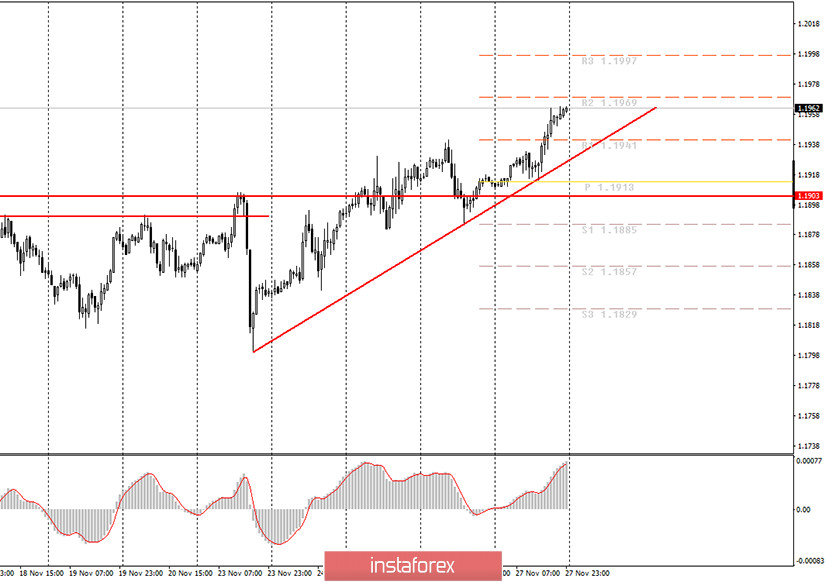

Hourly chart of the EUR/USD pair

The EUR/USD pair went back to moving up last Friday, and updated its previous local high, so we concluded that the rising movement has returned. Last Friday, we advised beginners to trade bullish if a new buy signal from MACD appears, but we also warned about the increased risks of such a transaction. Fortunately, the buy signal was not false and traders could earn 20-30 points. Current volatility levels are not too high, so 20-30 points is an absolutely normal result. The upward trend line has been rebuilt, so it now supports bull traders again. The pair ended Friday near the day's highs, so on Monday traders need to wait for a downward correction and, if the price remains above the trend line, re-consider options for opening buy orders. Despite the fact that the euro/dollar pair left the 1.1700-1.1900 horizontal channel, we still advise you to be wary of the upward movement. From our point of view, it is not fully justified now.

No important publications and news in America and the European Union last Friday. At least the US did not provide any particularly significant information. Nevertheless, the European currency has been actively growing in price for several days now and at this time it is very difficult to find out as to what this may be connected with. This is because there are several rather serious problems brewing in the European Union that may affect the European economy. Firstly, Poland and Hungary vetoed the EU budget for 2021-2027 and the Coronavirus Pandemic Recovery Fund. Secondly, the lockdown will inevitably lead to a contraction in business activity and the economy in the fourth quarter. There are no such problems yet in America, since a new hard quarantine was not introduced in this country. However, the euro is still rising despite all of these facts, which is a little strange.

European Central Bank President Christine Lagarde is set to deliver a speech on Monday. Her previous speeches were of a pronounced black color. Lagarde expressed concerns about the prospects for the economy due to the increase in the number of cases in October-November, as well as because of the lockdown. She also announced the expansion of stimulus measures in December. Thus, the chief economist of the EU believes that the European economy will start to experience serious problems again this winter. Most likely, her rhetoric will remain unchanged, which means that you should not expect anything optimistic

Possible scenarios for November 30:

1) Long positions are currently relevant since the upward trend line has been rebuilt. Now, in order to be able to open new long positions, you need to wait for a new round of downward correction. The price rebounding from the trend line or a buy signal from the MACD (after the indicator is discharged to the zero level) can be used for new buy positions on the euro with targets at 1.1969 and 1.1997. We do not see the pair moving above the 1.2000 level yet.

2) You are advised to not trade for a fall at this time. Only when the price settles below the trend line on Monday, which will lead to a change in the short-term trend to a downward trend. In this case, we recommend opening sell orders with a target near the 1.1903 level, which has been the upper border of the horizontal channel for a long time.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.