Outlook on December 7:

Analytical overview of major pairs on the H1 TF:

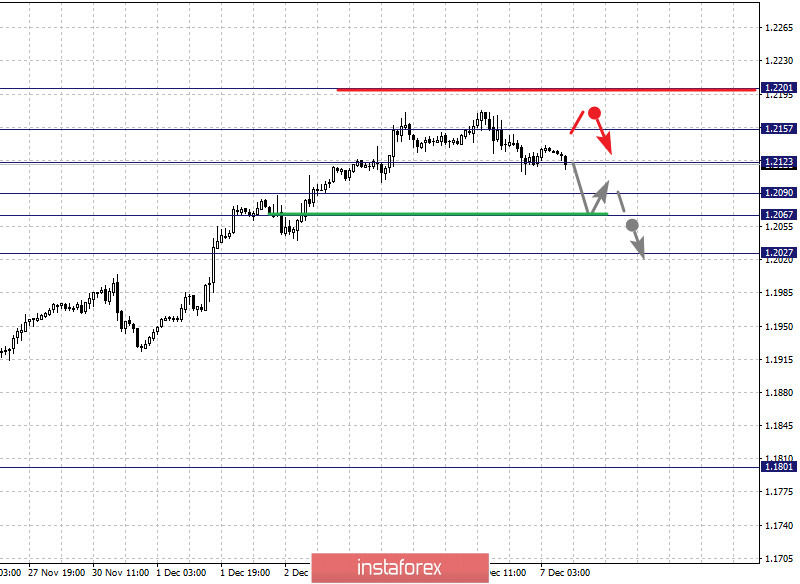

The key levels for the euro/dollar pair are 1.2201, 1.2157, 1.2123, 1.2090, 1.2067 and 1.2027. The rising trend from November 23 is being followed here. Now, a consolidated movement is expected in the range of 1.2123 - 1.2157, hence a key reversal into a downward correction is expected. On the other hand, the level 1.2201 (limit) will be considered as the upward potential target, however, we consider the movement to it as unstable.

A short-term decline, in turn, is possible in the range of 1.2090 - 1.2067. In case that the last value breaks down, a deeper correction may occur. The target here is 1.2027, which is the key support level on the upside.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: Take profit:

