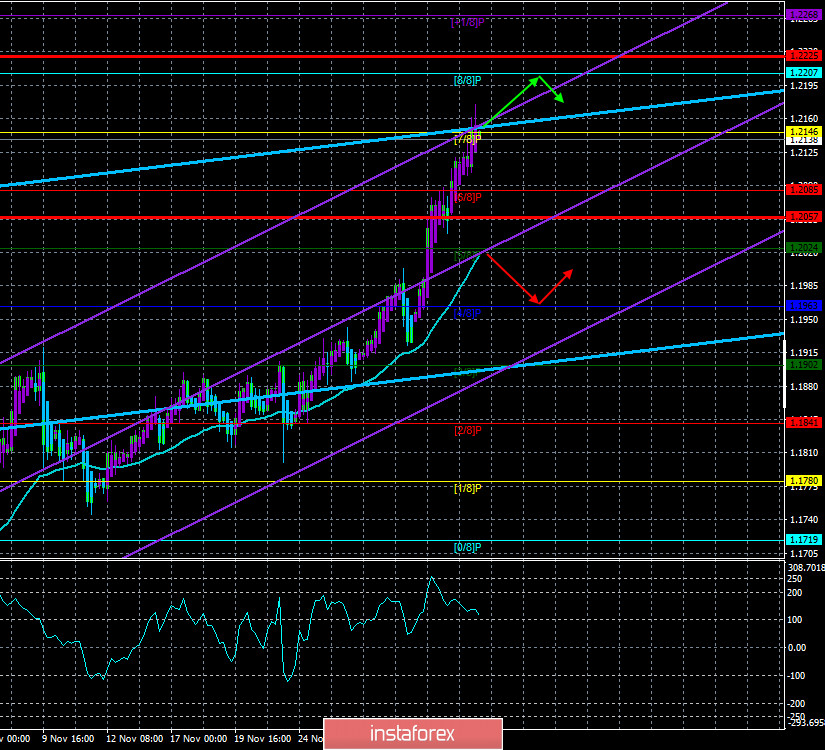

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 114.1784

The fourth trading day of the week for the EUR/USD pair was again in an upward movement. This time, the pair did not even take a short break, but simply continued north. If someone still has doubts about the fact that the current movement is exclusively speculative, then every new day brings more and more evidence of this. For what reasons can the European currency become more expensive at this rate? Over the past 8 trading days, the euro has risen by 300 points. Over the past three trading days – almost 250. In general, the weakness of the US dollar is striking now. We still do not see any good fundamental reasons for such a strong growth of the European currency. If in the period from March to August 2020, the US currency fell quite logically and reasonably, now the reasons for this fall have to be sought out and invented. Therefore, we still recommend trading higher as the upward trend persists. A possible downward reversal of the pair should be kept in mind, however, as we have repeatedly warned, any fundamental hypothesis requires technical confirmation, which is currently not available.

In the meantime, the euro currency is growing steadily and we suggest returning to the discussion of European problems. Yes, it is European, since nothing extraordinary or negative has been happening in the States lately. European Commission President Ursula von der Leyen openly accused the Polish and Hungarian authorities of blocking the budget and the recovery fund. Ursula von der Leyen suggested that Warsaw and Budapest should appeal to the EU court of justice if they think that the budget for 2021-2027 is distributed incorrectly or illegally. "In July, all 27 states and their governments agreed on a new mechanism for allocating funds. It eliminates violations of the rule of law that threaten the European budget. However, two member states expressed doubts," the head of the European Commission said. Ursula von der Leyen also added that if Poland and Hungary have claims, they should be resolved through dialogue or in court, and not at the expense of millions of Europeans who are waiting for help, because the entire European Union is in a deep crisis.

However, German Chancellor Angela Merkel believes that the most important thing now is to unblock the budget and the recovery fund. Since it is Germany that currently holds the EU presidency, this country will negotiate with the troublemaking countries. According to Angela Merkel, the principle of the rule of law and its binding to the distribution of budget funds will have to be improved in order for Poland and Hungary to withdraw their veto. Prime Ministers Mateusz Morawiecki and Viktor Orban said they are open to new proposals. According to the Prime Ministers of Poland and Hungary, the countries will not withdraw their veto if the mechanism for allocating funds from the budget and the anti-crisis fund is tied to the rule of law. Recall that it is the implementation of the rule of law (and democracy) that Brussels has claims to Warsaw and Budapest. According to Brussels, the governments and ruling parties of these countries want to establish undemocratic control over the media and the courts, as well as reject the EU's immigration policy, while negatively treating sexual minorities. Thus, the EU wants to be able to influence these countries by cutting off funding. Naturally, this option does not suit the countries themselves that vetoed the budget and the fund. Recall also that 750 billion euros (anti-crisis fund) consist of 2/3 of grants, that is, gratuitous payments to countries with the most affected by the pandemic economy. Poland and Hungary are among the most affected countries on this list.

