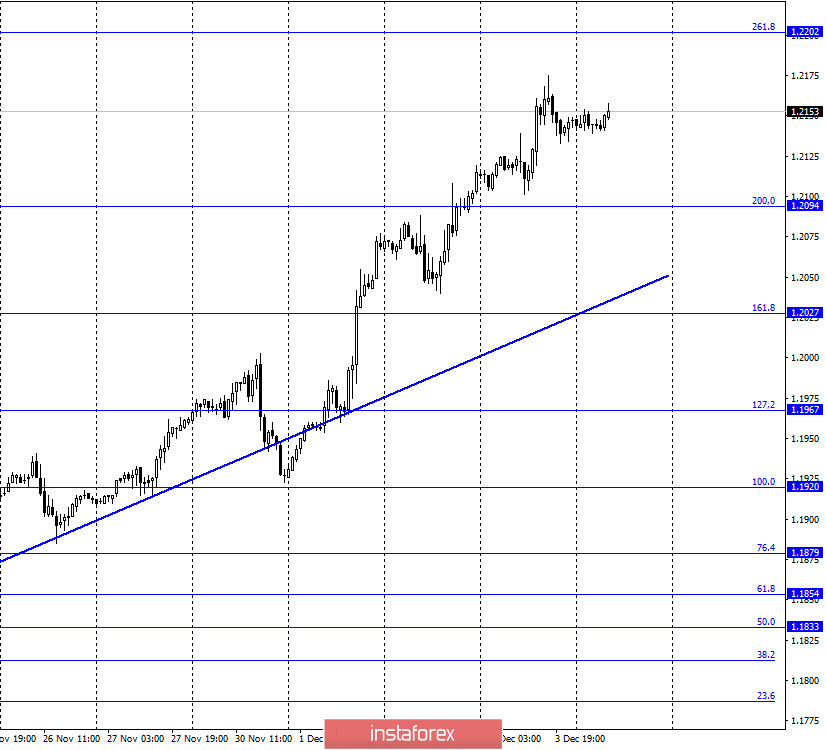

EUR/USD – 1H.

On December 3, the EUR/USD pair continued the growth process in the direction of the corrective level of 261.8% (1.2202). The pair's quotes are far from the trend line. And the trend line is conditional since the pair was anchored under it. The American dollar is still falling in price. Today is the last working day of the week, and it is still unclear what to expect for the US currency and what should happen so that it stops falling in price for at least a day. Today, the dollar's hopes are linked to only two factors. First, today is Friday. On Fridays, markets often do not trade as actively if there was a strong trend before. In other words, a correction may start today, as traders may take a pause that is not related to anything. The second is the American statistics. Important Nonfarm Payrolls indicators, the unemployment rate, and changes in average wages in the United States will be released today. If wages and the unemployment rate are of interest to traders, then the report on Nonfarm can cause a resonance among traders. Moreover, the latest ADP report, which shows the change in the number of employees in the US private sector, was weaker than traders' expectations. Thus, NonFarm may be weaker. And for the American economy, the labor market is of great importance and importance in the issue of economic recovery. Thus, the US will need strong Nonfarm to expect growth throughout today.

