The USD/JPY pair is trading in the green at 115.71 at the time of writing. It remains to see how it will react after reaching strong and major resistance levels. The pair rallied as the Dollar Index stays higher while the Japanese Yen futures dropped. The bias is bullish, but we still have to wait for strong confirmation before taking action.

Today, the US and the Japanese economic data came in mixed. The US Trade Balance was reported at -89.7B below -87.5B, while the Final Wholesale Inventories rose by 0.8% matching expectations.

On the other hand, the Japanese Current Account dropped unexpectedly lower from 0.81T to 0.19T, the Economy Watchers Sentiment dropped from 37.9 to 37.7 even if the specialists expected a potential growth to 38.1 points, while Lending Indicators came in line with expectations. In addition, the Bank Lending reported worse than expected data, while the Average Cash Earings reported better than expected data.

USD/JPY Buyers In Control!

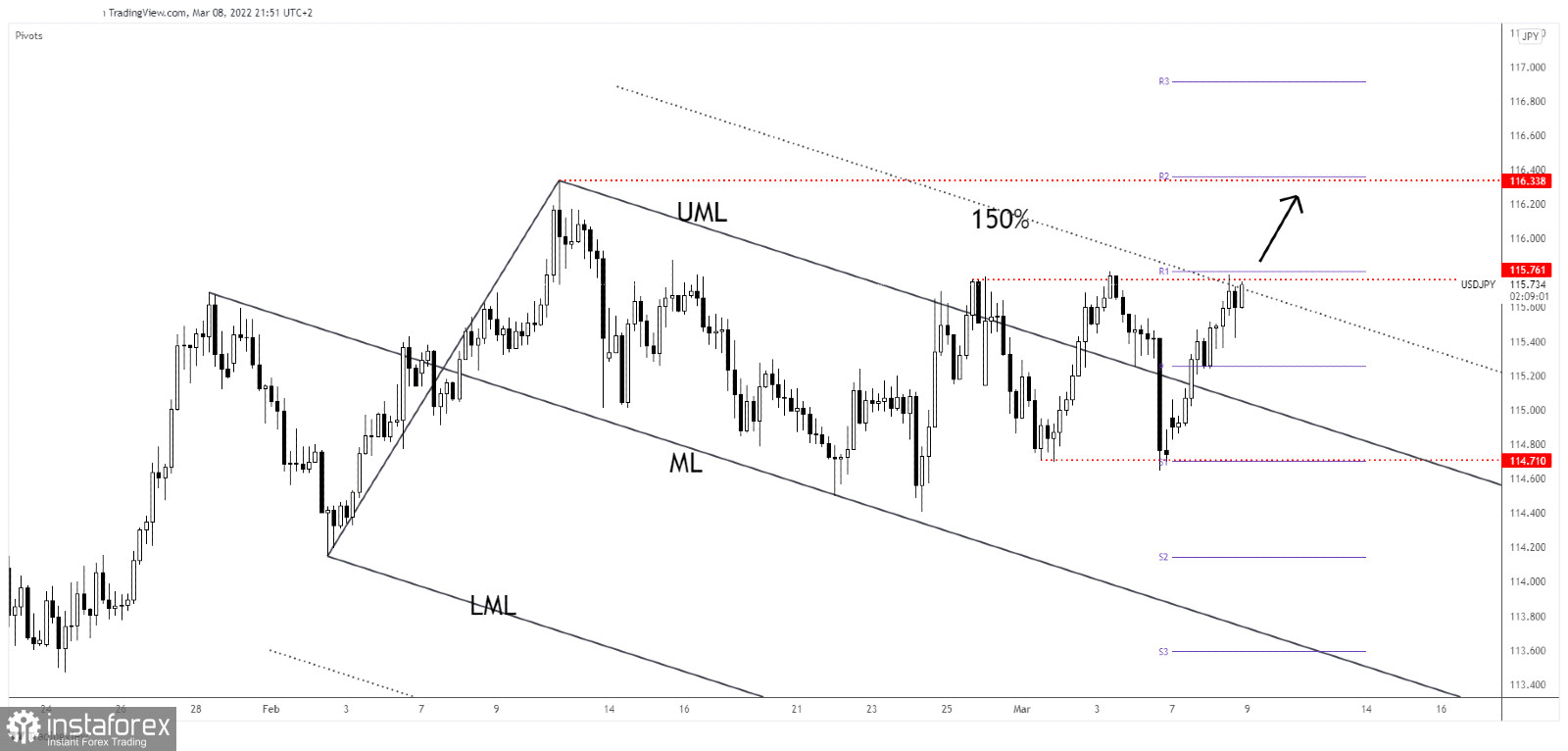

As you can see on the h4 chart, the USD/JPY challenges the 150% Fibonacci line of the descending pitchfork and the 115.76 static resistance. The price registered a strong rally after failing to take out the 114.71 support.

Staying near the immediate resistance levels may announce an imminent upside breakout. Registering only false breakouts may signal new bearish momentum. An upside breakout from the range between 115.76 and 114.71 could activate further growth.

USD/JPY Outlook!

Jumping, closing, and stabilizing above 115.80 could confirm an upside continuation and could bring new buying opportunities with a potential target at 116.33.