Well, the States have their own problems with helping the economy. Recall that at the beginning of autumn, a new package of financing for the economy was discussed for a long time. However, the Democrats and Republicans were not able to agree, and it seems that the main reason for their quarrel was the upcoming elections and not differences in the amount of aid. However, the stimulus package was never provided. The elections were held, and the economy did not feel better without financial injections. In the third quarter in the United States, unprecedented growth was recorded. However, it should be understood that it was recorded after an unprecedented fall. And in the fourth quarter, the US economy is showing signs of slowing again. First, the number of applications for unemployment benefits has increased slightly recently. Second, the labor market has begun to slow down in its recovery. Third, the number of daily reported cases of coronavirus continues to grow. From our point of view, the US economy is now in a more favorable state than the EU economy. It recovered less in the third quarter, however, it may lose less in the fourth. However, this does not mean that it can do without the help of Congress and the Fed. Both congressional representatives and Jerome Powell are well aware that a new stimulus package is needed like air. A bipartisan group of senators, therefore, proposed an alternative plan to the failed one this fall. The essence of the proposal is to provide $ 908 billion to the neediest sectors. Of this, 280 billion will be used to support small businesses, 180 billion for unemployment benefits, and 160 billion for state and city governments. Future US President Joe Biden supports this proposal, believing that such a "raw" option is better than none. Some Republicans also support this proposal. In particular, Treasury Secretary Steven Mnuchin. However, in words this fall, the parties also really wanted to agree and accept the package, but in practice, it turned out differently. However, now the chances of agreeing on the package are still much greater than in the fall.

What does all this mean for the euro and the dollar? By and large, nothing. The dollar stood still for four months when Democrats and Republicans couldn't agree on another aid package. Currently, the budget and the fund are blocked in the EU, and the States may soon agree on a package of stimulus measures, but the euro currency is still growing. Therefore, we continue to insist that speculators and traders themselves are to blame for everything that is happening in the currency market right now, who buy the euro every day, which leads to its growth. However, we also recommend that you trade according to the trend, and therefore support speculative demand for the euro currency. We only warn you that sooner or later the "soap bubble" will burst. Then the European currency may fall in price very much. But this may not happen very soon.

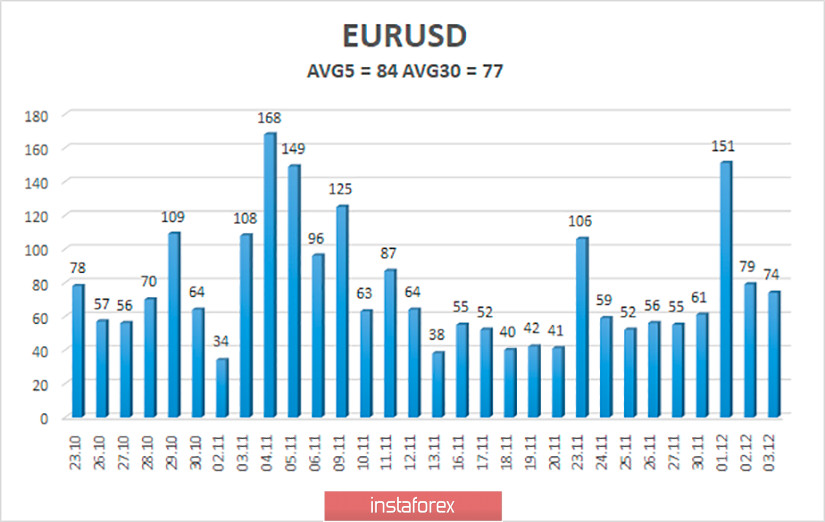

The volatility of the euro/dollar currency pair as of December 4 is 84 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.2057 and 1.2225. A reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The EUR/USD pair continues to increase its upward movement. Thus, today it is recommended to stay in buy orders with targets of 1.2207 and 1.2225 until the Heiken Ashi indicator turns down. It is recommended to consider sell orders if the pair is fixed below the moving average with a target of 1.1963.