Outlook on December 1:

Analytical overview of major pairs on the H1 TF:

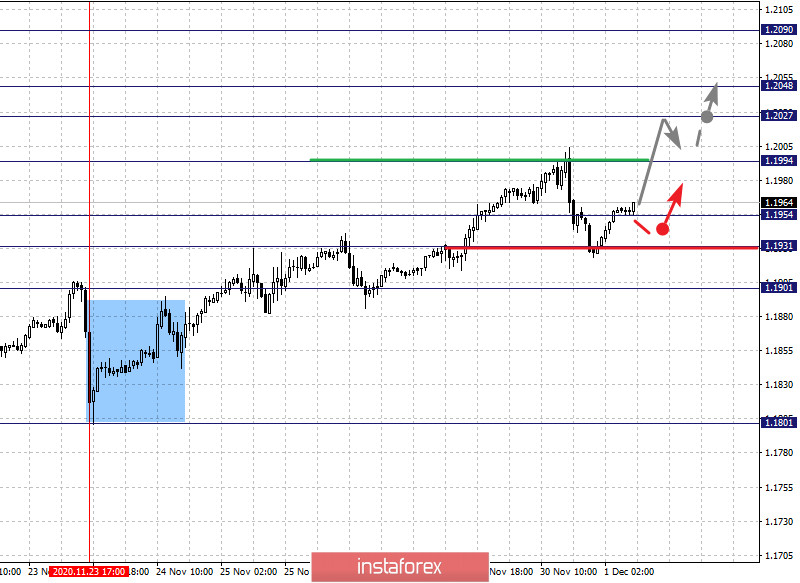

The key levels for the euro/dollar pair are 1.2090, 1.2048, 1.2027, 1.1994, 1.1954, 1.1931 and 1.1901. The rising trend from November 23 is being followed here. Now, the upward movement is expected to resume after breaking through the level of 1.1994. In this case, the target is 1.2027. On the other hand, there is a short-term growth and consolidation in the range of 1.2027 - 1.2048. For the potential value upwards, the level of 1.2090 is considered. A downward pullback is expected upon reaching this level.

A short-term decline, in turn, is possible in the range of 1.1954 - 1.1931. If the last value breaks down, a deep correction will occur. The target here is 1.1901, which is the key support level for the top.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: 1.1995 Take profit: 1.2027

Buy: 1.2028 Take profit: 1.2047

Sell: 1.1954 Take profit: 1.1932

Sell: 1.1929 Take profit: 1.1901

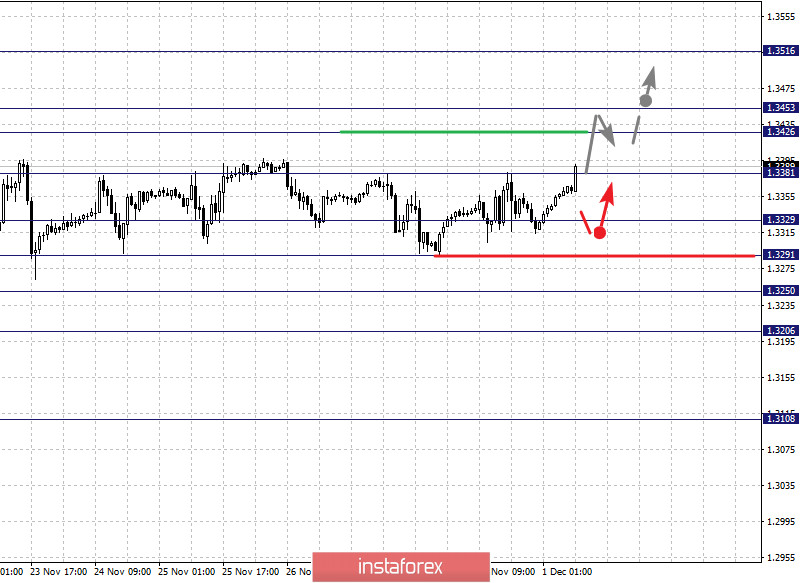

The key levels for the pound/dollar pair are 1.3516, 1.3453, 1.3426, 1.3381, 1.3329, 1.3291, 1.3250 and 1.3206. Here, we are following the rising trend from November 13. The pair is expected to continue rising after the level of 1.3381 breaks down. In this case, the target is 1.3426. Meanwhile, price consolidation is in the range of 1.3426 - 1.3453. As a potential value for the top, we consider the level 1.3516. A downward pullback is expected upon reaching this level.

