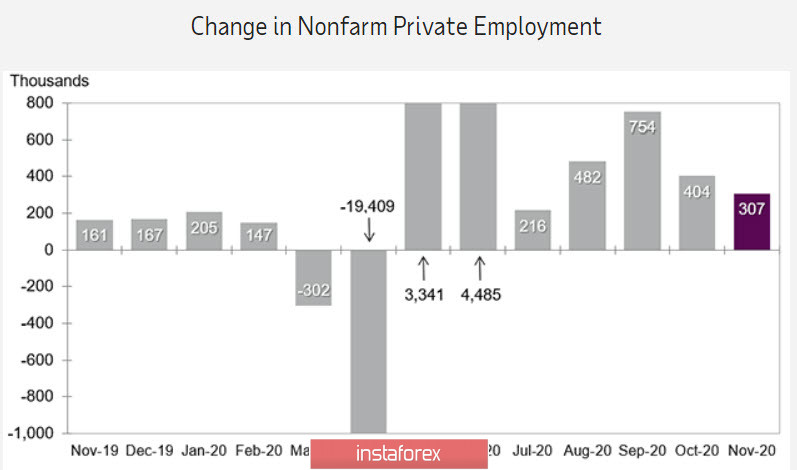

Based on the ADP report, US employment in the non-agricultural private sector rose by 307 thousand, which was significantly worse than forecasted. Despite the strong economic recovery in the third quarter, it is easy to calculate that the employment decline in April by more than 19 million over the following months was counterbalanced by barely 50%.

And although the ISM index in the manufacturing sector turned out to be significantly worse than expected, and employment data continues to decline, ADP observed an employment growth in the construction and industry sector. The contradictions between the ISM and ADP reports add intrigue ahead of the Nonfarms publication tomorrow, but it is already clear that is unlikely to see employment growth above forecast.

The Fed's beige book before the FOMC meeting in mid-December notes signs of slowing activity in some regions in November, which also indirectly indicates the need for new stimulus.

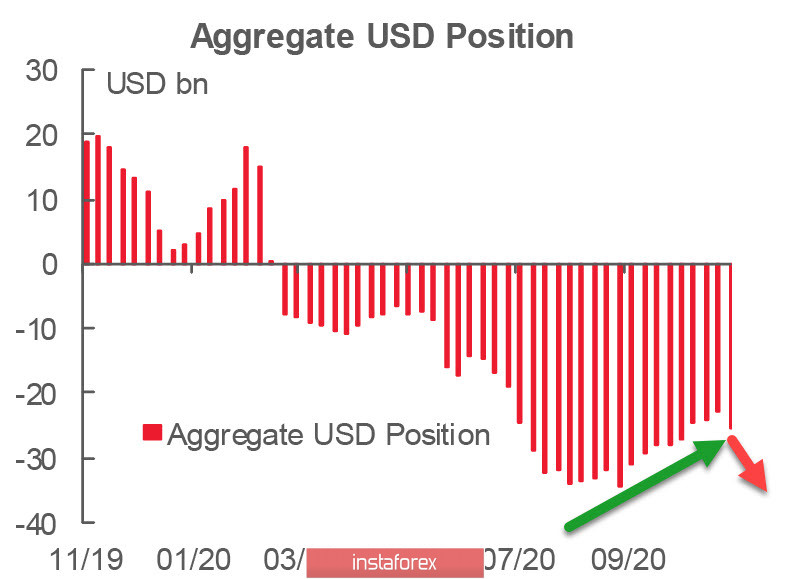

It should also be noted that the CFTC report is clearly bearish for the dollar, even if it is a little outdated by Thursday. All major currencies, with the exception of the NZD, were bullish, and the consolidated short position on the dollar rose by $ 2.535 billion at once. However, the US dollar did not get into positive zone, despite strengthening for almost two months.

Everything indicates that the consensus on the need to introduce the next large-scale stimulus package is getting closer. Republicans took a step forward with a $ 980 billion bill that would at least extend additional unemployment benefits until January 31 and reduce the likelihood of a shutdown. Democrats, in turn, have not yet given an official reaction to the bill, but the markets reacted quickly. In any case, the yield on bonds clearly rose.

Currently, the chances of the dollar strengthening look doubtful, since there are almost no factors that can give the bulls at least some impulse.

