A sharp decline in stock indices was seen by equity markets yesterday, which led to the US dollar's local strengthening and, although the demand for risk has partially recovered, new sharp sales are still possible.

It was believed that the main reason for the sharp and strong decline was due to major market players' profit-taking at the end of the most successful month for the stock markets. And although investors believe that the invention of effective vaccines in the West can become the basis for a "V" shaped recovery of the world economy, the continuing pandemic problems and the general weakness of the world economy, as well as European and American in particular, remains.

Markets completely created an entirely positive theme for the COVID-19 vaccine. Despite the fact that they will continue to grow, a new strong impulse is necessary. This is because reports that pharmaceutical companies achieving high efficiency of their vaccines are clearly not enough. Moreover, the topic of US elections has already disappeared, which means that if there is no new strong stimulus to grow in the near future, then the stock markets will most likely face a correction, which will provoke the US dollar to rise.

On the other hand, the euro and the pound continues to be a victim to the unresolved Brexit issue. EU and British officials say they already lack time to resolve factual, hopeless disputes. Therefore, if they are not resolved, then we should expect the UK stock market to continue declining and a clear weakening of the pound.

The euro, in turn, is still supported by hopes for the implementation of the EU's recovery fund with a financial volume of 750 billion euros, which should finally be in progress. The dollar's weakness on the wave of strong demand for risk last month, and the expectation of financial aid to support the EU economy led to the growth of the EUR/USD pair above the level of 1.2000. However, it is doubtful that it will break through this level and consolidate above it in the near future, unless Brexit agreements are reached and the EU's recovery fund starts. So far, the Euro is growing, but you can expect it to sharply decline in a pair with the US dollar any time, if the two problems mentioned above are not resolved in the near future.

Another important factor is yesterday's statement of Fed's head, J. Powell, who expressed concern about the uncertainty of the future of the US economy. He noticed that everything will depend on COVID-19. It is clear that economic activity continues to recover, but growth is slowing down. He advocated the necessary support for the national economy, which the markets also hoped for, driving up the price of shares. However, it should be noted that the topic of support measures that was so actively discussed during the pre-election period first faded into the background, and then disappeared altogether. We believe that without these important drivers, a deeper correction in the stock markets may occur after the hopes for vaccines disappear completely and the markets face the realities, which are not yet too optimistic.

Forecast of the day:

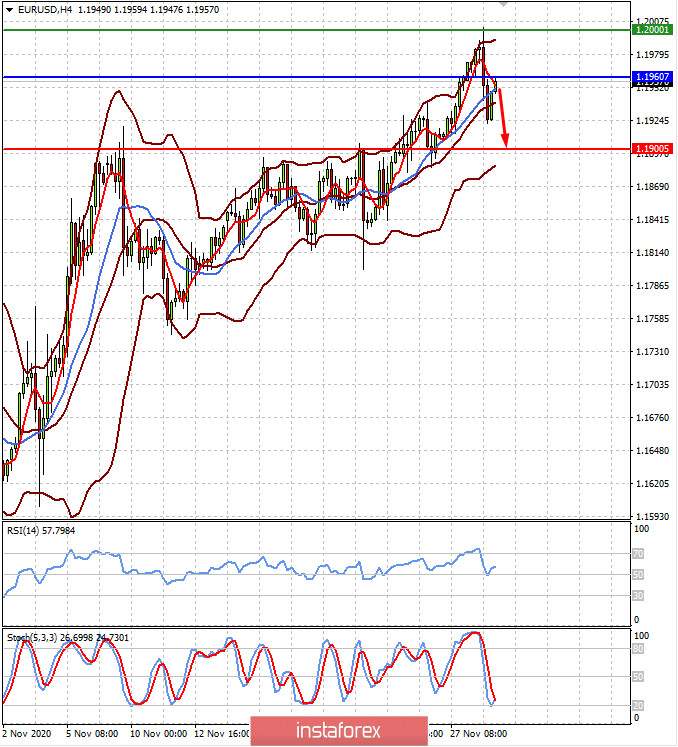

The EUR/USD pair is trading below the level of 1.1960. If it fails to break through it, further decline can be expected to 1.1900.

The XAU/USD pair is trading below the level of 1788.00. If it breaks this level, there is a chance that it will rise to 1800.34.