For the US currency, the new week is extremely unfortunate. The dollar index on Wednesday almost touched support at 91.00. The deeper fall was facilitated by the renewed negotiations between Steven Mnuchin and Nancy Pelosi on further stimulus in the United States. A cross-party group of Senators and members of the House of Representatives proposed $ 908 billion in support measures, and Senate majority leader Mitch McConnell stated that it was necessary to include new stimulus measures in the $ 1.4 trillion spending bill.

Since vaccine aid may be somewhat delayed, the heads of the Federal Reserve and the Treasury Department called on congressmen to provide more support to small businesses. This should help keep the economy from a deeper recession. It seems that incentive measures will be taken after all, and there is an assumption that this may happen before the end of this year.

A weak report from the Institute for Supply Management played against the greenback. On Wednesday, traders are assessing ADP data on the state of the US labor market. If the indicator disappoints again, the US dollar index is at risk to gain a foothold below the level of 91.00. In November, the number of jobs in private companies in the United States increased by 307 thousand, while the markets expected an increase of 410 thousand.

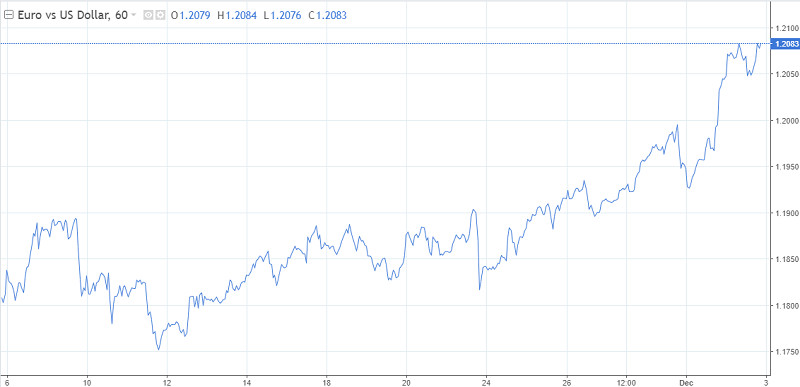

A new wave of decline in the dollar contributed to the growth of the EUR/USD pair to fresh highs. Due to the difference in macroeconomic data, the exchange rate at the moment went to the area of 1.2080. Data on the German labor market was significantly better than the forecast. The number of unemployed fell despite the introduction of lockdowns in November. The final PMI for manufacturing industries was better than the initial estimates, indicating a fairly rapid recovery in business activity.

The major Forex pair broke the established trading range, as previously predicted. Now, the road is open for growth in the range of 1.20-1.25.

Comments from the top US officials caused the wariness of investors and the fall of the dollar. Outgoing Treasury Secretary Steven Mnuchin spoke about the need for extensive new incentives during the pandemic. Meanwhile, future Treasury Secretary and former Fed Chair Janet Yellen called for action as America is close to economic "devastation."

Recent events have inspired euro buyers. However, it is unlikely that the ECB will like this leadership. Financial officials have repeatedly spoken about the negative effects of the growth of the single currency. Excessive appreciation of the exchange rate hurts export potential and creates deflationary risks in the economy of the region. In mid-December, the ECB will hold a meeting, it is possible that the regulator will decide to take measures to curb the growth of the euro.

It is worth noting that the European Central Bank does not have the brisk determination that can sharply reverse the euro exchange rate. As a rule, the regulator's measures are stretched over time, which means that a quick change of direction should not be expected.

The trend in the pair is now set by the dollar, and your focus must be mainly on news headlines from the United States. The key topic is negotiations on a fiscal deal. The euro is likely to try not only to stay at 1.20, but also to reach new highs. And it has all the prerequisites for this. The main risks for the single currency are Brexit negotiations and the bloc's recovery Fund. However, they are weak. If we talk about the ECB, the regulator will not swing a sledgehammer, which is to reduce rates. It can expand targeted assistance to particularly distinguished banks. The European currency is quite satisfied with this state of affairs.

Paying attention to the seasonality, we can say that December will be unfruitful for the dollar. At least in the previous seven years, this period was a month of weakening for the US currency. In this case, speaking of the dollar index, the main struggle will unfold at around 90 points.