Buy: 1.2158 Take profit: 1.2195

Sell: 1.2090 Take profit: 1.2068

Sell: 1.2065 Take profit: 1.2030

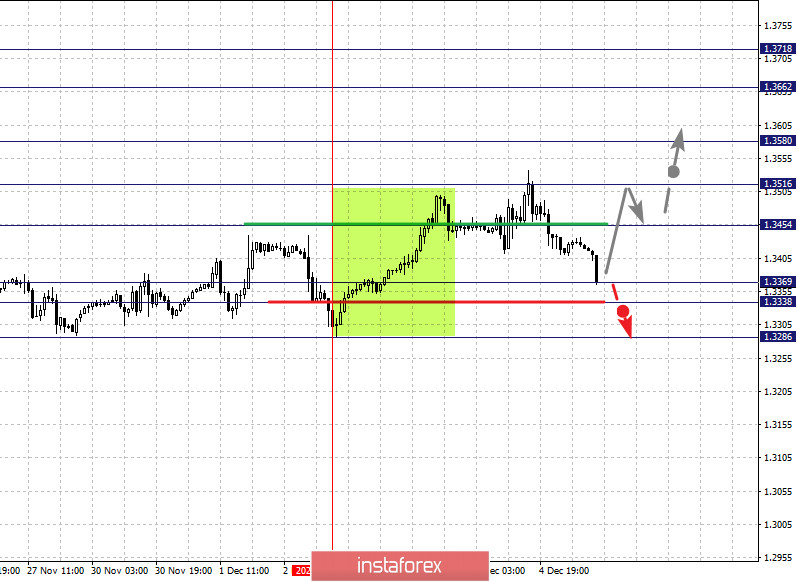

The key levels for the pound/dollar pair are 1.3718, 1.3662, 1.3580, 1.3516, 1.3454, 1.3369, 1.3338 and 1.3286. Here, the price is forming a potential upward trend from December 2. Therefore, we can expect the pair to resume growth after breaking through the level of 1.3454. In this case, the first target is 1.3516. In turn, there is a short-term decline in the range of 1.3516 - 1.3580. If the last value breaks down, it will lead to the development of a strong growth. In this case, the next target is 1.3662. On the other hand, we consider the level of 1.3718 as an upside potential target. Price consolidation and downward pullback is expected upon reaching this level.

The key support for the top is the range of 1.3369 - 1.3338. The price passing this level will encourage the resumption of a downward trend. In this case, the first potential target is 1.3286.

The main trend is the formation of potential trend for growth from December 2, deep correction stage

Trading recommendations:

Buy: 1.3455 Take profit: 1.3514

Buy: 1.3516 Take profit: 1.3580

Sell: Take profit:

Sell: 1.3337 Take profit: 1.3286

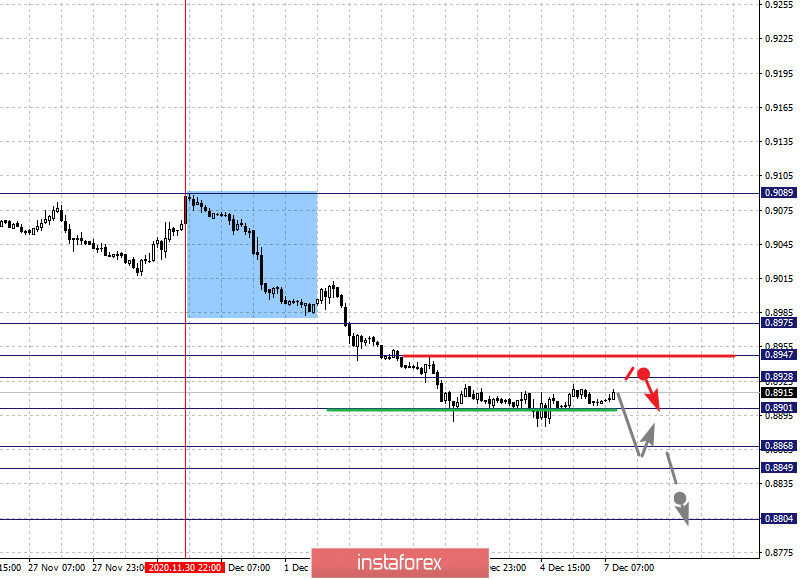

The key levels for the dollar/franc pair are 0.8975, 0.8947, 0.8928, 0.8901, 0.8868, 0.8849 and 0.8804. The development of the downward trend from November 30 is closely monitored here. In this regard, we expect the decline to continue after breaking through the level of 0.8900. In this case, the target is 0.8868, while price consolidation is in the range of 0.8868 - 0.8849. For the potential target on the downside, the level of 0.8804 is considered. An upward pullback can be expected after this level is reached.

On the other hand, short-term growth is possible in the range of 0.8928 - 0.8947. If the last value breaks down, a deep correction will occur. The next target here is 0.8975, which is the key support level for the local downward trend from November 30.

The main trend is the local downward trend of November 30

Trading recommendations:

