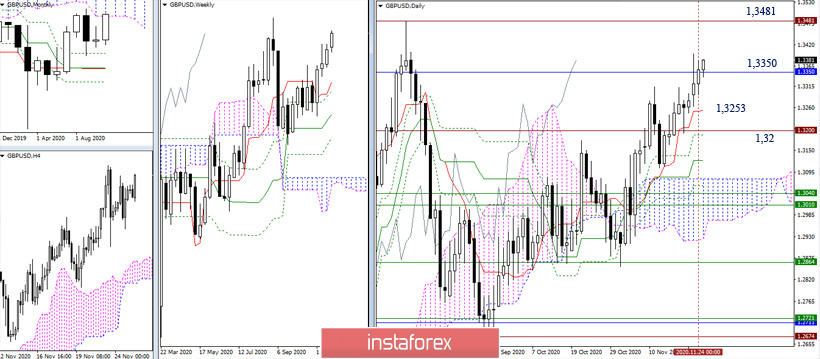

GBP / USD

The bulls are not leaving the level of 1.3350 (lower limit of the monthly cloud), but so far they cannot regain the high of the beginning of the week (1.3397). Their main task for the next few days before the month closes is to sharply consolidate above. By doing so, they can close November in the monthly cloud. Next, it will be important to get out of the weekly and monthly correction zone (1.3481). Failure to hold positions and a long upper shadow on the monthly candle will most likely result in a return of bearish sentiment for a fairly long time. The nearest supports can now be noted at 1.3253 (daily Tenkan) and 1.32 (historical level).

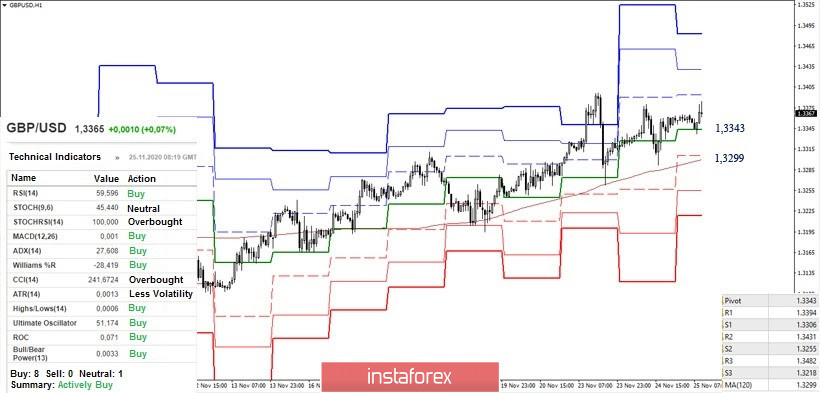

The key levels in the smaller time frames continue to defend the interests of players, being included in the work on a daily basis. This indicates the weakness of players for promotion. The loss of support levels of 1.3343 (central pivot level) - 1.3299 (weekly long-term trend) will change the current balance of power in one-hour time frames, which can lead to a change in priorities in bigger time frames. The next support levels, which are reinforced in the higher TFs, are located at 1.3255 and 1.3218 today. If the rise continues, the upward resistances within the day can be noted at 1.3394 (R1) - 1.3431 (R2) - 1.3482 (R3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)