On the other hand, a short-term decline is expected in the range of 1.3329 - 1.3291. In case that the last value breaks down, a deep correction will occur. The target here is 1.3250, which is a key upward support level. If this target breaks down, it will lead to the development of a downward trend. In this case, the potential target is 1.3206.

The main trend is the upward trend from November 13

Trading recommendations:

Buy: 1.3381 Take profit: 1.3426

Buy: 1.3454 Take profit: 1.3516

Sell: 1.3329 Take profit: 1.3292

Sell: 1.3289 Take profit: 1.3250

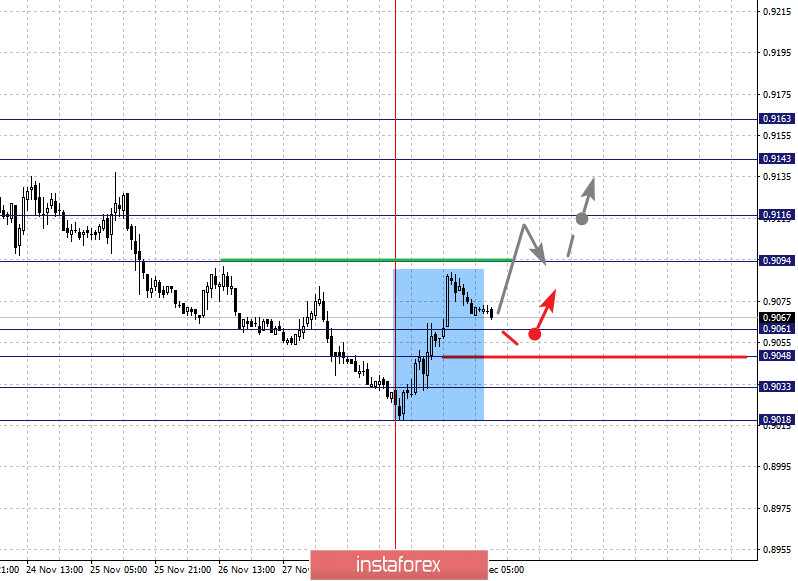

The key levels for the dollar/franc pair are 0.9163, 0.9143, 0.9116, 0.9094, 0.9061, 0.9048, 0.9033 and 0.9018. We are following the formation of the upward trend from November 30. Thus, we expect the pair to continue rising after breaking through the level of 0.9094. In this case, the target is 0.9116 and price consolidation is near this level. On the other hand, if the level of 0.9117 breaks down, a strong growth will occur. The next target will be 0.9143. For the upward potential value, we consider the level 0.9163. Price consolidation and downward pullback are expected upon reaching this level.

Meanwhile, a short-term decline is possible in the range of 0.9061 - 0.9048. If the last value breaks down, a deep correction will occur. Here, the target is 0.9033, which is a key support for the upward trend.

The main trend is the formation of an upward trend from November 30

Trading recommendations:

