The news that the United States will be pumping money early next year put pressure on the US dollar.

Yesterday, President-elect Joe Biden backed the adoption of the $ 900 billion worth of stimulus package that was discussed recently in the Congress. However, in his statement, Biden said this is only the beginning of a long journey, and 900 billion is clearly not enough to revive the economy. Last financial year, over $ 3 trillion was used for the economy.

But in spite of this news, the European currency did not grow, mainly because of weak data on the euro area's service sector. According to IHS Markit, the EU's Service PMI fell to 41.7 points in November, but is better than its preliminary figure which is 41.3 points. Back in October, the index was 46.9 points. This did not come as a surprise and did not greatly affect the euro, as everyone already knew that business activity has been affected by new quarantine restrictions designed to contain the second outbreak of COVID-19.

On the topic of COVID-19, Pfizer was reported to have halved its target vaccine supply after encountering problems in its raw materials. The company said the materials it used in the earlier-produced vaccines do not meet the standards, thus, it will purchase a new one, which shifts the planned terms and volumes of supplies. Meanwhile, the number of cases and deaths (from coronavirus) in the US has reached new highs, which once again indicates the likelihood of imposing tighter restrictions by the authorities. If such a decision is made, the US dollar may decline even more.

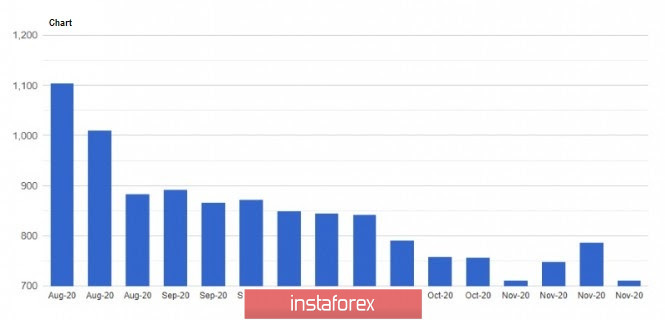

As for economic reports, data on jobless claims decreased in the US last week, which indicates a better state of the labor market after a strong increase in applications a week earlier. According to the US Department of Labor, initial jobless claims for the week of November 21-28 fell by 75,000, amounting to 712,000.

Meanwhile, employment data in the US non-agricultural sector will be published today, and experts project it to come out worse than the previous month's value. They forecast a 480,000 increase in the number of employees, but if the report comes out lower, the pressure on the US dollar will return, which may lead to the continued rise of the euro towards new highs.

At the moment, the technical picture of the EUR / USD pair shows the bulls are clearly aiming for a continued growth towards 1.2200, a breakout of which will definitely give confidence to new buyers, which will push the euro even higher towards 1.2260 and 1.2340. But if the pressure on the pair returns, the quote may collapse to 1.2080 and 1.2040.

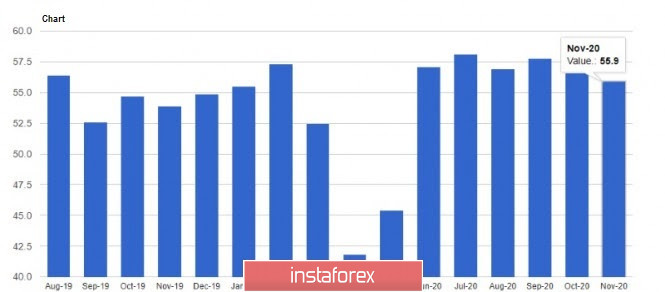

Another report that put pressure on the US dollar yesterday was the signs of a slowdown in the US economy. The report published by the Institute for Supply Management (ISM) said Service PMI continued to rise in November, but at a slower pace. The index fell to 55.9 points in November, after recording 56.6 points in October. Nonetheless, index values above 50 indicate an increase in activity.

S&P also published economic forecasts for the US yesterday, saying the US economy has recovered 2/3 of the losses it suffered during the COVID-19 crisis, but now there are signs of weakness. Therefore, real GDP is projected to contract by 3.9% this year, and will not return to pre-crisis levels until the 3rd quarter of 2021. As for the unemployment rate, it will not return to pre-crisis levels until 2023. The risk of another recession in the US is estimated at 25% -30%.

Such reduced the confidence of dollar bulls, however, a very active growth in the European currency is also not good for the European Union, according to the European Central Bank. The central bank said a massive rise in the euro will harm the economy no less than a partial lockdown.