Buy : 0.8928 Take profit: 0.8946

Buy : 0.8948 Take profit: 0.8975

Sell: 0.8900 Take profit: 0.8868

Sell: 0.8848 Take profit: 0.8805

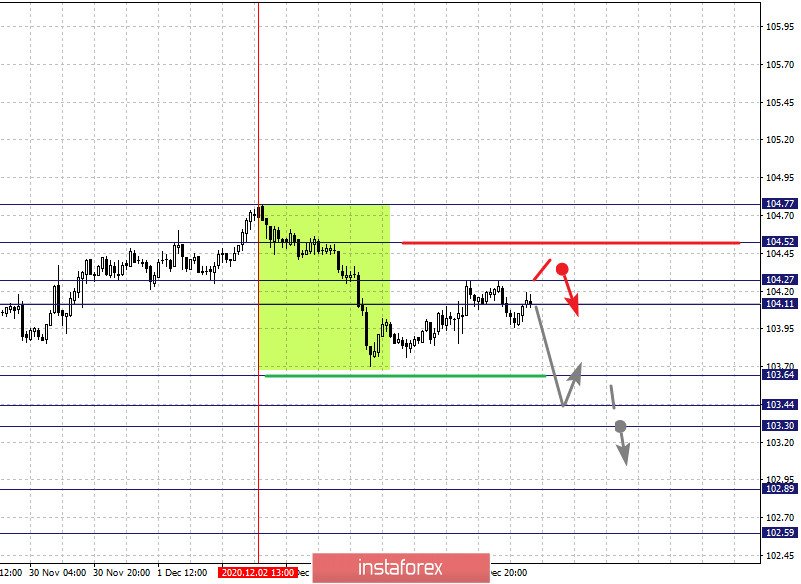

The key levels for the dollar/yen are 104.77, 104.52, 104.27, 104.11, 103.64, 103.44, 103.30, 102.89 and 102.59. The price here is forming a potential downward trend from December 2. Therefore, the downward movement is expected to continue after breaking through the level of 103.64. In this case, the target is 103.44. There is consolidation near this level. On the other hand, the price overcoming the noise range of 103.44 - 130.30 will lead to the resumption of further decline. In this case, the target is 102.89. For the potential target below, the level 102.59 is considered. Price consolidation and upward pullback is expected upon reaching this level.

In turn, short-term rise is possible in the range of 104.11 - 104.27. If the last value breaks down, it will lead to a deep correction. The next target will be 104.52, which is the key support level for the downward trend from December 2.

The main trend is the downward trend from December 2

Trading recommendations:

Buy: 104.11 Take profit: 104.26

Buy : 104.28 Take profit: 104.50

Sell: 103.64 Take profit: 103.45

Sell: 103.30 Take profit: 102.90

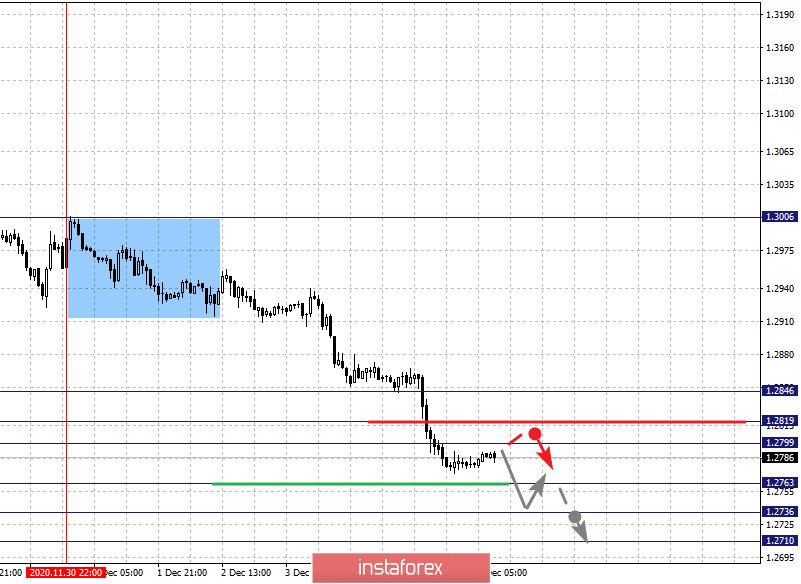

The key levels for the USD/CAD pair are 1.2846, 1.2819, 1.2799, 1.2763, 1.2736 and 1.2710. Here, the continuation of the downward trend from November 30 is being followed. In this regard, a short-term decline is expected in the range of 1.2763 - 1.2736. Given that the last value breaks down, it will lead to the potential target of 1.2710. Upon reaching this level, an upward pullback can be expected.

