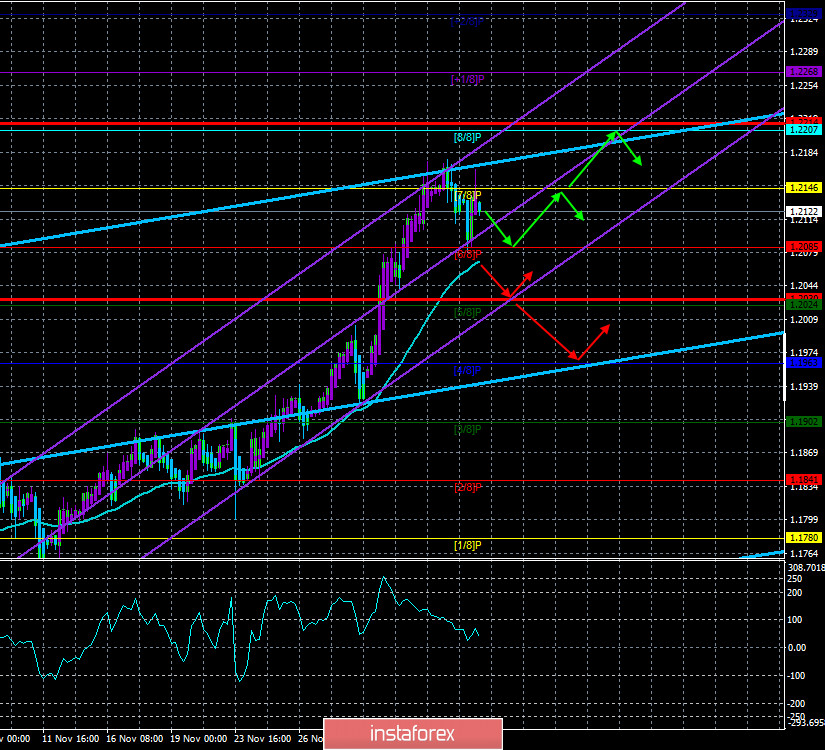

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 41.8104

The first trading day of the week for the EUR/USD pair passed in a futile attempt to adjust to the moving average line. Given the fairly strong strengthening of the European currency in the last two weeks, traders were entitled to expect a correction at least to the moving average (which is the minimum in current conditions). However, as it turned out during Monday, the "bullish" mood among traders is so strong that the euro/dollar quotes could not even fall to the moving average. Already in the second half of the day, in the complete absence of any macroeconomic statistics and other fundamental events, the upward movement resumed. Thus, market participants, especially novice traders, could see a new round of absolutely groundless growth. In the last two weeks, the euro currency has only been growing for no reason. The growth is either purely speculative (as oil once grew to $ 140 per barrel) or the pair's rate is now influenced by major players who have different motivation and information from most traders.

In the past few months, the fundamental background for the pair has been extremely plentiful. Perhaps most of the topics that we reviewed were not extremely important and did not have a momentary impact on quotes, however, they could not be ignored. Now we can only highlight a couple of the same topics that are not too important right now, which even theoretically cannot be the reasons for the current fall of the US dollar and the growth of the European currency. We'll look at them below. In the meantime, let me draw the attention of traders to how quickly and abruptly the flow of messages from the White House has dried up. Previously, Donald Trump spoke almost every day, his social media accounts were bursting with new messages and comments. In addition to Trump, representatives of the Senate, Congress, Nancy Pelosi, Steven Mnuchin, and Joe Biden regularly spoke. Now there is a complete news calm. Trump has only spent a couple of weeks trying to convince America that he is not giving up and will seek a review of the results of the vote. However, either he quickly got tired of this occupation, especially given its futility, or the American and world media became uninterested in publishing the US President (who will soon leave office) in their publications and issues. One way or another, global interest has fallen very much to the figure of Donald Trump after he lost the election. However, it seems that the government of the United States went on vacation. Steven Mnuchin or Jerome Powell make comments from time to time, and there is no more interesting information for currency traders and markets. It looks like everyone is just waiting. They are waiting for the official date of January 20, when Donald Trump will leave the White House. Only then will the new Congress and the White House resume their work.

By the way, do not forget that Joe Biden still can not be called the winner of the election. Each state's electoral college will vote on December 14. And although in the vast majority of cases, this is a pure formality. And even though the majority of electors are already ready to vote for Joe Biden. Still, it's better to wait for the official results. However, the US government itself has already begun the process of transferring power from the team of Donald Trump to the team of Joe Biden.

Meanwhile, the European authorities decided to issue an ultimatum to Poland and Hungary. This was stated by an unnamed EU official. Until December 8, that is, until today, the rulers of these countries will have to confirm their veto or express their desire and intentions to start negotiations that will lead to the lifting of the block. According to the European official, the EU authorities want to clearly understand how far the leaders of Poland and Hungary can and want to go in their unwillingness to approve a whole package of bills due to the new "rule of law mechanism". As we said earlier, EU countries can take a different path. They will not try to vote at the EU summit for the entire package of documents and bills at once. They can break it down into separate questions and vote for each one separately. What will it do? This will make it possible to adopt a seven-year budget and a recovery fund to start distributing funds from them in the first quarter of 2021. Individual issues do not require the approval of all 27 member countries of the alliance. 55% of the countries with the highest number of inhabitants will be enough. Thus, Poland and Hungary may be left out of the distribution of the EU's seven-year budget, and most importantly, out of the distribution of the recovery fund, most of the funds of which will be available to the countries most affected by the pandemic in the form of grants, that is, free of charge. European authorities, in particular Ursula von der Leyen, have already criticized Warsaw and Budapest, saying that millions of Europeans should not suffer because of the decision of the leaders of the two countries. However, Warsaw and Budapest have their truth. The only question is whether they are ready to defend it, or will they be saved from the threat of losing funds from the budget and the fund?

According to the same unnamed EU politician, if Mateusz Morawiecki and Viktor Orban do not clarify this issue in the coming days, the European Union will launch the so-called "Plan B". It just implies the adoption of the fund and budget without the votes of Poland and Hungary, and the countries will remain without funding. The next EU summit is scheduled for December 10-11, so after these dates, it will become known for certain about the decision of the "blockers".

Despite the high probability of conflict among the EU member states and not the most enviable state of the EU economy (due to the second "wave" of the pandemic and the second "lockdown"), the European currency continues to grow. As before, we recommend that traders follow the trend. If the euro/dollar pair is growing now (and it is growing almost continuously), then it should be bought. All COT report data and fundamental hypotheses must be supported by specific market movements and specific signals. Without confirmation, they don't make much sense. So far, the pair's quotes remain above the moving average, so the upward trend continues.

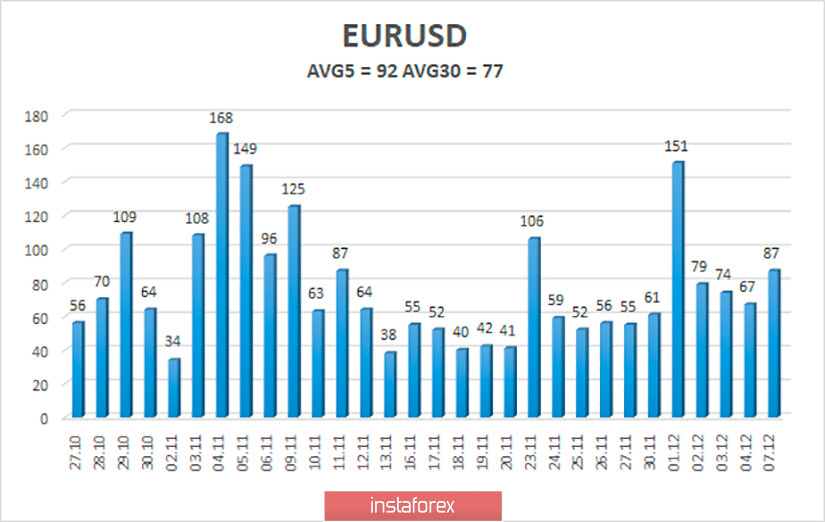

The volatility of the euro/dollar currency pair as of December 7 is 92 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.2020 and 1.2214. A reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The EUR/USD pair started to adjust. Thus, today it is recommended to open new buy orders with a target of 1.2207 and 1.2214 if the Heiken Ashi indicator turns up again. It is recommended to consider sell orders if the pair is fixed below the moving average with targets of 1.2020 and 1.1963.