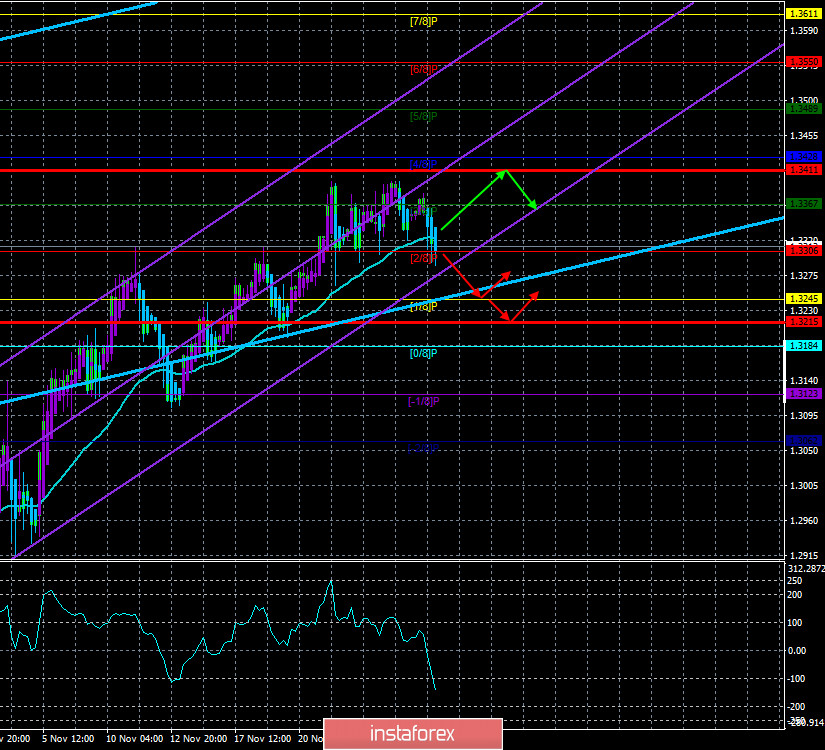

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 164.1826

The British pound started a new round of corrective movement on Friday, November 27. However, at the moment, it is not clear what this round of correction means. Is it just a correction, after which the upward trend will resume? Or market participants have finally stopped believing in a trade agreement, which is highly likely not to happen? One way or another, the quotes of the pound/dollar pair have fixed below the moving average line, thus, the trend has changed to a downward one. Therefore, the downward movement may continue for some time. We have been waiting for several weeks in a row for the pound to start a prolonged fall. We believe that the British currency is overbought and most importantly - completely unreasonably overbought. However, Friday's movement does not make it possible to conclude that a new downward trend has begun. It's still too weak.

Although market participants do not pay any attention to the statements of Boris Johnson, Michel Barnier, Ursula von der Leyen, and David Frost regarding the progress in the negotiation process, it is the topic of trade negotiations that remains the most important for the UK, the British economy and the British pound. In principle, since November 15, all traders are waiting for both sides to make a statement on the outcome of the negotiations. Recall that it was on November 15 that the negotiations were supposed to end to have time to ratify the agreement in the two parliaments later if there was one at all. On the weekend, fresh news was received from London. On November 28, Michel Barnier arrived in London to resume face-to-face talks. In other words, the negotiations are continuing, although all conceivable deadlines have already been violated. At the weekend, Michel Barnier said that "we are very close to the moment: either yes or no". A similar statement was made by his British counterpart David Frost, who also does not know whether there will be an agreement in the end. Barnier also said that "significant differences remain" between the parties, however, we have heard this many times before.

It also became known over the weekend that Barnier made an offer to Frost regarding the most pressing issue of fishing. It is reported that Barnier offers to return from 15% to 18% of the value of fish stocks that are caught by European fleets in British waters. The offer is expected to bring in more than 100 million euros for the British fishing industry. What London thinks about this is still unknown, but we believe that this proposal will be rejected. 10 Downing Street has repeatedly stated that they want to have full control over their territorial waters. However, Boris Johnson himself still makes statements like: "There are significant and important differences that still need to be overcome, but we continue to work on this. The probability of a deal is largely determined by our friends and partners in the EU." That is, the British Prime Minister continues to "throw the ball" to half of the field of the European team as if to show that everything depends on them. And the EU does the same when the ball is on its side. Both sides have consistently stated that significant differences remain, and no one has ever said that there are fewer problematic issues. "It is late, but a deal is still possible, and I will continue to say this until it becomes clear that this is not the case," said British negotiator David Frost.

