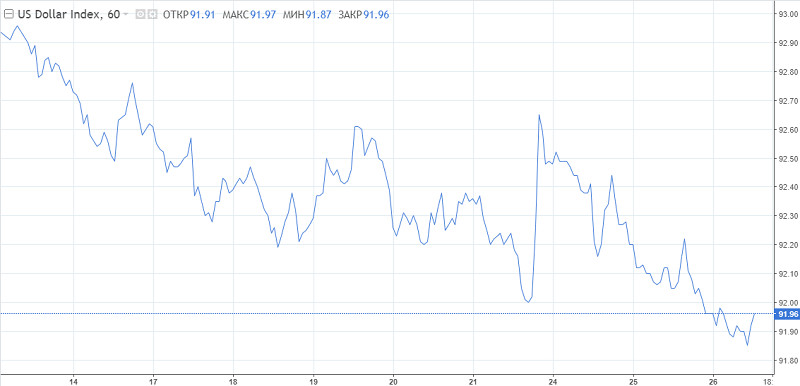

The US dollar sellers broke a new target. The US dollar index slumped below 92 points. On Thursday, the US Thanksgiving Day, the greenback was trying to recoup some of its losses. On Wednesday, the US national currency showed a sharp decrease. That is why a correctional movement in the short-term perspective was expected. However, in the long-term perspective, the US dollar is likely to go on losing in value.

Notably, on Wednesday, the greenback approached 91.75, the low logged in September. It is an important long-term support level. If the quote breaks this support level, it may nosedive. The next support level is located only at 88.25.

In recent weeks, the US dollar has been suffering losses as investors switched to riskier assets. The change was triggered by positive news about the coronavirus vaccine and signs of political stability in the US. Traders lost their interest in the greenback after the publication of the US unemployment claims. The indicator rose more than expected. At the same time, personal income declined. It is quite possible that people are still losing jobs as some US states have to impose tougher restrictions to halt the virus spread.

According to the FOMC meeting minutes, the economic forecast is extremely vague because of the pandemic. Moreover, there are risks that the US economic recovery will slow down in the winter period. The country's economic health will highly depend on the epidemiological situation. In the short-term, the COVID-19 pandemic will go on weighing on the consumer activity, employment, and inflation. It may cause serious economic problems in the mid-term perspective.

In November, all voting members of the FOMC supported the proposal to remain the key rate and the asset purchasing program unchanged. Primary dealers believe that the Fed will not raise the key interest rate until 2024. At the same time, the asset purchasing program will be in force until the end of 2021. After that, the stimulus program will be reduced.

The Fed always takes into account views of primary dealers. The regulator receives market information from them. Thus, the market got a signal that the US money supply is expected to grow at least for one year. All this has a negative influence on the national currency.

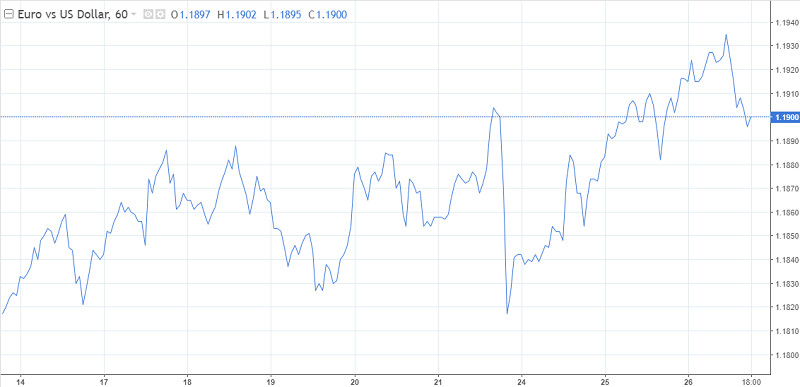

The possibility of the US dollar drop is boosting the euro/dollar pair. On Wednesday, it reached the high of 1.19 logged in September. Economists foresee a further decline in the US dollar. Thus, the pair's rally is likely to continue. Buyers hope to consolidate above 1.9 and move even higher above 1.20.

However, on Thursday, they did not have such an opportunity. The euro was trying to reach the level of 1.19. A drop in the US dollar is not enough to consolidate above the mentioned level. The euro needs hints about the economic stability in the eurozone. Notably, Angela Merkel said that the restrictive measures aimed at curbing the new coronavirus pandemic will take place at least until January.

Fresh statistical data from Germany was also rather disappointing. The consumer climate index slid to -6.7 points from the revised level of -3.2 points. Markets had expected a decline to -5 points.

In fact, statistical data has a short-lived effect on the currency. In the longer-term perspective, the euro will gain in value. For example, Credit Suisse sees an advance in the EUR/USD pair to 1.25 by the end of 2021. The jump could be triggered by lower political risks.

On Thursday, traders of the euro were focused on the speeches provided by the ECB's representatives and the latest ECB's meeting minutes. The euro may get additional support from hints about the expansion of the QE program or lower benchmark rate.