Although it is obvious that the week did not end in the best way for the UK, the decline in the pound was clearly extremely limited. Even more symbolic. Largely for the simple reason that investors were generally prepared for another failure in talks between London and Brussels. In fact, ever since the middle of the week, everyone was gradually prepared for the fact that everything would end this way. So the news that the negotiations were again put on hold, or to put it bluntly, they simply stopped this useless activity, did not have the effect of a bomb exploding. Moreover, we found out that Boris Johnson and Ursula von der Leyen would hold emergency talks, designed to revive the negotiation process. This is exactly what happened, so talks will resume in Brussels today. At the same time, you should not have any illusions, since the negotiators should have time to come to an agreement before December 10, which is when the next summit of the heads of the European Union countries will begin and a trade deal with the UK should be considered. And if the parties have not been able to move forward for several years, the chances that they will manage to do it in just a couple of days are almost zero. Judging by the market reaction, it seems that investors are mentally prepared for such a development. Most likely, many expect a repeat of the same thing that happened in this situation - talks and the transition period are to be extended again. It is quite possible that such a decision will be made at the end of the European Union summit.

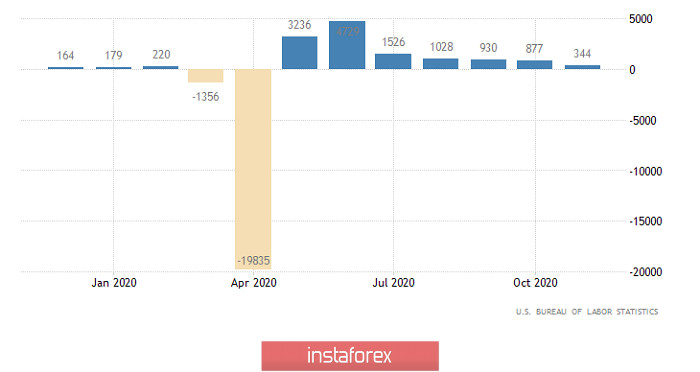

However, if the course of negotiations on Brexit did not come as such a surprise, then the content of the United States Department of Labor report was somewhat surprising. Formally, its content looks pretty good. After all, the unemployment rate fell from 6.9% to 6.7%, which is slightly better than the forecast of 6.8%. So we can conclude that the US labor market continues to recover and nothing threatens the pace of economic recovery. However, only 344,000 new jobs were created outside agriculture. This is approximately one and a half times more than in normal, pre-crisis conditions. But the labor market is clearly far from the state it was in at the end of 2019. Moreover, the projected creation was of 590,000 new jobs. Therefore, the impression that the labor market continues to progressively recover is misleading. Things are not going as well as we would like. This means that there is a high risk that the Federal Reserve will be forced to look for more ways to ease its monetary policy. But so far no one wants to think about it, amid a clear decrease in the unemployment rate in the market.

Number of new jobs created outside agriculture (United States):

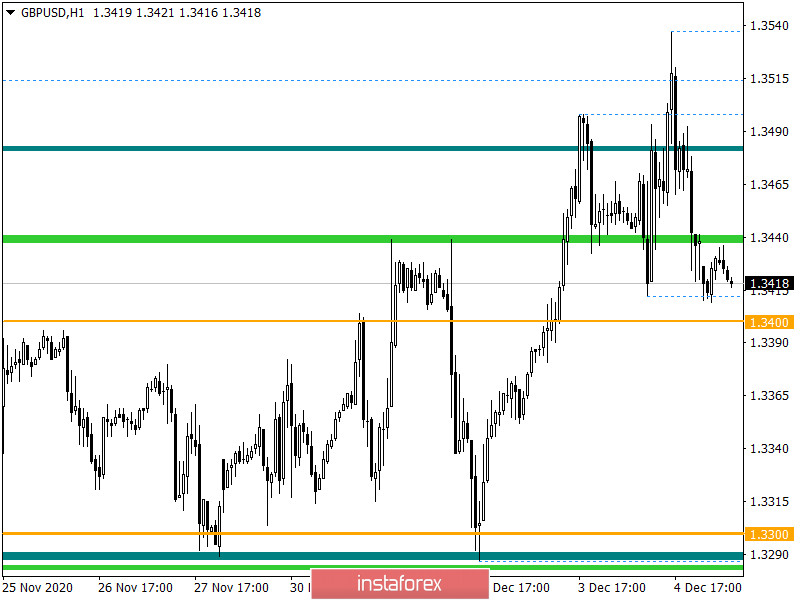

The GBPUSD pair reached the 1.3480/1.3500 resistance area during an intense upward movement, where it tried to break through it, but after a short jolt, a natural rebound occurred. The overbought factor is still present in the market, but the speculative excitement continues to hold the pound at the peak of the upward movement.

As for volatility, it accelerated last week, which was confirmed on the chart in the form of impulsive price changes.

Based on the quote's current location, you can see the process of rebounding from the local high of 1.3537, where the 1.3410 coordinate serves as a variable support.

Looking at the trading chart in general terms, the daily period, you can see a rapid upward move from the end of September with a scale of more than 800 points.

We can assume that in the absence of price taking lower than 1.3400, a temporary horizontal movement in the 1.3400/1.3500 range may appear on the market. You should take note of the fact that the pound is overbought and it is still felt in the market.

From the point of view of a complex indicator analysis, we see that the indicators of technical instruments on the hourly and daily intervals continue to signal buy, while the short-term periods are working at the rebound stage.