Buy : 0.9094 Take profit: 0.9116

Buy : 0.9118 Take profit: 0.9142

Sell: 0.9060 Take profit: 0.9049

Sell: 0.9047 Take profit: 0.9035

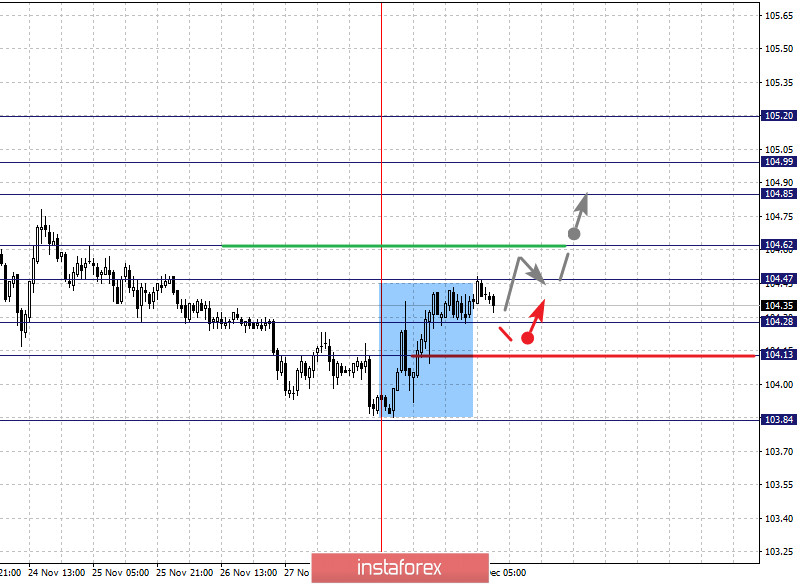

The key levels for the dollar/yen are 105.20, 104.99, 104.85, 104.62, 104.47, 104.28, 104.13 and 103.84. Here, the price is forming a potential upward trend from November 30. Now, a short-term growth is expected in the range of 104.47 - 104.62. In case that the last value breaks down, it will lead to a strong movement. The target here will be 104.85. Meanwhile, there is a short-term growth and consolidation in the range of 104.85 - 104.99. As a potential value for the upside, the level of 105.20 can be considered, from which a downward pullback is expected after reaching it.

A short-term decline, in turn, is possible in the range of 104.28 - 104.13. A breakdown of the last value will encourage the development of a downward trend. Here, the potential target is 103.84.

The main trend is the formation of the downward trend from November 30

Trading recommendations:

Buy: 104.47 Take profit: 104.60

Buy : 104.63 Take profit: 104.85

Sell: 104.28 Take profit: 104.15

Sell: 104.11 Take profit: 103.86

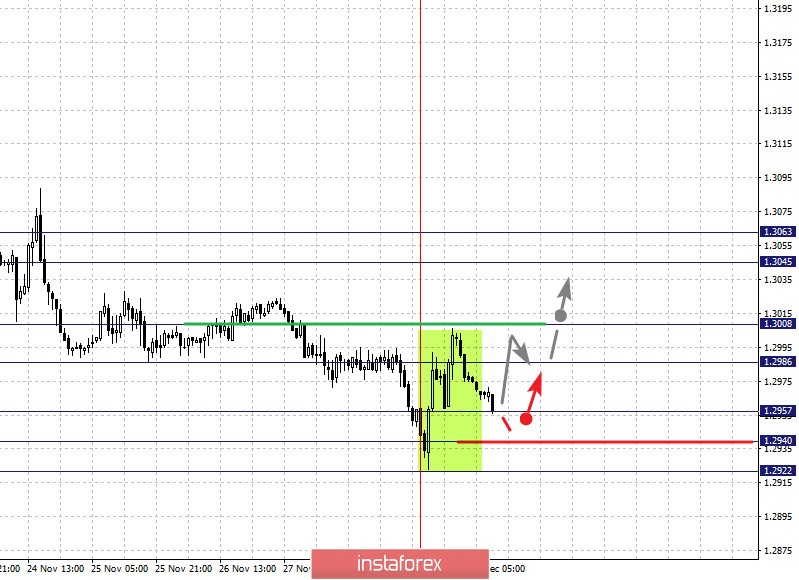

The key levels for the USD/CAD pair are 1.3063, 1.3045, 1.3008, 1.2986, 1.2957, 1.2940 and 1.2922. The price here forms a potential trend for the November 30 high. In this case, we expect the upward movement to continue after breaking through the level of 1.2986. If this happens, the target is 1.3008. Price consolidation is near this level. Considering that this target breaks down, a strong growth will occur. Here, the next target is 1.3045. For the upward potential value, we have the level of 1.3063. Upon reaching which, a downward pullback is expected.

