Crypto Industry News:

The UK Financial Conduct Authority (FCA) has announced that it is conducting 50 active investigations as part of its efforts to crack down on unregistered crypto companies.

In today's announcement, the FCA said it has opened more than 300 cases involving unregistered crypto companies in the past six months, "many of which may be scams." In addition, the national financial regulator said it had 50 active investigations, which could include criminal investigations.

According to the FCA, UK residents sent 16,400 inquiries between April and September 2021 which included cryptocurrency scams. The regulator said it would use "more assertive supervision and enforcement actions" and be "tougher against companies willing to operate" in the UK.

In January, the financial regulator began consultations on the proposals, which included the application of financial promotion rules to "high-risk investments, including crypto assets." The group will be accepting feedback until March 23.

Cryptocurrency exchanges and cryptocurrency service companies must register with the FCA to serve UK users. As previously reported, as of February 23, 32 companies had received approval as service providers for registered crypto assets in the country out of about 200 that applied.

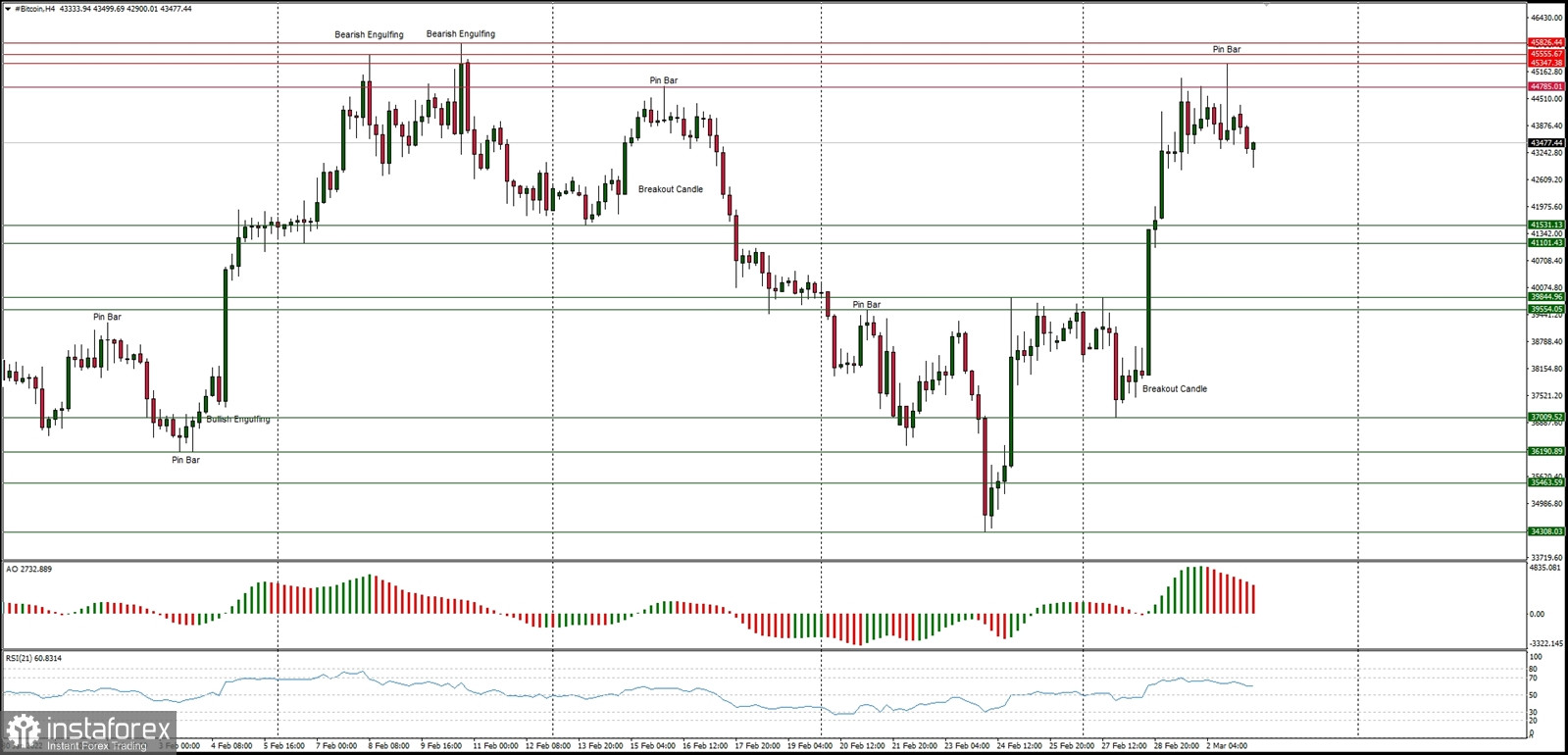

Technical Market Outlook

The BTC/USD pair has hit the immediate technical support seen at $41,531, so it means 38% of the last wave up had been retraced already. The strong and positive momentum supports the short-term bullish outlook on BTC, however the pull-back might extend deeper towards the levels of $41,101, $39,844 and $39,554. The later is in line with 50% Fibonacci retracement as well, so a breakout below this level will intensify the bearish pressure towards $37,000.

Weekly Pivot Points:

WR3 - $49,623

WR2 - $42,432

WR1 - $40,007

Weekly Pivot - $37,159

WS1 - $34,592

WS2 - $31,509

WS3 - $29,166

Trading Outlook:

The market is bouncing after over the 80% retracement made since the ATH at the level of $68,998 was made. The level of $44,442 is the next key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend.