To open long positions on EURUSD, you need:

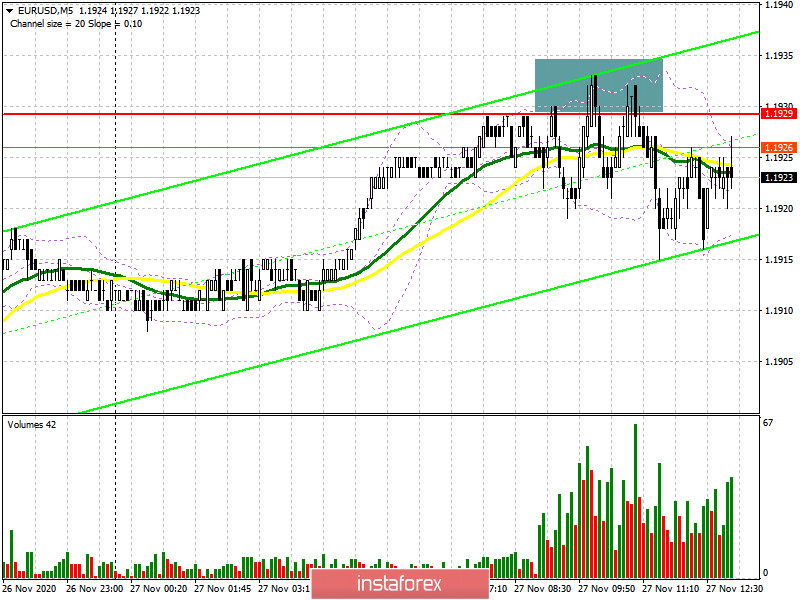

In my morning forecast, I paid attention to sales from the level of 1.1929, provided that a false breakout was formed there, which happened. On the 5-minute chart, I marked the entry point to short positions after the bulls failed to get above the high of 1.1929. However, at the time of writing, there was no major fall in the euro, which makes us doubt the strength of sellers. While trading will be conducted below the resistance of 1.1929, the sell signal will work. However, at the next attempt to break the above level, I recommend that you exit short positions and wait for the conditions that will be described below.

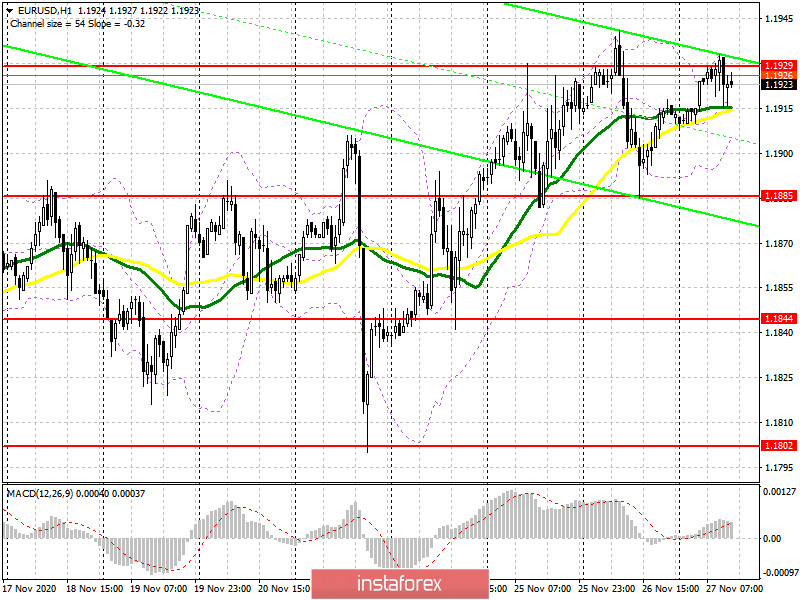

The initial goal of the bulls is to break through and consolidate at the maximum of 1.1929, the top-down test of which, similar to yesterday's purchase, forms a convenient entry point into long positions in the expectation of continuing the upward movement of EUR/USD and reaching a new level of 1.1964, where I recommend fixing the profits. The longer-term goal of the bulls is still the resistance of 1.2008, which is also psychological. In the scenario of EUR/USD falling back to 1.1885 in the second half of the day, only the formation of a false breakout there will be a signal to open long positions. If there is no bull activity at this level, I recommend that you do not rush to buy, but wait for a downward correction to the support area of 1.1844, from where you can buy the euro today immediately for a rebound based on an upward correction of 15-20 points.

To open short positions on EURUSD, you need to:

With the first morning task, the bears coped perfectly and did not allow the bulls to take control of the resistance of 1.1929, forming a sell signal there, which is still valid at the moment. The next task for sellers, even against the background of low trading volume, is to return to the level of 1.1885, which they have tested several times this week. However, only a consolidation below 1.1885 and its test from the reverse side from the bottom up form a more convenient entry point for short positions in the expectation of a resumption of the downward trend. In this case, the nearest target of the bears will be a new low of 1.1844, where I recommend fixing the profits. If the bulls are stronger in the second half of the day and take control of the resistance of 1.1929, then I recommend selling EUR/USD immediately for a rebound only from the maximum of 1.1964, based on a correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for November 17 recorded an increase in long and short positions. Thus, long non-profit positions increased from 202,374 to 203,551, while short non-profit positions increased to 69,591 from 67,087. The total non-commercial net position fell to 133,960 from 135,287 weeks earlier. It is worth noting that the delta has been declining for 8 consecutive weeks, which confirms the lack of desire of euro buyers to go to the market in the current conditions. It will be possible to talk about a further recovery of the euro only after European leaders "settle" their differences with Poland and Hungary, and the UK agrees with Brussels on a new trade agreement. Otherwise, we will have to wait for the lifting of restrictive measures imposed due to the second wave of coronavirus in many EU countries.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates the sideways nature of the market before a period of low trading volume at the end of the week.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator around 1.1929 will lead to new growth of the pair. A break of the lower limit of the indicator in the area of 1.1904 will increase the pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.