Here, a short-term decline is possible in the range of 1.2957 - 1.2940 and breaking through the last value will lead to the development of a downward trend. In this case, the target is 1.2922.

The main trend is the formation of potential upward trend from November 30

Trading recommendations:

Buy: 1.2986 Take profit: 1.3006

Buy : 1.3010 Take profit: 1.3045

Sell: 1.2955 Take profit: 1.2942

Sell: 1.2938 Take profit: 1.2922

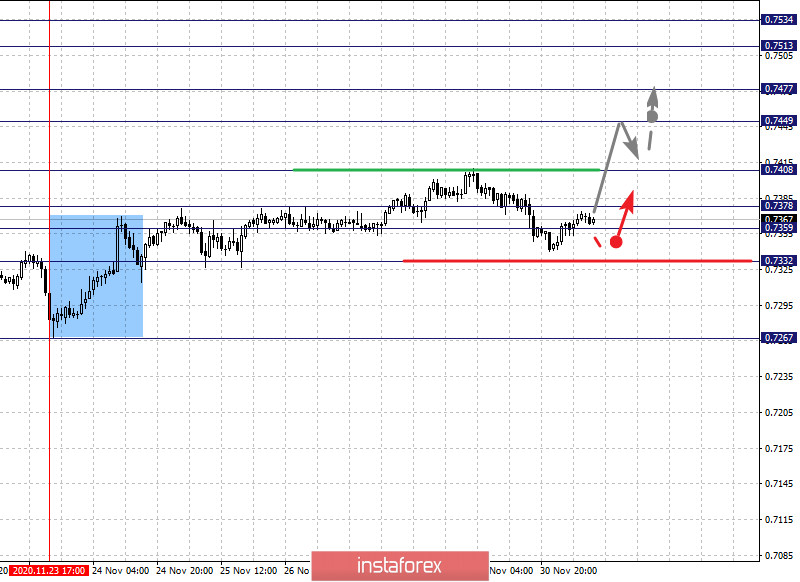

The key levels for the AUD/USD pair are 0.7534, 0.7513, 0.7477, 0.7449, 0.7408, 0.7378, 0.7359 and 0.7332. Here, we are following the local bullish trend from November 23. In this regard, the pair is expected to continue rising after breaking the level of 0.7408. In this case, the target is 0.7449. On the other hand, there is a short-term growth and consolidation in the range of 0.7449 - 0.7477. If the last value breaks down, it will lead to a strong growth. Here, the next target is 0.7513. For the upward potential value, we consider the level of 0.7534. Price consolidation and downward pullback is expected after this level is reached.

In turn, a short-term decline is expected in the range of 0.7378 - 0.7359. The last value being broken will lead to a deep correction. Here, the target is 0.7332, which is a key support for the top.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: 0.7410 Take profit: 0.7449

