GBP/USD is extending a steady bullish run. The day before yesterday, GBP buyers were able to approach 1.34 but did not dare to test the level of 1.3400. Nevertheless, despite deep correctional retracements, trading sentiment is still optimistic. The pair is following the bullish trajectory not only amid the weakness of the US currency.

Traders are still monitoring the Brexit saga which is hanging like the sword of Damocles over the pound sterling. Any negative rumor about the Brexit talks immediately pushes the sterling down. In other words, GBP/USD dynamic can be described as follows: one step forward – two steps backward. The dynamic is complicated by abrupt and unexpected moves downwards. For example, the rumors about another failure to come to the common denominator on vital issues between London and Brussels are enough to push the price down. Though such information resurfaces in the mass media frequently, investors cannot get used to it. The sterling takes a nosedive in response to negative news.

If we look at the 1-week chart of GBP/USD, we can find out that the pair has climbed from 1.2860 up to the current high of 1.3397 over three and half weeks, i.e. since early November. Remarkably, despite all worries about the prospects of the trade deal, GBP/USD buyers have pushed the pair more than 500 pips up over three weeks. This indicates that the market is confident about a compromise decision, so that the UK will avoid hard-Brexit. That's why down moves do not encourage the bearish momentum. On the contrary, traders take advantage of the sterling's weakness to open long deals at an attractive price. Besides, the broad-based weakness of the US dollar cements the bullish sentiment on GBP/USD.

The fundamental background enables us to predict that GBP/USD will be able to hit multi-month highs in the medium term. The first upward target is seen at 1.3400. The upper border of the Bollinger bands at 1.3450 is considered to be the main target. At the moment, there are some preconditions for this scenario to come true.

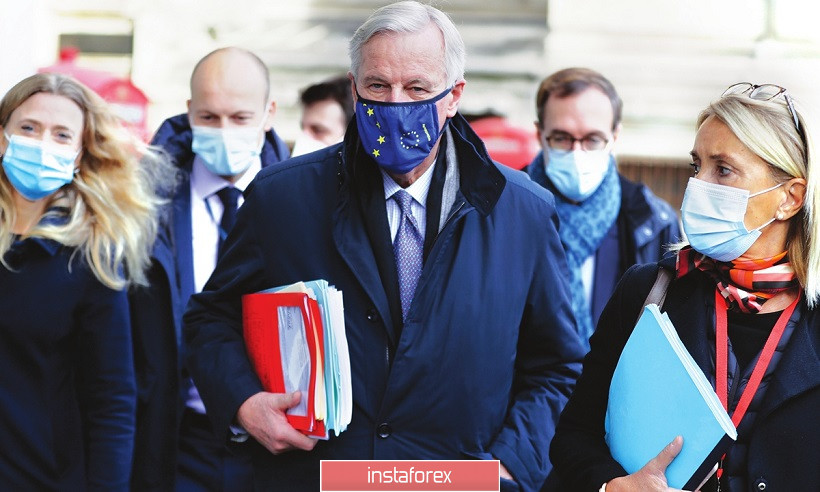

At the end of the last week, one of the Brexit negotiators was tested positive for COVID-19. So, both delegations were kept in quarantine. The close-door briefing for EU ambassadors was cancelled. Chief EU negotiator Michel Barnier was expected to shed light on prospects of the trade deal. Such disappointing news weighed down on the British currency, though for a short while. After a pause, the parties resumed the talks online. Besides, journalists found out at what stage the talks were for the time being.

In fact, the deal is reportedly 90-95% ready. At the same time, some disagreement on thorny issues did not allow the parties to finalize the deal. First and foremost, the parties still cannot settle quotas for the fisheries and decide how to ensure fair competition for companies, including the government financial aid. The fishing question is the most troublesome stumbling rock. Nevertheless, the British mass media reported that the parties were able to find an option which could resolve the gridlock.

According to the insider information, the negotiators are discussing "floating" agreements, i.e. some paragraphs regulating fisheries are proposed to be revised within regular intervals (in a year or a few years). One of the EU diplomats confirmed for the UK Sun periodical that such option is on the table. At the same time, he noted that Brussels insists on incorporating the clause on such revisions to the whole trade agreement. In other words, the terms on fisheries could be reviewed alongside other trade terms. So, the talks are focused on these intricacies at present.

The light at the end of the tunnel supported the pound sterling. All other fundamentals are also of the positive or at least neutral nature. For example, the Bank of England gave up the idea of a rate cut to a negative territory, advocating the wait-and-see stance for the medium term. The UK CPI was much stronger than expected. Some metrics showed upbeat scores. Besides, on Saturday the UK and Canada signed an interim trade deal that guarantees continuity when Brexit transition period expires. The countries decided not to change the rules maintaining their imports and exports worth $27 billion. This fact was also bullish for the British currency.

To sum up, GBP/USD is keeping the bullish momentum. Any downward retracement can be used as an opportunity to open long positions. The technical picture is also in favor if this strategy. On the daily timeframe, GBP/USD is trading between the upper and lower lines of the Bollinger bands indicator. This proves the priority of the uptrend with the target of 1.3450 (the upper border of the Bollinger bands on the daily chart). The first target is seen at 1.3400 because the bullish momentum could stall a bit in this area for a while. GBP/USD buyers need some forceful news to conquer levels above 1.3400.