Crypto Industry News:

CoinShares chief security Meltem Demirors believes geopolitical tensions could affect how investors view Bitcoin. Thus, from a risky asset (risk on), the oldest cryptocurrency can evolve into a safe one (risk off).

However, it is worth bearing in mind that risk off assets are usually associated with lower profits. However, they are more eagerly chosen in the event of an economic downturn, when many investors give up risky assets.

Opinions on whether Bitcoin as a store of value can replace gold over time are divided. While Bill Miller recently announced that the collapse of the ruble is in favor of Bitcoin, weeks or even months are not enough time for BTC to mature as an asset.

Demirors notes that investing in Bitcoin and cryptocurrencies is beginning to be seen as a response to geopolitical crises. This, on the other hand, could mark the beginning of a change that will keep Bitcoin from becoming a risk-on asset and instead becoming a risk-off asset over time.

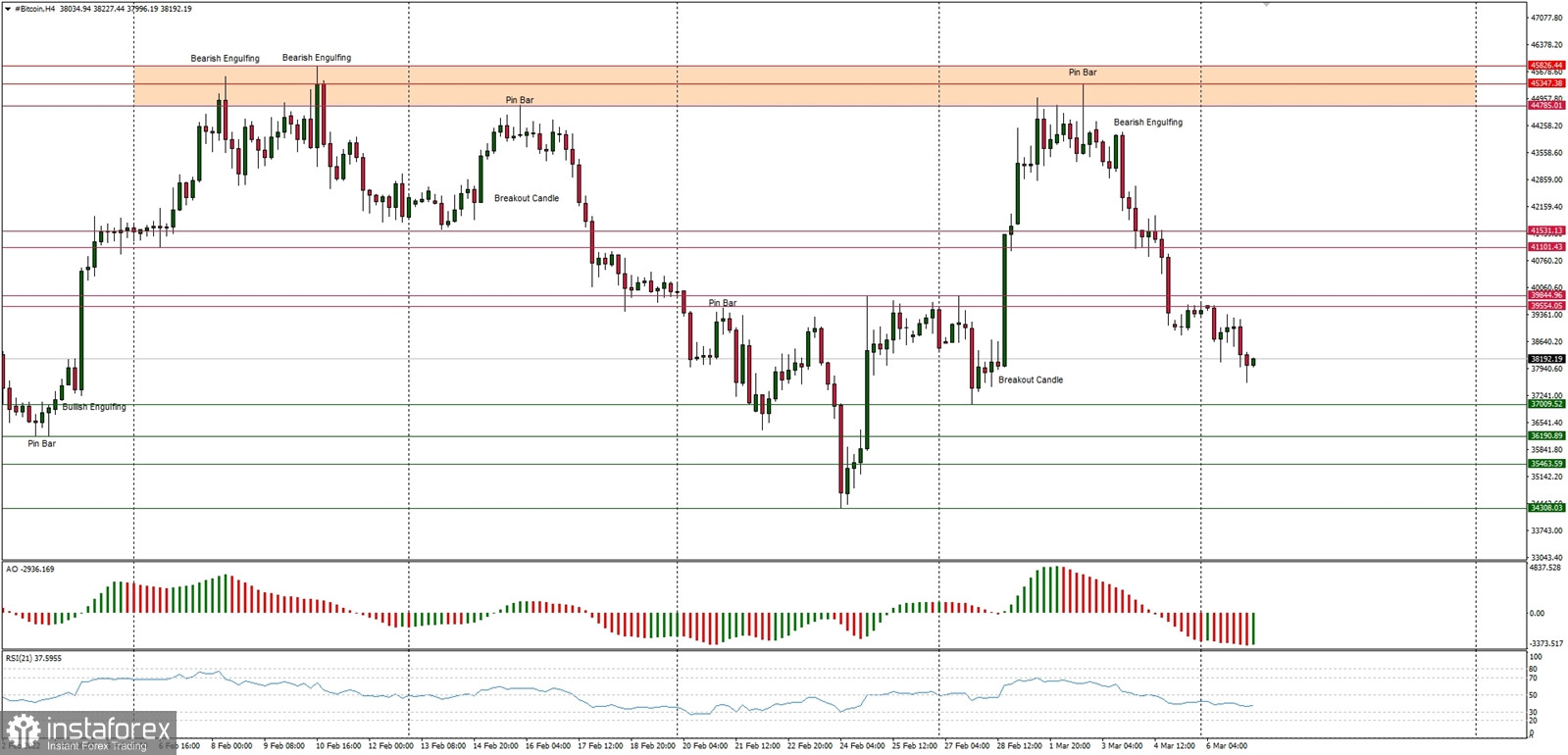

Technical Market Outlook

The BTC/USD pair had broken below all of the Fibonacci retracement levels after the rejection from the technical resistance seen at $45,421 level. The bears are in control of the market and the target for them is located at the swing low seen at $32,806. The momentum is weak and negative, so even despite the extremely oversold mark et conditions on the H4 time frame the down move might continue for some time. The technical support levels are seen at $37,009, $36,190 and $35,546. The immediate technical resistance is seen at the level of $39,554. Only a clear and sustained breakout above the 38% Fibonacci retracement located around $46,674 level would change the outlook to bullish in the near time.

Weekly Pivot Points:

WR3 - $50,991

WR2 - $48,083

WR1 - $42,916

Weekly Pivot - $40,144

WS1 - $35,041

WS2 - $32,033

WS3 - $26,666

Trading Outlook:

The market still keeps trying to bounce after over the 60% retracement made since the ATH at the level of $68,998 was made. The level of $45,427 is the key technical resistance for bulls, but the game changing technical supply zone is seen between the levels of $52,033 - $52,899. When this zone is clearly broken, the BTC is back to the up trend, otherwise the bearish pressure might push down the BTC towards the level of $29,254.