EUR/USD

Analysis:

On the hourly chart of the European currency, an incomplete wave is rising from November 4. In its structure, on the 23rd, a flat correction (B) was completed. Then a new section in the main direction (C) started.

Forecast:

Today, we expect a general upward mood. In the first half of the day, a short-term decline in the support area is possible. A slowdown in price growth and a transition to the side plane can be expected in the area of the calculated resistance.

Potential reversal zones

Resistance:

- 1.1970/1.2000

Support:

- 1.1900/1.1870

Recommendations:

Trading on the euro market today will be more efficient within the intraday borders. There are no conditions for sales. At the end of counter-movements, it is recommended to open long positions.

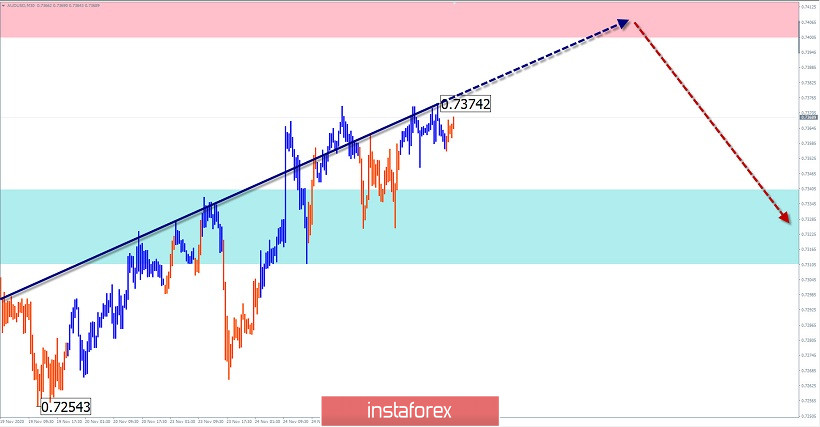

AUD/USD

Analysis:

Since March of this year, the trend direction of the Australian dollar points to the north of the chart. The last wave of the main exchange rate has been reporting since September 25. By the current day, the wave structure looks complete. The price has reached a wide area of a potential reversal of a large TF. There are no signals of an early trend change yet.

Forecast:

Today, the price is expected to move in the corridor between the nearest zones. An upward trend is more likely in the European session. By the end of the day, you can expect a reversal and decline up to the support zone.

Potential reversal zones

Resistance:

- 0.7400/0.7430

Support:

- 0.7340/0.7310

Recommendations:

Trading on the "Aussie" market today is possible during trading sessions with a reduced lot. Before the exchange rate change signals appear, the pair's purchases are promising.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!