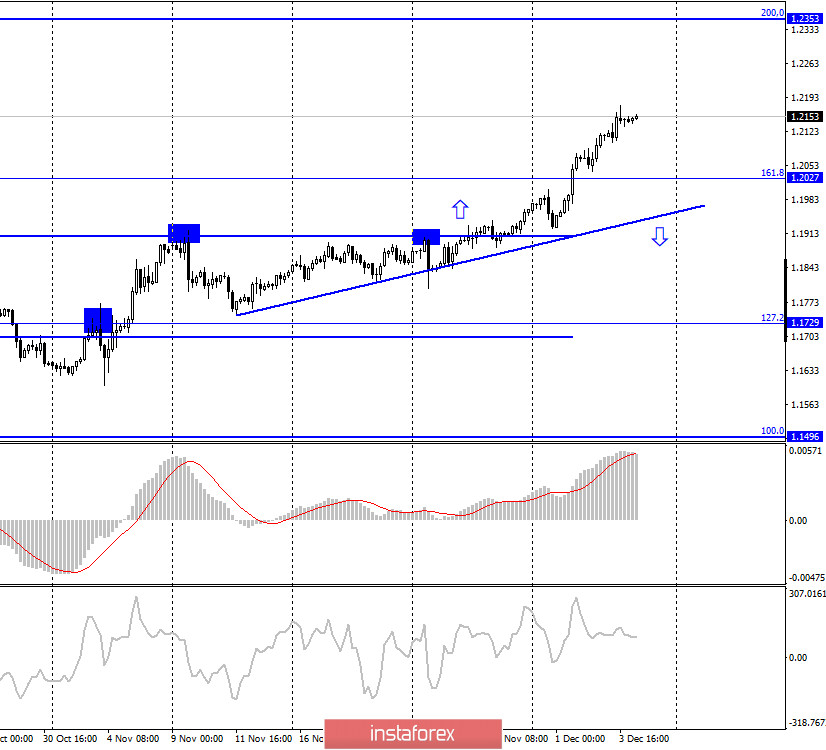

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes have consolidated above the corrective level of 161.8% (1.2027) and continue the growth process towards the next corrective level of 200.0% (1.2353). Today, the divergence is not observed in any indicator. Given the nature of the growth of the euro currency (recoilless), I would say that any technical signals now have a small value.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079). Thus, the probability of continuing growth in the direction of the next corrective level of 423.6% (1.2495) increased.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 3, the European Union released the index of business activity for the service sector (worse than forecasts) and retail sales (better than forecasts), and in America – applications for unemployment benefits (much better than forecasts) and the ISM index for the service sector (worse than forecasts). The American could have received support from traders on this package of reports but did not receive it.

The news calendar for the United States and the European Union:

US - unemployment rate (13:30 GMT).

US - change in the number of people employed in the non-agricultural sector (13:30 GMT).

US - change in the average hourly wage (13:30 GMT).

On December 4, the most interesting reports will be released in the United States. Keep a close eye on the Nonfarm report for November.

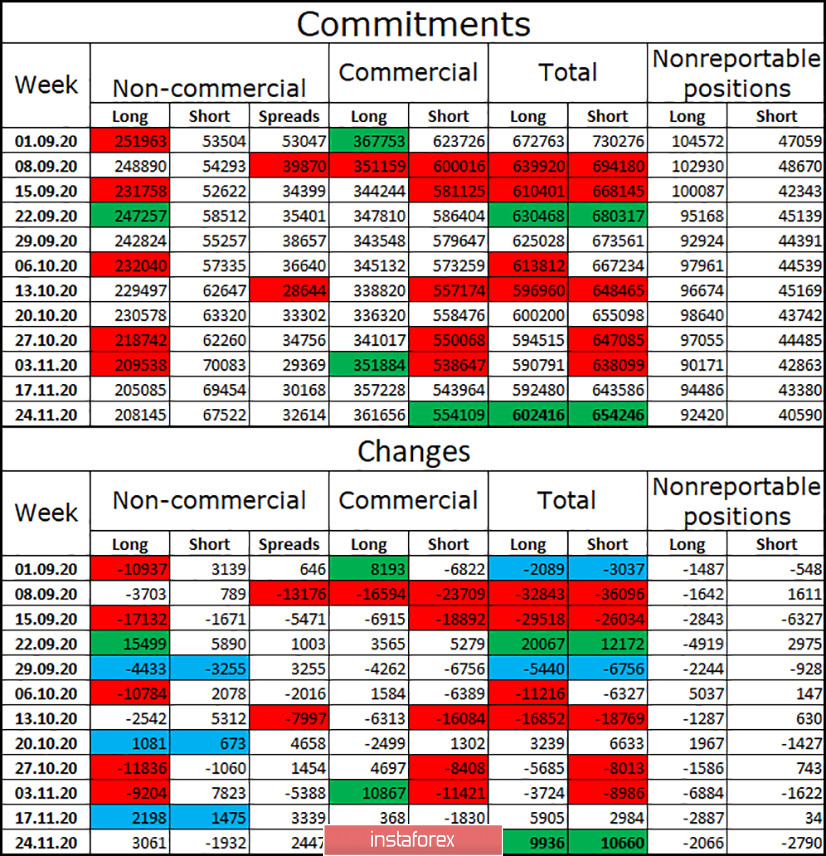

COT (Commitments of Traders) report:

The last COT report was released again late, and there were few changes in it again. The "Non-commercial" category of traders, which is the most important, opened 3,061 new long contracts during the reporting week and closed 1,932 short contracts. Thus, quite unexpectedly, the mood of the major players became more "bullish" after it had become more "bearish" for several months. Perhaps this is an isolated moment and the next report will show a new desire of speculators to get rid of the European currency. However, this is the case now. The total number of long contracts held by speculators is still extremely high, however, the euro currency has grown quite significantly over the past 9 months.

EUR/USD forecast and recommendations for traders:

Today, I do not recommend selling the euro currency as the pair does not have a single level near the top from which it would be possible to perform a rebound. In purchases, the pair can continue to stay with the target near the Fibo level of 261.8% (1.2202), as it was fixed above the level of 200.0% on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.