Half a month has passed since the critical deadline, and there are only five weeks left before Britain leaves the EU, during which parliaments must ratify the proposed agreement, and the GBP/USD pair continues to trade near 3-month highs. Isn't it a paradox, London and Brussels are still far from a compromise on the most controversial issues, time is running out, and investors still believe in an orderly Brexit. And sterling has enough problems without it.

Britain has dismissed the European Union's proposal to cut the revenue of European fishing companies by 18% as ridiculous. The annual figure is €650 billion, Brussels is ready to give about €120 billion, but London wants €520 billion, that is 80%! The difference is huge, and it once again shows how far the parties are from each other. Can they reach a compromise within a few days if they haven't been able to find a common language for years? Until recently, the market believed that yes, but now it began to doubt. This is clearly seen in the reluctance of GBP/USD to grow against the backdrop of a retreat of the US dollar on all fronts due to the growth of global risk appetite and a decrease in political uncertainty in the US.

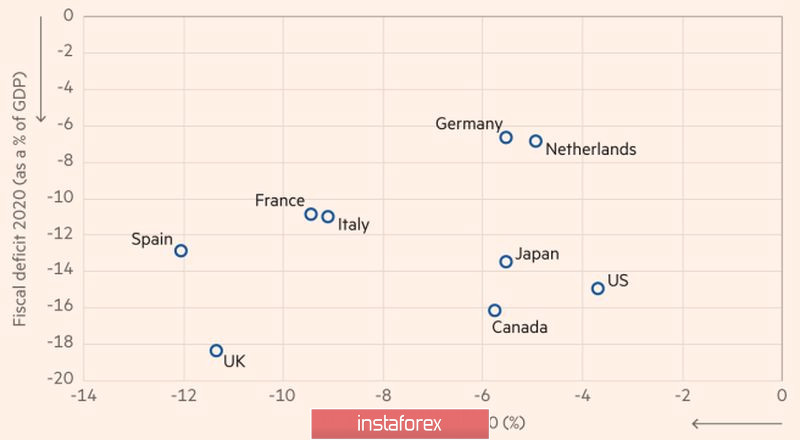

But behind Brexit, UK hides other problems. Despite the fact that the scale of monetary and fiscal stimulus in Britain, relative to the size of the economy, is one of the highest among the major developed countries in the world, the depth of the recession and mortality send it to the margins. The office for budget responsibility predicts that the country's GDP will shrink by 11.2% in 2020, and the budget deficit will be 18.4%. Both indicators are the worst for the G7 countries, with only Italy surpassing Britain in terms of mortality.

Budget Deficit to GDP by G7 Countries and Spain:

There is a lack of effective management of the pandemic, which may result not only in an economic crisis in London but also in the loss of Scotland. Scottish leader, Nicola Sturgeon, said an independence referendum should be held at the beginning of the term of the new Autonomous Parliament, which will start working in the first half of 2021. In 2014, 54% of survey participants voted to remain part of the United Kingdom, but COVID-19 and Brexit certainly changed the worldview of Scots. In any case, whether Britain and the EU can reach an agreement or not, there will be chaos at the beginning of next year, which raises serious doubts about the continuation of the GBPUSD rally.

Of course, the vaccination of the population, the victory over the pandemic, the growth of global risk appetite, and the recovery of the global economy make safe-haven assets in the face of the US dollar and the Japanese yen outsiders on Forex, but the deterioration of the political landscape in the UK increases the risks that sterling will join them.

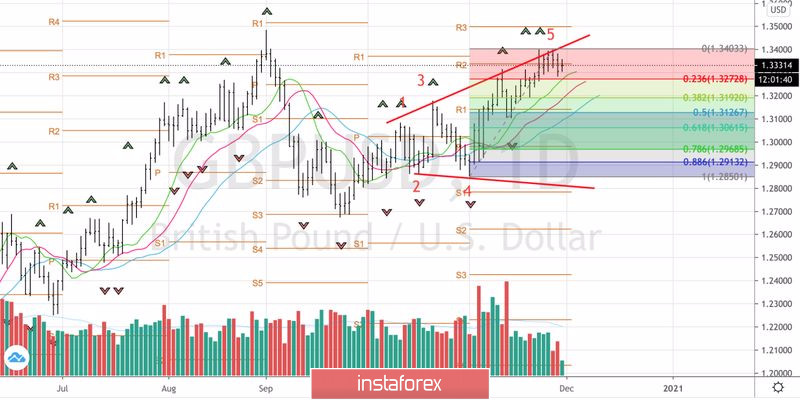

Technically, a breakout of the lower border of the current consolidation range of 1.3285-1.3395 by the GBPUSD pair is fraught with a pullback in the direction of 1.3195, 1.3125, and 1.306, where in case of a rebound from support, you should start forming long positions in accordance with the Broadening Wedge pattern. In the meantime, you can try short-term sales.

GBPUSD daily chart: