While investors are debating whether Bitcoin can replace gold as a store of value, the precious metal is recouping losses. XAU/USD quotes reached a one-week high against the background of the ongoing retreat of the US dollar and the rise in the yield of 10-year Treasury bonds to 1%. The most interesting thing is that one of the most significant daily sales of gold since 2013, which took place at the auction on November 9, also happened against the background of a rise in debt market rates. The precious metal took this factor very differently, and we must admit that it has reasons for this.

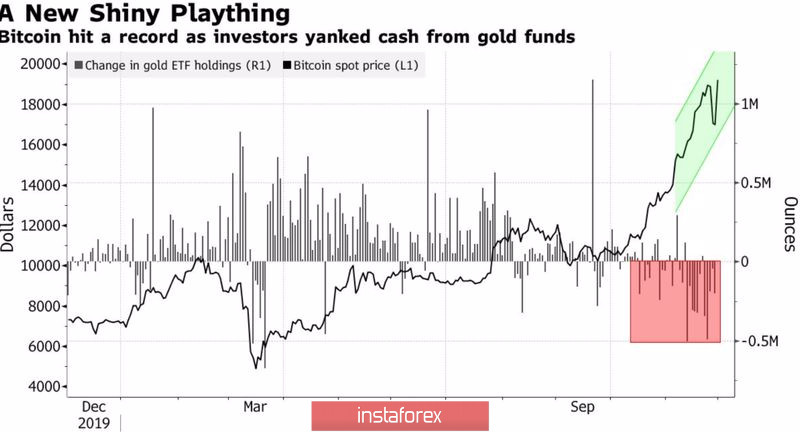

Since the start of 2020, Bitcoin has gained about 150%, and its November rally coincided with an outflow of capital from gold-focused ETFs. There is a growing perception in the market that the precious metal was a good tool for portfolio diversification and inflation protection for the baby boomer generation. Now the reality is different. A new generation is choosing cryptocurrencies. CoinShares estimates that the current size of the Bitcoin market is only 3.1% of the size of the gold market. If this ratio rises to 5%, BTCUSD quotes will soar to 31300.

Dynamics of Bitcoin and Capital Flows in Gold ETFs:

Anyway, we analyze gold. In my opinion, its December success is related to the revival of the idea of a reflationary environment. If before the presidential election, Republicans were not ready to provide the US economy with more than $650 billion, now their leader in the Senate, Mitch McConnell, is talking about $1.4 trillion. The amount is even larger than the bipartisan group's $900 billion proposal. The more impressive the fiscal stimulus, the more likely it is to see a CPI crackdown, which is good news for the precious metal.

The bulls on XAUUSD is driven by the information about the growth of inflation expectations, measured using TIPS rates, to the level of 1.83%, the maximum in the last 18 months. The interest rate swap market signals that in 5 years, inflation will exceed the Fed's 2% target and reach 2.25%. If this is the case, then against the background of the Fed's reluctance to raise the Federal funds rate, a drop in the real yield of US Treasury bonds will lead to an increase in gold prices.

The precious metal may well be able to rise from the ashes if the global economy faces a reflationary environment. As I noted in previous articles, investors fear this from happening, as in 2011-2013, that forced them to sell XAUUSD. Let me remind you that after the previous economic crisis, many people were waiting for inflation to accelerate and bought gold, which allowed it to reach a record high of more than $1,900 per ounce at that time. The disappointment led to the breakdown of the bullish trend.

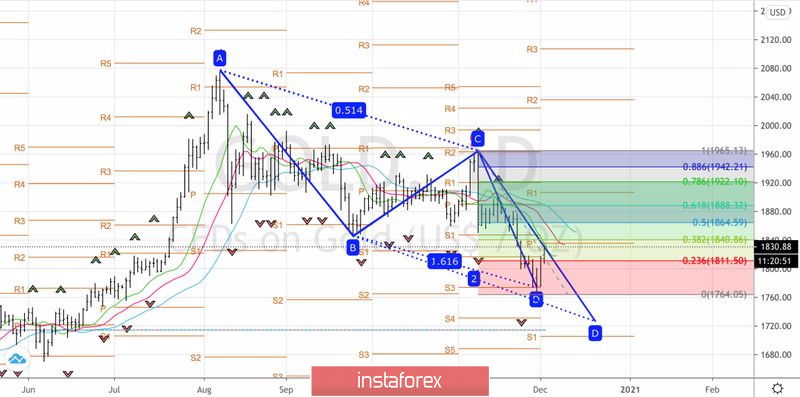

Technically, the precious metal began to correct after the target was completed by 161% using the AB=CD pattern. As a rule, the rebound from the 23.6%, 38.2%, and 50% Fibonacci levels from the last descending wave is used for sales, but in the current situation, I would recommend being doubly careful. Gold should be sold if the bulls are unable to hold above the $1840 and $1865 resistances, with a subsequent return and close below $1810 and $1840 per ounce, respectively.

Gold, daily chart: