Traders of the EUR/USD (neither buyers nor sellers) were not impressed by yesterday's publication of the Fed's minutes from their November meeting. Meanwhile, the US dollar index continues to gradually decline. It has entered the level of 0.91 during the Asian session, thus marking a two and a half year low. It was in April 2018 when the index was at such lows.

In my opinion, the market quite ignored yesterday's release. Three weeks have passed since the November meeting – since then, the winner of the US presidential election, the candidate for the post of Finance Minister (Janet Yellen), and the approximate dates for the start of vaccination against coronavirus have been determined. But at the same time, a lot of the problems and risks discussed in November have only worsened. Therefore, the next December meeting may be more naturally "dovish", due to the statements of the Fed members at the November meeting. As a result, the published minutes yesterday failed to support dollar bulls – the US dollar remained under pressure from negative fundamental factors.

It should be recalled that this year's second to the last Fed's meeting was ignored, since a lot of the things that were said were already discussed during the previous meetings. At the same time, Mr. Jerome Powell did not voice any specifics regarding the future prospects of monetary policy at the press conference. The attention was focused on weakening the recovery pace of the US economy, attributing this to the growth in the number of COVID-19 cases in the US. In view of this, Fed's chief noted the high uncertainty for the economy. In addition, he hinted at further easing monetary policy, but without giving specific details. He only said that the Fed already used up all its potential to support the economy. On the other hand, he called on Congressmen once again to adopt a new package of measures to stimulate the economy. In other words, Powell's rhetoric at the November meeting was almost identical to his rhetoric at previous meetings.

Same thing can be said regarding the minutes of this meeting published yesterday. For example, Fed members stated that they are concerned about the rising COVID-19 cases in the US. In their opinion, this contributes significant risks for the economic recovery in the medium term. It should be noted that at the time of the meeting, the daily cases was at the level of 100-110 thousand. In the second half of this month, this figure does not fall below 170 thousand. Last Saturday (Nov 21), it almost reached the 200 thousand mark. Such anti-records are partially offset by the fact that the coronavirus vaccination process may begin in the States as early as mid-December.

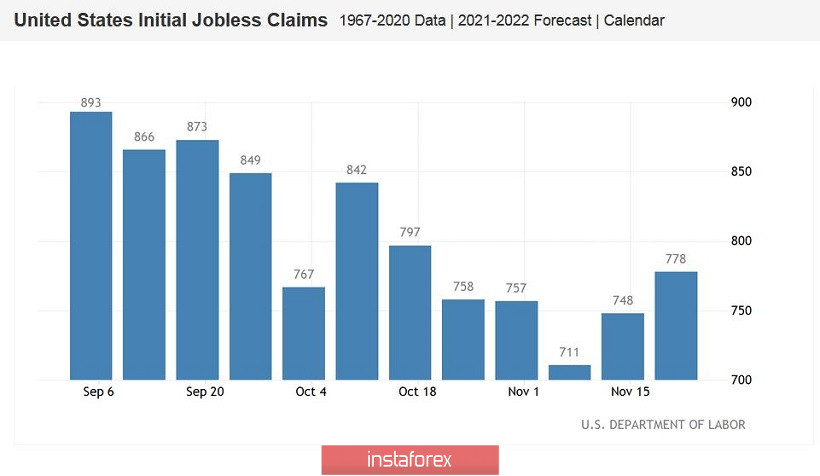

The Fed was also worried about the situation on the US labor market. According to them, there will be an average rate of recovery of key indicators. Just yesterday, one of the indicators of the US labor market was published. The growth of initial applications for unemployment benefits entered the red zone again, disappointing the dollar bulls. This indicator is growing since the previous weeks, slowly approaching back to the millionth value. Yesterday, it came out at around 778 thousand, while a week ago, it was around 732 thousand. At the same time, it showed a stable decline starting from the end of September to the beginning of November. This means that the nearest Nonfarms data can also be disappointing.

To sum up the November meeting, Fed members said that they may make adjustments to the program for buying bonds in the near future, which is apparently in December. Thus, several scenarios are being considered. In particular, the Central Bank can increase the volume of purchases of securities or shift purchases of Treasury bonds to securities with a longer maturity (without increasing purchases' volume). The indicated bank also allows the option of extending the current program.

Thus, the minutes of the November meeting reminded EUR/USD traders about the current issues, but did not cause any excitement in the market. Its release only added negative impact for the US dollar, together with the existing fundamental picture.

Amid general interest in risky assets, the US currency continues to decline, which means that long positions in the EUR/USD pair are still relevant. Buyers of this pair managed to consolidate in the area of the 19th figure. Now, the main resistance level is the upper line of the Bollinger Bands indicator on the daily chart, which corresponds to the level of 1.1970. If this level is broken down, EUR/USD bulls will be allowed to move at the 20th figure, but it is too early to talk about this. It is noteworthy that the US is celebrating Thanksgiving today, which means that American trading floors will be closed.