The AUD/USD pair is trading in the green at 0.7281 level at the time of writing but the downside pressure remains high. The pair is trying to rebound as the Dollar Index has retreated a little. After its amazing sell-off, a temporary rebound is natural. It could test and retest near-term broken obstacles before resuming its drop.

Fundamentally, the Aussie received a hit from the Australian Westpac Consumer Sentiment which registered a 4.2% drop more versus a 1.3% drop in the previous reporting period. On the other hand, the AUD could still try to rebound as the Chinese CPI rose 0.9% matching expectations, while the PPI registered an 8.8% growth beating the 8.5% expected.

Later today, the JOLTS Job Openings indicator is expected at 10.96M in January versus 10.93M in the previous reporting period.

AUD/USD Validates Its Breakdown!

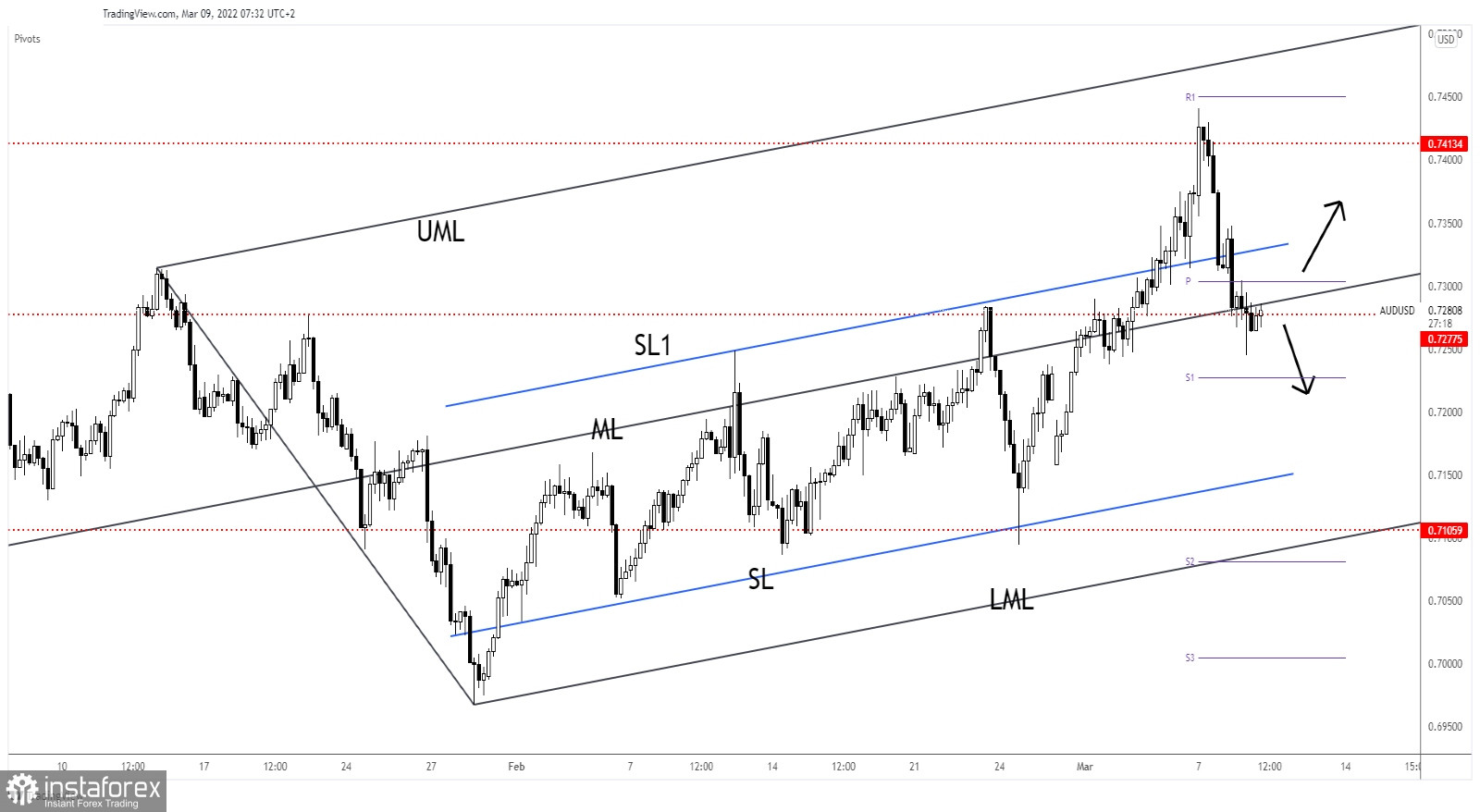

Technically, the currency pair found resistance right above the 0.7413 key level. After that, it has registered a strong sell-off. Now, it's located below the ascending pitchfork's median line (ML) and under the weekly pivot point of 0.7303.

In the short term, AUD/USD could test and retest these levels before dropping deeper. Stabilizing below the ML may signal more declines. Only coming back and stabilizing above the median line (ML) and above the weekly pivot point could really announce that AUD/USD could come back higher.

AUD/USD Forecast!

Testing and retesting the 0.73 psychological level and the median line (ML), registering only false breakouts could confirm a deeper drop and could bring new short opportunities. A temporary rebound could help the sellers to catch a new bearish movement.