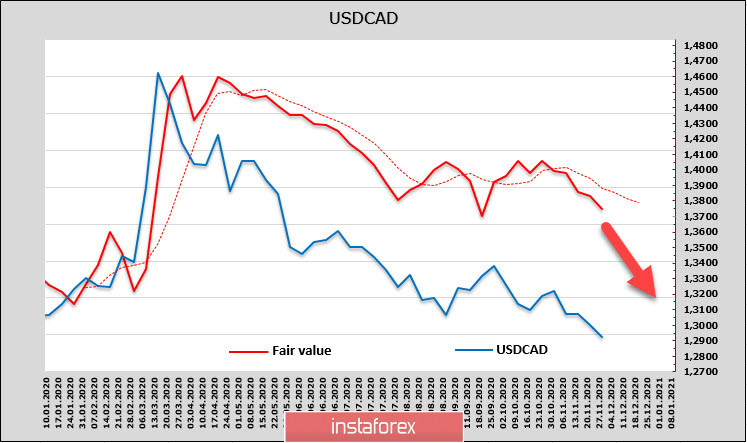

USD/CAD

CAD's net short position is down by $257 million. There is still a strong bearish preponderance, but the trend is changing. Moreover, the target price is located below, which indicates good chances for USD/CAD to decline.

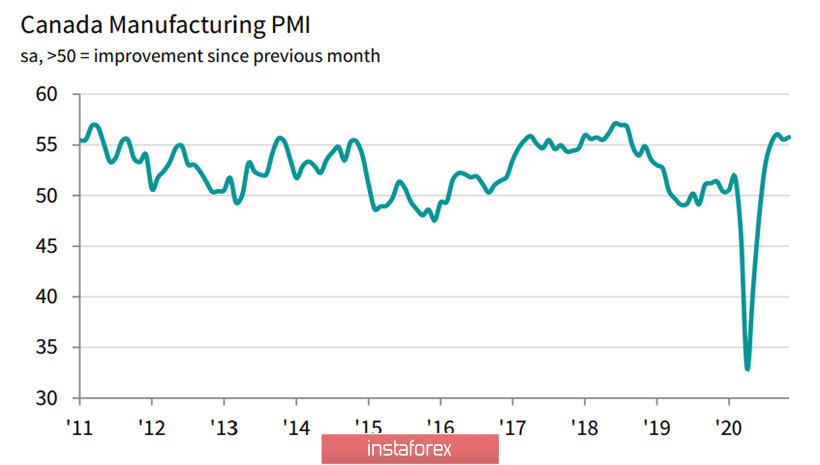

Tomorrow, there will be new guidelines, primarily in the state of the labor market in November. The Canadian economy passed the first wave of COVID-19 more confidently than the United States. There was also less gap in employment and the recovery was faster, which largely determined CAD's high demand. GDP growth in Q3 was 40.5%, which is lower than expected, but better than in the US. At the same time, activity in the manufacturing sector recovered very quickly and continues to grow.

It is not yet clear whether the Bank of Canada assumes any additional steps to stimulate, due to the cautious comments from officials. Moreover, there are no hints that something will change at the next meeting on December 9. This is clearly a bullish situation for the Canadian dollar, since the Fed, on the contrary, is actively hinting at some large-scale measures.

Technically, the USD/CAD pair has consolidated below the support level of 1.2950. The target is 1.2780, which is expected to be reached in the upcoming days.

USD/JPY

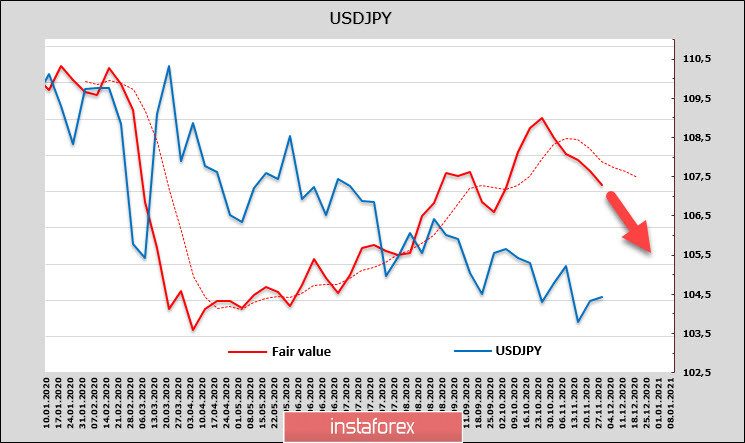

An increase of 1.257 billion was noted again after reducing yen's long position a week ago. The size of the long position is 4.816 billion, with a bullish momentum. The estimated price is directed down, the trend is stable, and it is logical to use upward corrections for sales.

On December 8, the Cabinet of Ministers is expected to approve the next stimulus package, which will have a specific content – green energy and support for the housing market. In general, the stimulus package, which Japan called the "third supplementary budget", will be more than $ 20 trillion, but less than $ 30 trillion yen. This will serve as a bearish factor for the yen and its strengthening amid weak economic recovery.

The resistance zone is 104.90/105.00. In turn, sales are justified within the zone of 104.00/10, with a target of 103.20.