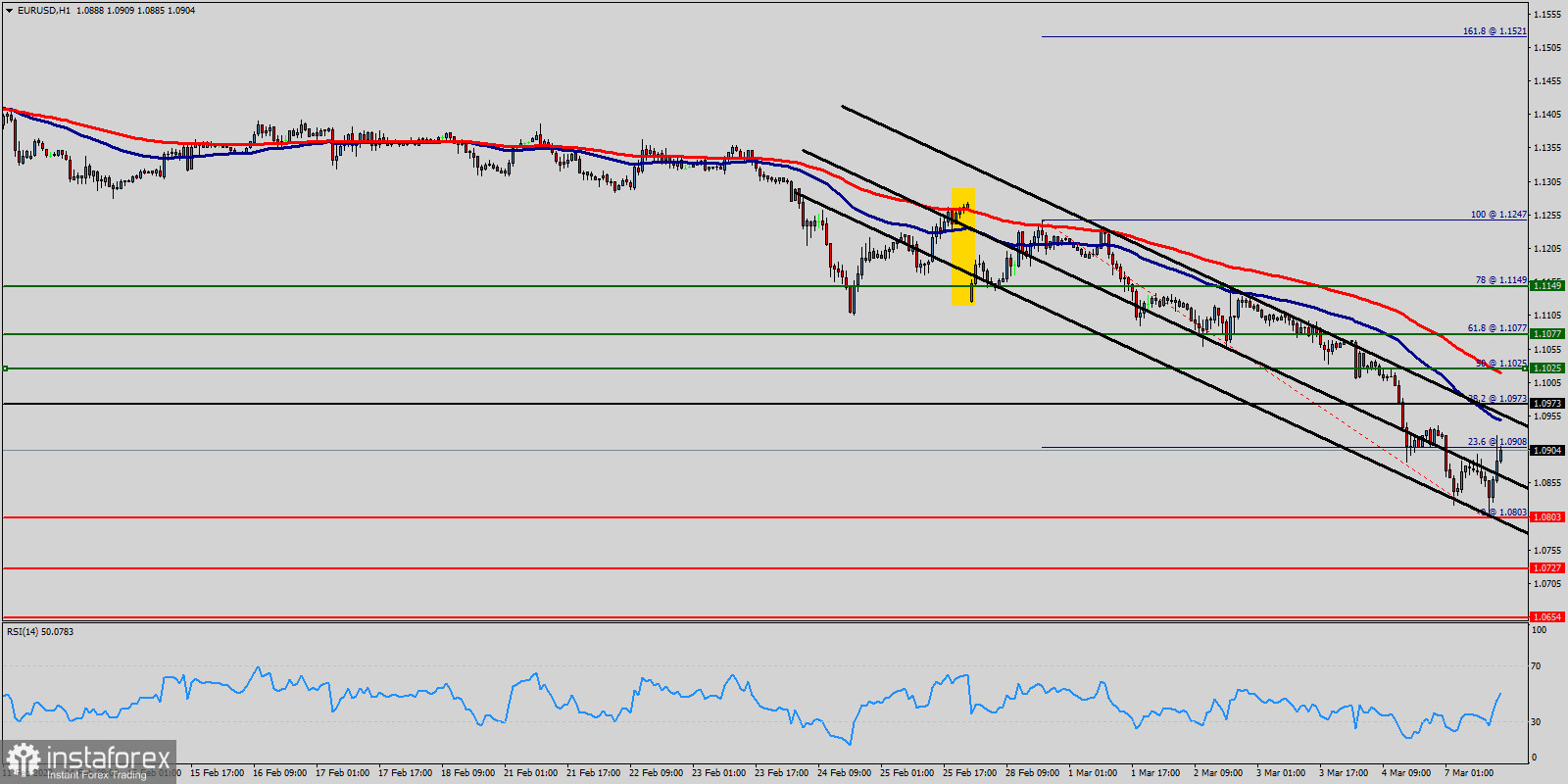

The EUR/USD pair hit the weekly pivot point (1.0973) and support 1 (1.0900), because of the series of relatively equal highs and equal lows.

The pair has dropped down in order to bottom at the point of 1.0803. Hence, the major support was already set at the level of 1.0803.

Currently price is set at the price of 1.0901 on the hourly chart.

Moreover, the double bottom is also coinciding with the major support this week. Additionally, the RSI is still calling for a strong bullish market as well as the current price is also below the moving average 100 and 50.

Therefore, it will be advantageous tosell below the resistance area of 1.0973 with the first target at 1.0803.

From this point, if the pair closes belw the daily support of 1.0803, the EUR/USD pair may resume it movement to 1.0727 to test the weekly support 1.

The price will fall into the bearish market in order to go further towards the strong support at 1.0645 to test it again.

Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at 1.1247.