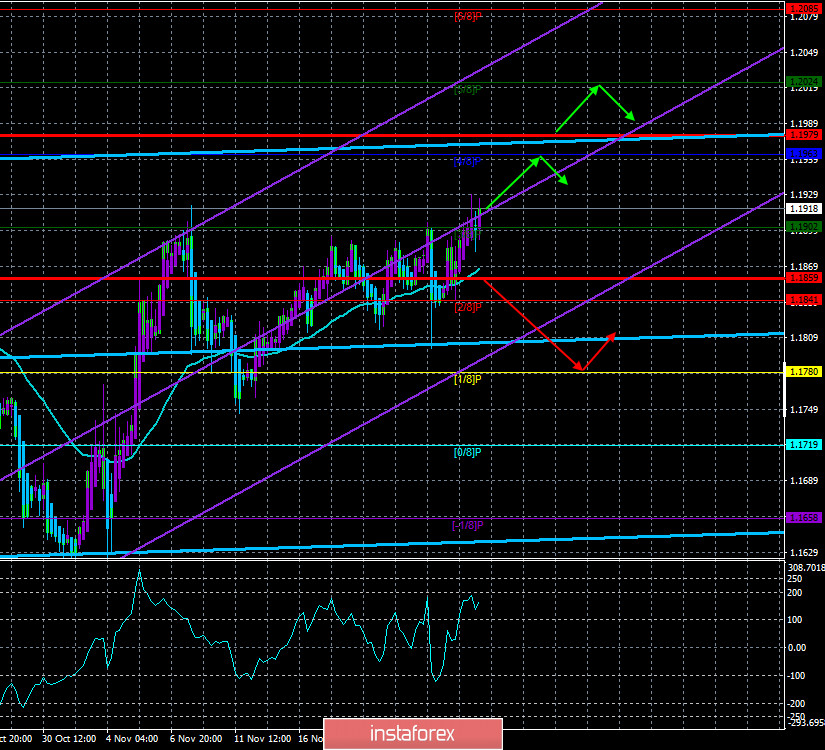

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 163.7550

The third trading day for the EUR/USD pair was again held in fairly calm trading, without any sudden movements. The volatility was average, even closer to a low value, about 50 points. Thus, it is impossible to say that on this day the markets reacted desperately to macroeconomic statistics or tracked the fundamental background all day. Moreover, the technical picture remains very simple, however, the way the pair has been moving in the last couple of weeks is already causing concern. If in the last 3-4 months the quotes were mostly traded in the range between 1.1700 and 1.1900, then in the last two weeks they spent exactly under the upper line of this channel, moving along this level. In other words, we got a flat inside a flat. Trading in such conditions is even more difficult than just in a side channel. By and large, we are witnessing market noise. Yesterday's auction was completely beyond comprehension. The price bitterly broke the 1.1900 level and traded along the level of 1.1910 (approximately) all day. In other words, overcoming the upper limit of the side channel, in which the euro/dollar pair spent four months, led to an increase of 10 points and a flat within 20-24 hours. Further, the quotes could not move up or start falling (in case the breakout was false). As a result, we have a pair that is fixed 10 points above the side channel, and what to do with it is unclear. The "linear regression channels" system formally indicates an upward trend. The last bars are colored purple, but the quotes really could not even overcome the Murray level of "3/8"-1.1902, trading again near it. Thus, in the current situation, traders should be advised to just wait. Wait for the situation to become completely clear.

I don't want to talk about the fundamental background either. A pair that has been standing almost in one place for four months (in the long term), refusing to respond to really important events, now does not give any reason to assume that it will work out any indicator of GDP. By and large, traders continue to ignore all the news, as if showing that the current fundamental background is such that the pair will remain in the $1.17-$1.19 channel for another six months. Briefly about the latest important topics for the euro and the dollar.

1) Hungary, Poland, and Slovenia blocked the adoption of the EU budget for 2021-2027 and the fund for economic recovery after the pandemic. Poland and Hungary are accused of violating the democratic principle and trying to establish a totalitarian regime in some areas of the country's life (be it the courts or television). The EU, on the other hand, wants the rule of law to be respected and can simply cut the allocation of budget funds to those EU members who, in its opinion, violate this rule. However, this is politics. Nothing is unambiguous here. How, for example, is the EU going to prove that the parties of Poland and Hungary violate the principles of the rule of law? The EU will not sue these countries in court. And if so, in which one? To the European? Which of course implies that the side of the European authorities will be accepted. Formally, the EU can exclude these countries from financing altogether. However, this will mean a split of the entire European Union. All participating countries will understand that at any moment they can be "thrown out on the street" and the integrity of the Alliance can be seriously shaken. So, naturally, the parties will try to reach an agreement. And to do this, you need to guarantee the troublemaking countries funding from the funds listed above. In general, this issue can be resolved for a long time, although the parties also have time.

2) America. The election is over, and the process of transferring power to Joe Biden has begun. former Fed chair Janet Yellen may become the new Finance Minister. Donald Trump does not recognize the election results and continues to bombard all US courts with lawsuits. At the same time, his actions have not yet led to the desired revision of the voting results in any state. Thus, now, probably, it is already possible to say with 100% confidence that Joe Biden will be President, and all Trump's attempts to seize power from the Democrat failed. Trump will be remembered by the States and the world for a long time and will stand at the end of the list of failed presidents who failed to get re-elected for a second term. Trump himself in recent speeches spoke about the "coronavirus", the vaccine, and the Dow Jones index, which, despite the pandemic, broke the record. However, most Americans are not very interested in the Dow Jones index. They are more interested in when the coronavirus vaccine will be available and how much it will cost. Trump promised that the vaccine will be available next week and, of course, again lied. First, the vaccine is unlikely to be available next week. Secondly, according to doctors around the world, to defeat the COVID-2019 epidemic, it is necessary that a large part of the world's population either get sick with this virus or get vaccinated. Can you imagine how long it will take to vaccinate even 70% of the US population? How long will it take to create such a huge number of doses? Plus, it is unlikely that this vaccine will simply be available in all pharmacies. Most likely, it will be distributed in a special way and will be a deficit in the first months. Thus, even if the first vaccination with a new vaccine takes place in America tomorrow, this does not mean that the pandemic is over. In the United States, meanwhile, 170,000 to 180,000 new cases are reported every day.

3) Performances by Christine Lagarde and Jerome Powell. They took place last week, but the main thing is that both heads of central banks urged to prepare for the worst. According to Lagarde and Powell, both economies will experience problems in the winter, they need additional funding, which is not available (in the EU, the seven-year budget and the recovery fund are blocked, in America, the Democrats and Republicans have not agreed on a new package of assistance to the economy). Lagarde called on the European Commission to resolve problems with Poland and Hungary as quickly as possible, and also announced an increase in the asset purchase program in December. Powell has not announced anything yet, and the US has not had a second "lockdown", so the US economy may experience fewer problems than the European one.

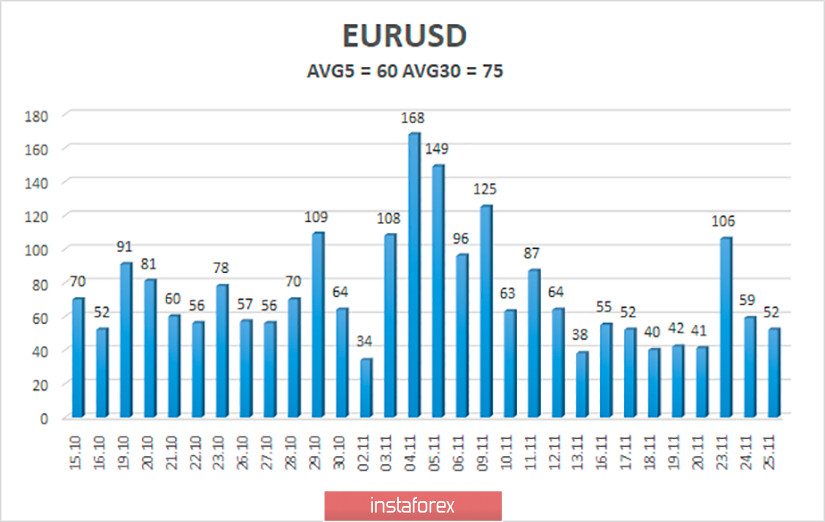

The volatility of the euro/dollar currency pair as of November 26 is 60 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1859 and 1.1979. A downward reversal of the Heiken Ashi indicator may signal a downward correction.

Nearest support levels:

S1 – 1.1902

S2 – 1.1841

S3 – 1.1780

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trading recommendations:

The EUR/USD pair continues to be located above the moving average line. Thus, today it is recommended to stay in long positions with targets of 1.1963 and 1.1979 until the Heiken Ashi indicator turns down. It is recommended to consider sell orders if the pair is fixed below the moving average with the first targets of 1.1841 and 1.1780.