Meanwhile, short-term growth is possible in the range of 1.2800 - 1.2819. In case that the last value breaks down, a deep correction will further develop. Here, the target is 1.2846, which is the key support level for the downward trend from November 30.

The main trend is the formation of a local downward trend from November 30

Trading recommendations:

Buy: 1.2800 Take profit: 1.2818

Buy : 1.2821 Take profit: 1.2846

Sell: 1.2763 Take profit: 1.2737

Sell: 1.2735 Take profit: 1.2710

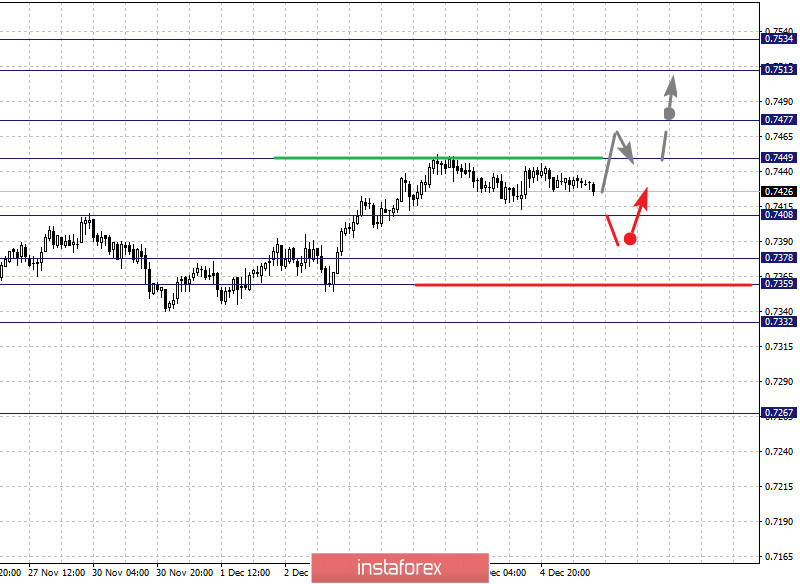

The key levels for the AUD/USD pair are 0.7534, 0.7513, 0.7477, 0.7449, 0.7408, 0.7378, 0.7359 and 0.7332. The local bullish trend from November 23 is being followed here. Thus, short-term growth is expected in the range of 0.7449 - 0.7477. In case that the last value breaks down, it will lead to a strong growth. The target here is 0.7513. For the upward potential value, we consider the level of 0.7534. Price consolidation and downward pullback are expected after this level is reached.

Leaving into a correction, in turn, is expected after the level of 0.7408 breaks down. The next target is 0.7378. On the other hand, the range of 0.7378 - 0.7359 is the key upward support and the price passing this level will encourage the formation of initial conditions for a downward trend. In this case, the potential target is 0.7332.

The main trend is the upward trend from November 23

Trading recommendations:

Buy: 0.7450 Take profit: 0.7475

Buy: 0.7478 Take profit: 0.7513

Sell : 0.7406 Take profit : 0.7380

Sell: 0.7357 Take profit: 0.7332

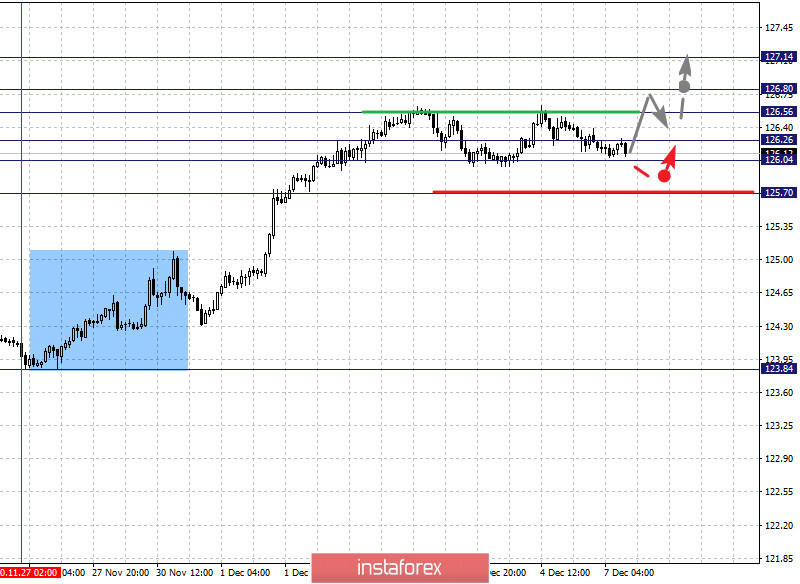

The key levels for the euro/yen pair are 127.14, 126.80, 126.56, 126.26, 126.04 and 125.70. Here, we are following the local upward trend from November 27. In this regard, a short-term rise is expected in the range of 126.56 - 126.80. Provided that the last value breaks down, it will allow us to move to the next potential target - 127.14. Upon reaching this level, a downward pullback can be expected.

On the other hand, a short-term decline is possible in the range of 126.26 - 126.04. The breakdown of the last value will lead to a deep correction. The potential target here is 125.70.

The main trend is the local upward trend of November 27

Trading recommendations:

Buy: 126.57 Take profit: 126.80

Buy: 126.82 Take profit: 127.14

Sell: Take profit:

Sell: 126.03 Take profit: 125.72

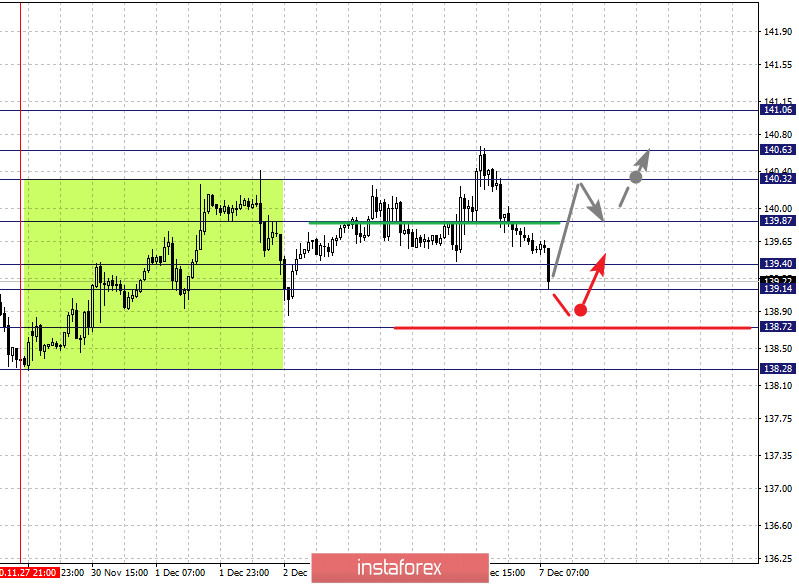

The key levels for the pound/yen pair are 141.06, 140.63, 140.32, 139.87, 139.40, 139.14, 138.72 and 138.28. The ascending trend from November 27 is monitored here. In view of this, we expect the pair to continue rising after the level of 139.87 breaks down. In this case, the target is 140.32. Meanwhile, there is a short-term growth and consolidation in the range of 140.32 - 140.63. For the upside potential target, the level 141.06 is considered. A downward pullback is expected after reaching this level.

A short-term decline is possible in the range of 139.40 - 139.14 and breaking through the last value will lead to a deep correction. The target here is 138.72, which is the upward key support level.

The main trend is the upward trend from November 27 high

Trading recommendations:

Buy: 139.88 Take profit: 140.32

Buy: 140.33 Take profit: 140.62

Sell: 139.40 Take profit: 139.15

Sell: 139.10 Take profit: 138.74