To open long positions on EURUSD, you need to:

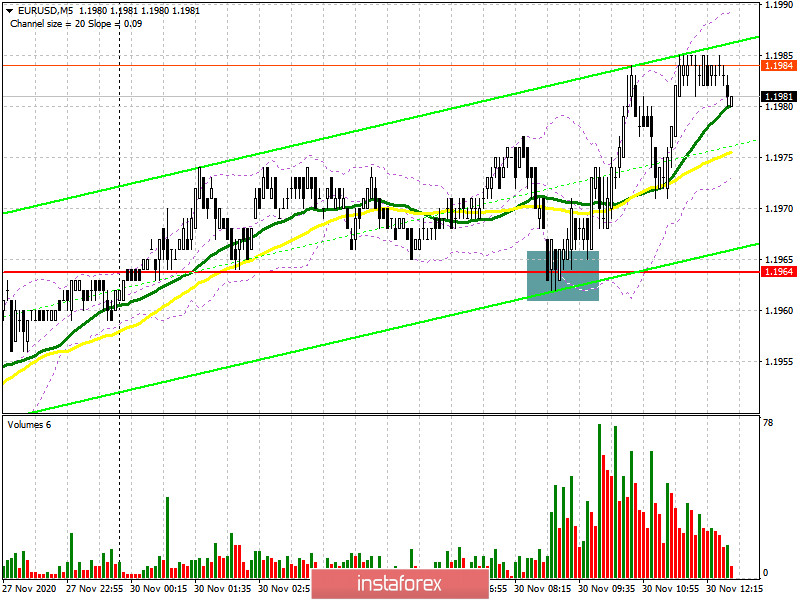

Euro buyers continued to push the pair up in their style. In my morning forecast, I paid attention to the level of 1.1964 and recommended buying euros from it in the continuation of the upward trend. Let's take a look at the 5-minute chart and talk about what happened. You can see how the bulls form a false breakout (I marked this zone on the chart), after which a return to the level of 1.1964 leads to the resumption of the bull market.

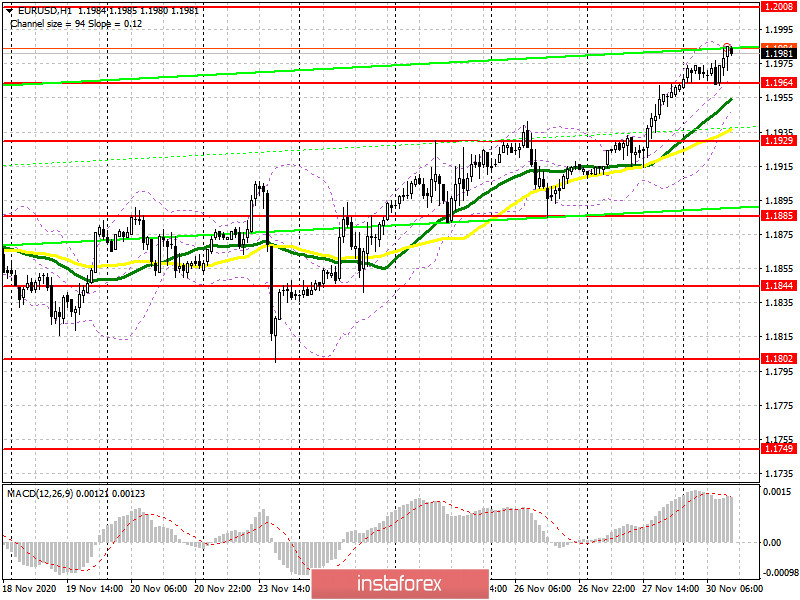

As long as trading is above this range, we can expect the euro to continue to grow. However, I repeat that there is no real reason for the euro to grow in the short term. It is likely that only a test of the level of 1.2008, together with the divergence that is currently being formed on the MACD indicator, will lead to a stop in the bull market, where I recommend fixing the profits. Without good news, for example on the Brexit trade deal or the vaccine, you can hardly expect a real breakthrough in the area of 1.2008, just above which the level of 1.2057 is located. If the pressure on the euro returns in the second half of the day, and the bears push the pair under the level of 1.1964, then you should not rush to open long positions. The optimal scenario is to wait for the support test of 1.1929, where the moving averages are playing on the side of the bulls, and open long positions there for a rebound in the expectation of a correction of 15-20 points within the day. Major buyers will focus on protecting the support of 1.185.

To open short positions on EURUSD, you need to:

From a technical point of view, nothing has changed for the bears. Sellers could not cope with the initial task and return the euro to the level of 1.1964, although they tried to do so at the beginning of the European session. Despite all the negative data on the European economy, traders are in no hurry to sell the euro, believing in the best. In the second half of the day, only a consolidation below 1.1964 and its test from the reverse side from the bottom up will form a more convenient entry point for short positions, counting on the formation of a small downward correction to the support area of 1.1929, where the moving averages pass. However, a single update to this level will not be enough to resume the bear market. Only a consolidation below 1.1929 will lead to a larger sell-off of the euro to the support area of 1.1885, where I recommend fixing the profits. If the bulls are stronger and continue to push the pair up after the German inflation data, in this case, it is best not to rush with sales, but wait for the formation of bearish divergence on the MACD indicator, as well as a test of the psychological maximum in the resistance area of 1.2008. From this level, you can open short positions immediately on the rebound. If there is no bull activity in the area of 1.2008, and given how the market behaves, this cannot be ruled out. I recommend opening short positions immediately for a rebound from the level of 1.2057, based on a correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for November 17 recorded an increase in long and short positions. So, long non-commercial positions increased from the level 202,374 to the level of 203,551, while non-commercial short positions increased to 69,591 from the level of 67,087. The total non-commercial net position fell to 133,960, down from 135,287 weeks earlier. It is worth noting that the delta has been declining for 8 weeks in a row. It will be possible to talk about a further recovery of the euro only after European leaders agree with the UK on a new trade agreement. Otherwise, we will have to wait for the lifting of restrictive measures imposed due to the second wave of coronavirus in many EU countries.

Signals of indicators:

Moving averages

Trading is above 30 and 50 daily moving averages, which indicates a continuation of the bull market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator around 1.1984 will lead to new growth of the pair. In the case of the first fall of the pair, the lower border of the indicator around 1.1950 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.