Buy: 0.7452 Take profit: 0.7476

Sell : 0.7378 Take profit : 0.7360

Sell: 0.7357 Take profit: 0.7332

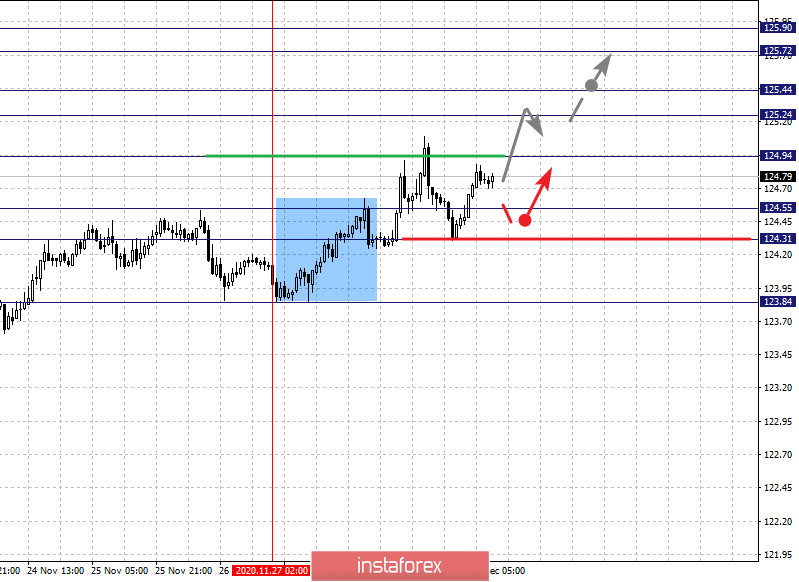

The key levels for the euro/yen pair are 125.90, 125.72, 125.44, 125.24, 124.94, 124.55, 124.31 and 123.84. The local bullish trend from November 27 is closely monitored here. Thus, we expect the pair to rise after breaking through the level of 124.94. In this case, the target is 125.24. On the other hand, there is a short-term growth and consolidation in the range of 125.24 - 125.44. If the last value breaks down, a strong movement towards the level of 125.72 is possible. As an upward potential value, we consider the level of 125.90. Price consolidation and downward pullback is expected after reaching this level.

A short-term decline is possible in the range of 124.55 - 124.31. In case that the last value breaks down, it will encourage the development of a downward trend. In this case, the potential target is 123.84.

The main trend is the local upward trend of November 27

Trading recommendations:

Buy: 124.95 Take profit: 125.24

Buy: 125.45 Take profit: 125.71

Sell: 124.55 Take profit: 124.32

Sell: 124.29 Take profit: 123.90

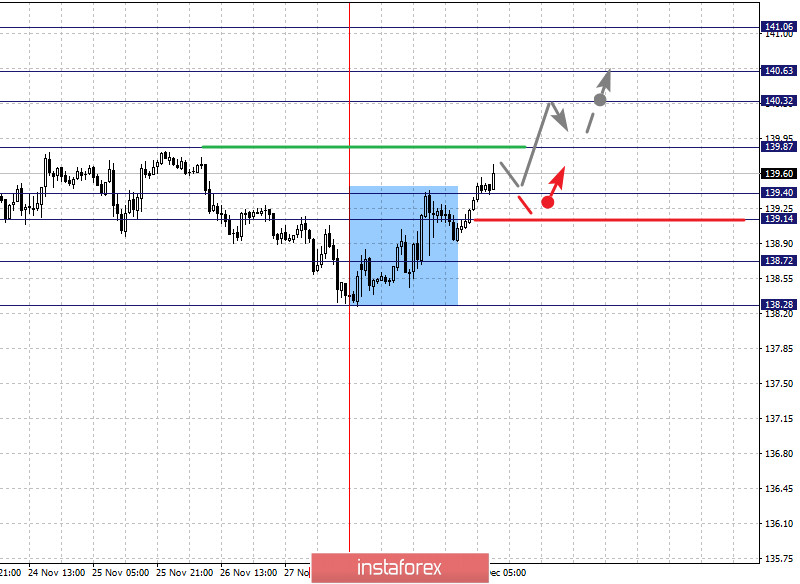

The key levels for the pound/yen pair are 141.06, 140.63, 140.32, 139.87, 139.40, 139.14, 138.72 and 138.28. Here, we are following the upward trend from November 27. In view of this, growth is expected to continue after the breakdown of 139.87. In this case, the target is 140.32. Meanwhile, there is a short-term rise and consolidation in the range of 140.32 - 140.63. For the upward potential value, we consider the level 141.06. Upon reaching which a downward pullback is likely.

A short-term decline, in turn, is possible in the range of 139.40 - 139.14. If the last value breaks down, it will lead to a deep correction. The target here is 138.72, which is a key support for the upward trend.

The main trend is the upward trend for the November 27 high

Trading recommendations:

Buy: 139.88 Take profit: 140.32

Buy: 140.33 Take profit: 140.62

Sell: 139.40 Take profit: 139.15

Sell: 139.10 Take profit: 138.74