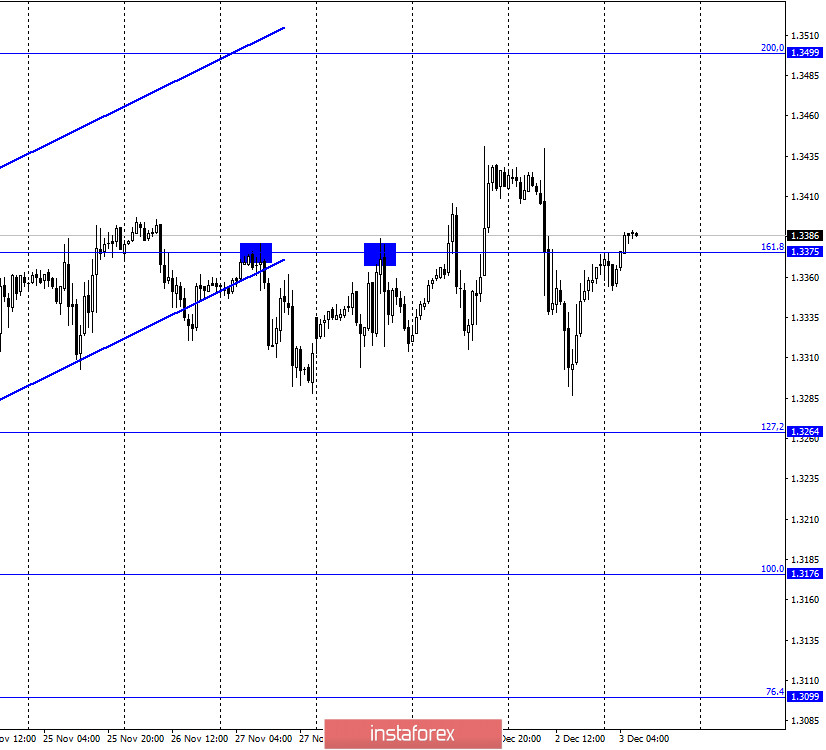

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed another reversal in favor of the British currency, fixing above the corrective level of 161.8% (1.3375), but at the same time, they returned to the side corridor (approximately 1.3304-1.3401). However, you only need to look at the pair's movements over the past week to understand that it is very difficult to work with it at this time. Quotes constantly change the direction of movement, there is no trend. Traders continue to closely monitor the negotiations on the trade deal, as well as the comments made by the participants in this process. According to the latest information, Michel Barnier does not guarantee an agreement, which he told European diplomats. He said that there were still serious differences between the parties on several issues. According to other information, David Frost has softened slightly on the issue of fishing and quotas for this process by European fishing fleets. This is written by the British The Guardian. The newspaper reports that London's offer is now 60%. This is how many percent of the total fish catch should be returned by European fishermen in Britain. Both sides said that everything should be resolved in the next 36-48 hours. Either a trade agreement or a failure. Thus, it is still completely unclear how the negotiations can end, and what is the probability of success. The Briton froze in anticipation of official results and has been in a side corridor for more than a week.

