At the start of trading on Monday, the euro-dollar pair updated its almost three-month high, reaching 1.1977. The last time the price was at such heights was in early September - when the pair impulsively broke through the psychologically important 1.2000 mark and updated the 2.5-year high (1.2010). But the buyers of EUR / USD celebrated their triumph for just a few hours: by the end of the trading day on September 1, the pair lost more than 100 points, settling at the base of the 19th figure. Then the bearish pressure intensified, and the euro was forced to retreat by several hundred points (the September low was marked at 1.1620). Since then, EUR / USD traders have not returned to the borders of the 20th figure.

The background of the September assault of the 20th figure is important in the context of current events. Let me remind you that at that time, the upward impulse was due to a sharp weakening of the US dollar throughout the market. A high-profile speech by Fed Chairman Jerome Powell at an Economic Symposium in Jackson Hole caused a bombshell effect. The head of the Federal Reserve announced a new strategy of the US Central Bank, which allows the regulator to keep base rates at the current record low level for a longer time. Figuratively speaking, the Federal Reserve agreed to tolerate inflation at a level above two percent, without tightening the parameters of monetary policy.

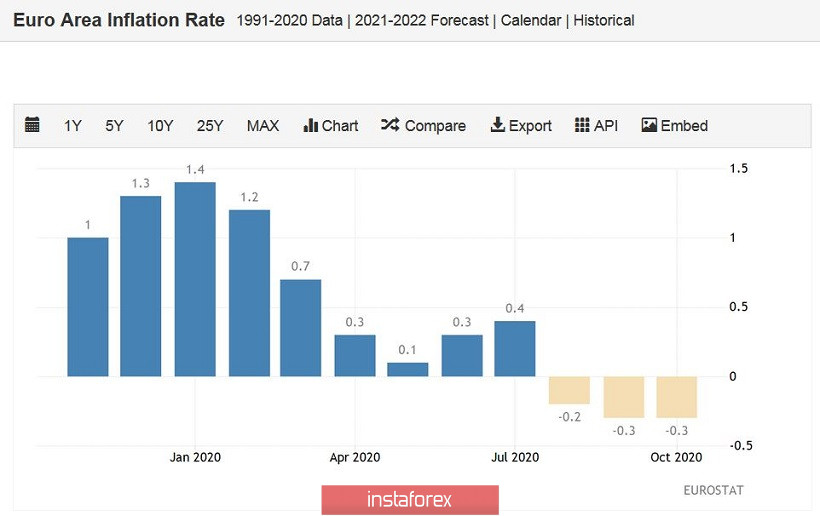

The dollar index reacted instantly, falling to 91.81 points, that is, to a two-year low, and buyers of EUR / USD were able to identify within the 20th figure, reaching a price high of 1.2010. But the pair's bulls retreated almost immediately. For three reasons: first, traders did not risk holding longs at such high positions; second, just the next day, European inflation disappointed (showing deflation for the first time in 4 years); and third, ECB members criticized the inflated exchange rate of the euro (although this happened a little later than the day of the storm of the 20th figure, but quickly enough for the Central Bank's reaction).

What do we have today? At first glance, the overall market situation is very similar to that of September. But there are nuances. For example, the US dollar is currently weakening not impulsively, but rather steadily, gradually losing its position. Take a look at the chart of the dollar index on the daily timeframe: if in early September the indicator dived and surfaced quite sharply, then since the beginning of November we have seen a systematic decline in the indicator from the 93rd figure to the current value of 91.70. Low demand for greenback is not due to one factor (a change in the Fed's strategy), but a combination of factors (general interest in risky assets and, accordingly, a decline in anti-risk sentiment, a slowdown in key US macro indicators, uncertainty with the new stimulus package, coronavirus anti-records in the US).

But you should not rush to open longs for the EUR / USD pair either - at least until Tuesday. Note that the September decline in prices from the two-year high of 1.2010 was due, among other things, to a disappointing inflation release. The overall consumer price index in the eurozone unexpectedly fell into negative territory, reaching -0.2%. The core index also slowed sharply to 0.4% (from the previous value of 1.2%).

On Tuesday, we will find out the dynamics of European inflation for November. According to general forecasts, the overall CPI will remain in the negative area, rising from -0.3% to -0.2%. Core inflation should remain at the level of September-October, that is, at the level of 0.2%. If the real numbers are lower than stated, the euro may significantly sink.

And yet, the current situation cannot be compared with the September one. Then, the indicator for the first time since the spring of 2016 fell into the negative area. Since then, the indicator has not exceeded zero, and according to ECB forecasts, it will remain in the negative area at least until the end of this year. Therefore, Tuesday's release is unlikely to shock investors, unless it collapses to indecent values below -0.5%.

In other words, despite the repetition of the September events, the upward trend for the EUR/USD pair is unlikely to fade in the near future. The fundamental background for the dollar remains negative, while the weak growth rate of European inflation is already partly taken into account in prices. But in any case, you should make trading decisions for the pair after Tuesday's release, first evaluating the release itself, and secondly, evaluating the market's reaction to the published figures. The US ISM manufacturing index will also be published on the same day, which should reflect the second wave of the coronavirus crisis in the US (the indicator is expected to fall to 57 points). If the indicator comes out at the level of forecasts or lower, the pressure on the US dollar will increase.

Thus, in my opinion, the priority for the EUR/USD pair remains for long positions. But Monday's price fluctuations should not be believed: it is advisable to make trading decisions based on the results of Tuesday's releases. The target of the upward movement is the 1.2010 – high mark of this year. In case of a corrective decline, which will most likely be caused by European inflation, you can open longs with the above target.