In November, market sentiment was boosted by Joe Biden's victory and positive news about the coronavirus vaccines. The US dollar dropped amid rising appetite to risk assets. On Monday, the greenback hit new lows against a basket of its main rivals declining to 91.54. In November, it showed the largest monthly drop of 2.5%. The currency is likely to go on falling. Thus, short positions are still possible.

At the same time, the offshore yuan is moving upwards displaying the sharpest increase in the last six years. The advance is triggered by China's economic recovery after the virus-induced crisis and steady capital inflows.

Today, Moderna announced its plans to apply for emergency approval of its COVID-19 vaccine in Europe and the United States. The actions of the American pharmaceutical company are based on the full results of the study, which showed that the COVID vaccine is more than 94% effective.

Most market participants suppose that in December, traders will avoid risk assets. Even now, investors' sentiment is not stable as they have already priced in most positive news.

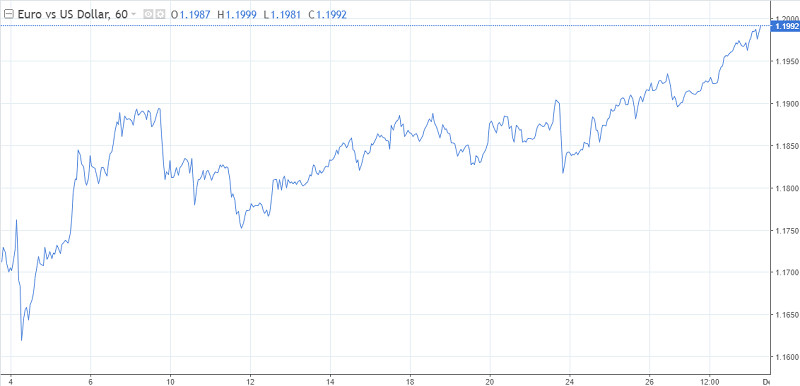

On Tuesday, the euro continues rising against the US dollar approaching the level of 1.20. The increase was caused by the US dollar weakness amid significant epidemiological risks. Moreover, analysts suppose that Biden will carry out important reforms and allocate money to support the pandemic-hit economy.

The report on the US labor market as well as data on US manufacturing and services PMI will show the negative influence of the coronavirus pandemic.

According to the fundamental data, the euro is weaker than the US dollar. The eurozone reports are really pessimistic.. However, on Friday, buyers of the euro will have a chance to ignore such reports.

Expectations of additional easing of the monetary policy make traders ignore weak reports. However, this ECB's decision should accelerate the economic revival in the eurozone. Thus, the euro/dollar pair is likely to go on climbing.

The European regulator pinpointed that it was closely monitoring the exchange rate of the euro/dollar pair. That is why investors doubt that the pair may exceed 1.20. There are no reasons to worry as the euro is rising only due to the US dollar depreciation.

On Monday, traders were focused on Christine Lagarde's speech. They expected comments on changes in the European monetary policy.

According to technical indicators, the euro/dollar pair will advance higher. Commerzbank emphasized that the recent close above 1.1926 allows the pair to reach the high of 1.2014 logged in September. If the pair drops, it may find a strong support level at 1.18 or a bit lower.

The euro's chances to break and consolidate above 1.20 at the beginning of the week will depend on various factors. For example, the OPEC+ decision on the extension of oil cuts has a significant influence on the single currency. At the same time, such indicators as US ADP non-farm employment change and business activity in various sectors may change the pair's trend. Traders will also take into account the statement of Jerome Powell and Steven Mnuchin.

According to the minutes of the last Fed's meeting, the issue of policy easing remains on the agenda. Perhaps Powell will give the markets some hints about its actions in December. However, risks could be posed by the announcement of additional easing, so the US dollar will remain under pressure.