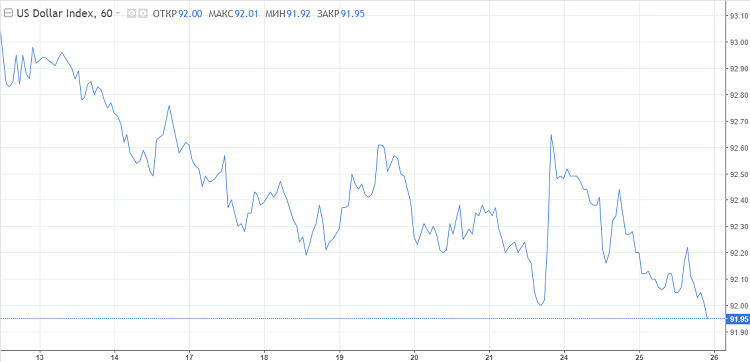

On Wednesday, the US dollar tried to keep from falling, but to no avail. In the American session, it went down again and broke the 92 mark. The dollar index is approaching a dangerous edge. If sellers manage to push it to the value of 91.75, an important long-term technical support level, then it will be followed by a sharp and rapid decline. It is worth considering that the next long-term support level is the 2018 low at 88.25.

The dollar is taking losses as progress in developing new vaccines and expectations of fiscal stimulus in the US instill risk appetite in investors. The dollar is expected to continue to fall also because former Fed Chair Janet Yellen may become the next US Treasury Secretary. Thus, markets welcome a return to stability.

As for the future prospects, the election of Joe Biden as President and the possible appointment of Yellen as head of the Financial Department can play into the hands of the US currency. If the Trump team created chaos around the dollar, the new government's policy towards the dollar is expected to be more predictable and positive. From Clinton to Obama, the authorities held the position of a strong dollar, considering it as a reflection of the strength of the country's economy. Donald Trump has repeatedly threatened to intervene against the strengthening dollar, and took the opposite position after a while.

Janet Yellen must restore clarity on dollar policy and stabilize the currency market. But first, the future Secretary of the Treasury and the new President of the United States will need time to fight the pandemic and repair the economic damage from it.

The Minister of Finance has traditionally been responsible for dollar policy. But under Trump, that framework has been erased. In addition, the administration has shown less commitment to a strong dollar because of the President's obsession with the US trade deficit.

Former Treasury Secretary Larry Summers states that it's time for the country to return to the traditional policy of a strong dollar.

Note that any changes in the currency policy will occur when the markets increase the opinion that the dollar is entering a long phase of decline.

The dollar index fell more than 11%. Bears on the dollar were encouraged by expectations that the Fed will keep rates near zero for many years. In addition, the demand for greenback will weaken, considering the strong results of testing of coronavirus vaccines.

According to strategists at Standard Bank, "Considering the dollar further falling during the Biden presidency, the issue of US monetary policy will be important. Moreover, the era of almost complete absence of currency intervention by developed countries may also end soon."

The trend of low rates may continue, I must say. Yellen praised the policy of the current head of the Regulator, Jerome Powell, which provides for a long period of low rates while expanding government spending.

Traders await decisive action against the dollar. However, not everyone agrees that Janet Yellen will make strong statements about currency policy, since attention will be focused on the internal problems of the economy – this is more important at the moment.

Be that as it may, the former head of the Fed can stop the loss of confidence in the reserve currency. She will turn to the "old Rubin doctrine", according to which a strong dollar is in the interests of the United States. The financier can repeat the G7 promise that exchange rates should be determined by the market. She will be able to find a way out of the situation and stop the loss of world domination by the dollar. Yellen is able to cheer up the markets and end the confusion around the US national currency.

Experts at Commerzbank believe that "Yellen really is a balm for the souls of all those who suffered as a result of the chaotic dollar policy of the previous government over the past four years."