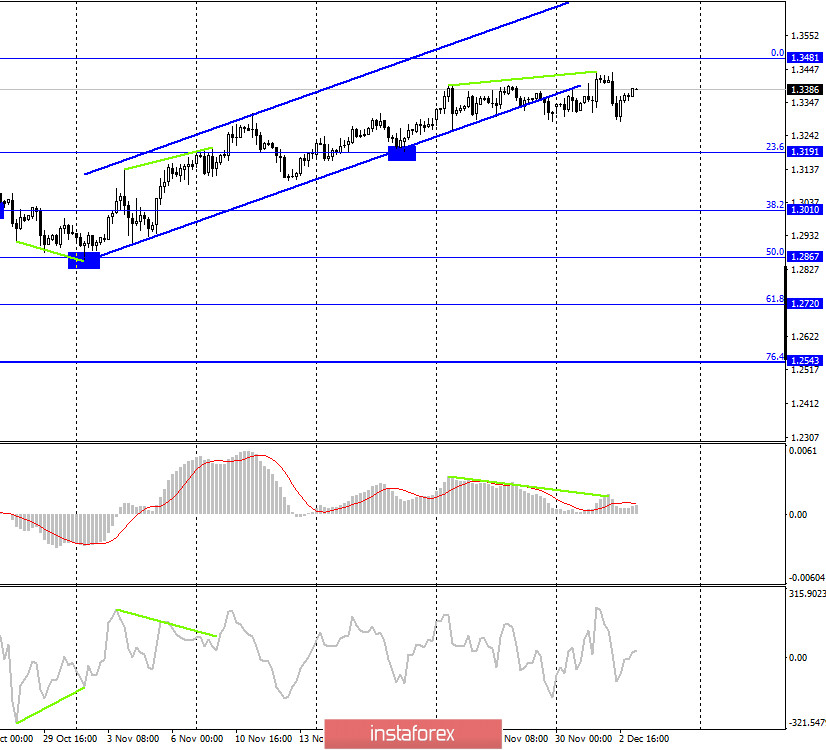

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation under the ascending corridor, as well as on the hourly chart. The bearish divergence of the MACD indicator allowed the quotes to perform a small drop, but in general, there is still movement in the side corridor, which is clearly visible on the hourly chart.

GBP/USD – Daily.

On the daily chart, the pair's quotes continue to grow in the direction of the corrective level of 100.0% (1.3513). However, when trading the pair, I recommend paying more attention to the lower charts. They are more informative.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

There were no economic reports in the UK on Wednesday. And the report from the US and the speech of Jerome Powell did not have much impact on the mood of traders.

News calendar for the US and the UK:

UK - PMI for the services sector (09:30 GMT).

US - number of initial applications for unemployment benefits (13:30 GMT).

US - ISM composite index for the non-manufacturing sector (15:00 GMT).

On December 3, business activity indices for services will be released in Britain and the United States. The number of initial and repeated applications for unemployment benefits in the United States will also be known. Traders are now paying little attention to the information background and are waiting for news from London, where negotiations between Barnier and frost are continuing.

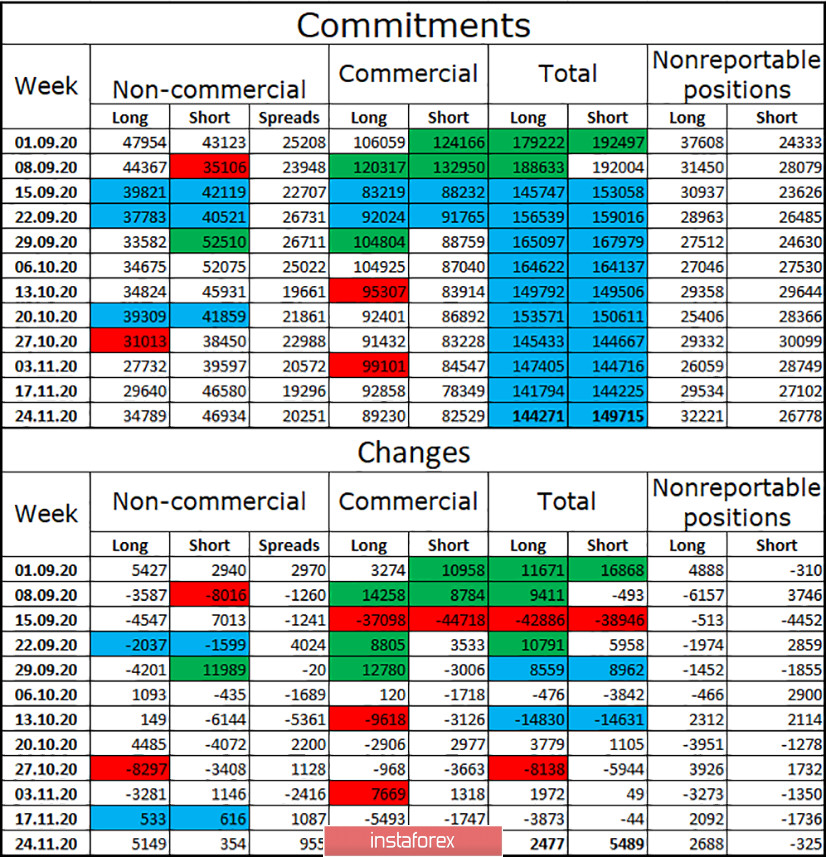

COT(Commitments of Traders) report:

The latest COT report showed a sharp increase in the number of long contracts held by speculators. Thus, the mood for the reporting week in the category of "Non-commercial" traders became more "bullish". However, before that, it became more "bearish" for several weeks, and the British did not get much cheaper. Thus, I believe that one report can not radically change the mood of speculators. There were also 354 short contracts opened, which is very small. In general, I can say that the chances of growth for the British dollar have even increased slightly recently, but most other factors still suggest that this currency should start falling in the near future.

Forecast for GBP/USD and recommendations for traders:

At this time, I recommend that you be extremely careful when opening any trades on the British dollar. First, it is extremely difficult to find signals right now. Secondly, the pair continues to move very raggedly and often changes direction. Third, the side corridor is clearly visible on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.