At the same time, it became known that next week is likely to be the last in the negotiations. This was stated by British Foreign Secretary Dominic Raab when asked about the deadline. "This is a very important, really last week, when some further delays are still possible," Raab said.

Thus, it is still unclear whether there will be an agreement in the end or not. It turns out that the British pound has grown in recent weeks solely on the belief of traders in a "bright future" (a trade deal). Because there was no economic reason to buy the pound. The British economy is reeling and swaying from side to side before it is dealt the final blow in the last 5 years. This blow is Brexit, a "hard" Brexit. But even if London and Brussels manage to reach an agreement, this does not mean that the British economy will not shrink in 2021. This will happen anyway. The only question is how hard the blow will be to the British economy. With a deal, it will be tolerable; without a deal, it will be terrifying. That's the difference. And of course, do not forget about the pandemic, the second "lockdown" and the consequences of these events in the Foggy Albion. Thus, the pound could grow all this time only due to the belief of market participants in the deal. Now, therefore, we need to understand whether the traders' faith has run out. London and Brussels can negotiate indefinitely, and we believe that they will continue in 2021. The pound can't grow all this time while the negotiations are going on.

From a technical point of view, the pound/dollar pair is only slightly fixed below the moving average line. Thus, the downward movement may continue, but we remind you that in the last two months, the price regularly went below the moving average line, and then very quickly returned to the area above the moving average. Therefore, something similar may be happening now. Markets do not respond adequately to the fundamental background, ignore the macroeconomic background, COT reports do not bring any clarity to what is happening, and the technical picture is often contradictory.

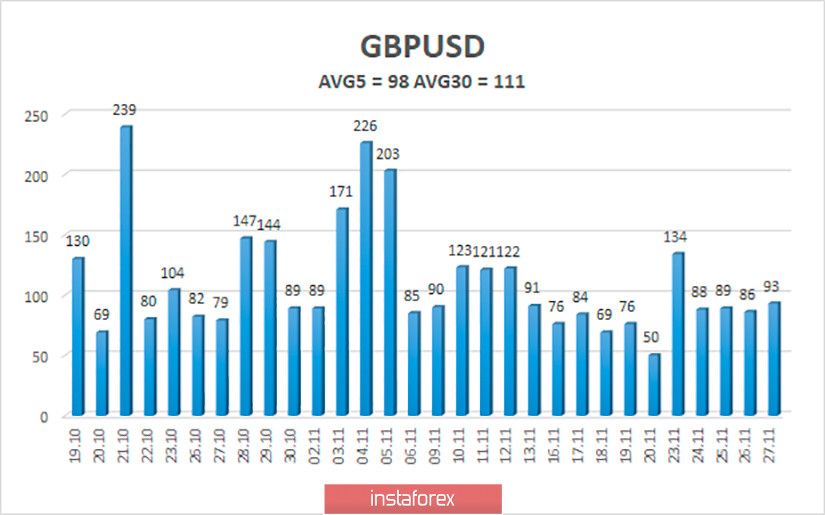

The average volatility of the GBP/USD pair is currently 98 points per day. For the pound/dollar pair, this value is "average". On Monday, November 30, thus, we expect movement inside the channel, limited by the levels of 1.3215 and 1.3411. A reversal of the Heiken Ashi indicator to the top signals a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

Trading recommendations:

The GBP/USD pair started a new round of downward movement on the 4-hour timeframe. Thus, today it is recommended to open short positions with targets of 1.3445 and 1.3215. You can keep them open until the Heiken Ashi indicator turns up. It is recommended to trade the pair again for an increase with targets of 1.3411 and 1.3428 if the price is fixed back above the moving average line.