To open long positions on GBP/USD, you need:

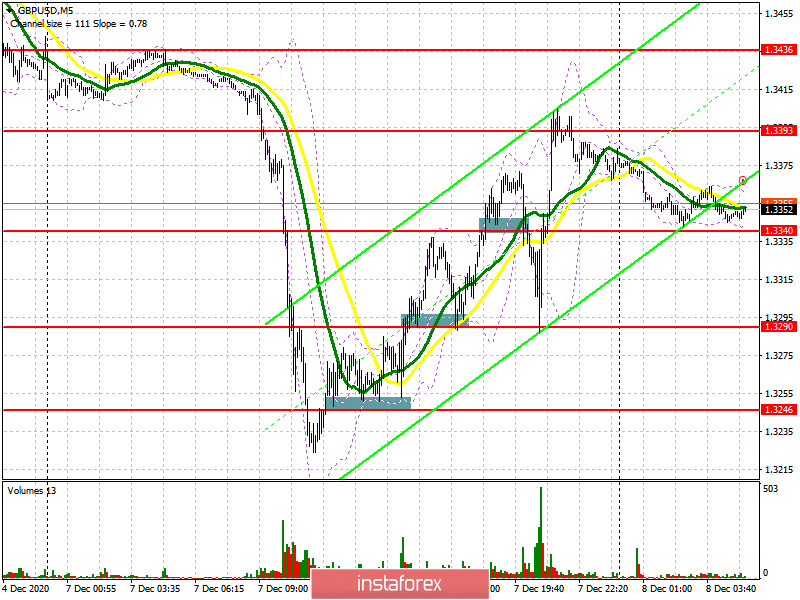

Pound buyers were in control in the afternoon after receiving news that British Prime Minister Boris Johnson would hold talks with European Commission President Ursula von der Leyen. This is the last chance to conclude a trade deal between the UK and the EU. Against this background, the pound strengthened and several interesting signals to enter the market appeared. Let's take a look at the 5-minute chart and break them down. In yesterday's review, I advised you to open long positions after forming a false breakout in the support area of 1.3246, which happened. But if you missed this entry point, you could always enter buy positions after the breakout and when the pair has settled above the resistance level of 1.3290, where a good entry for long deals appeared. A similar update of resistance at 1.3340 and testing it top to bottom resulted in another buy signal. There was no point in selling from these levels, since buyers immediately broke through these areas on its initial test.

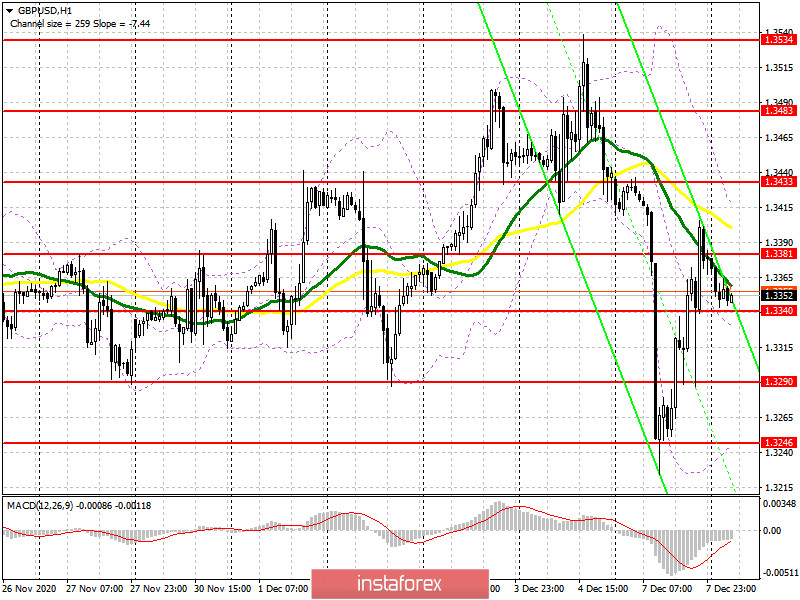

Buyers currently need to maintain their control over the 1.3340 level. Forming a false breakout there in the first half of the day will be an excellent signal to open long positions in hopes for the pound to rise in the short term. The main target will be a breakout and getting the pair to settle above resistance at 1.3381, testing it from top to bottom, similar to yesterday's purchases, produces a convenient entry point for sustaining the pound's growth in order for it to reach a high of 1.3433, where I recommend taking profits. The next goal will be resistances 1.3483 and 1.3534, but they will be available only if we receive good news regarding the outcome of the Brexit trade talks. In case bulls are not active in the support area of 1.3340, it is best not to rush to buy, but wait for a downward correction to the area of the 1.3290 low, where you can try to catch hold of the market, counting on a 20-30 point correction within the day. A larger support level is still at 1.3246, where you can also buy GBP/USD immediately on a rebound, counting on a correction of 20-30 points.

To open short positions on GBP/USD, you need:

Pound sellers retreated from the market again amid rumors that Boris Johnson may make a number of concessions at the last moment in order to conclude a trade deal with the EU. The initial goal is to protect resistance at 1.3381, where forming a false breakout will return pressure to the pair and result in updating the 1.3340 low. The next goal is to form a breakout and get the pair to settle below 1.3340. Testing this level from the bottom up produces a good signal to sell the pound in hopes for it to fall to the 1.3290 and 1.3246 areas, where I recommend taking profits. Bad news on the trade deal will pull down GBP/USD to the 1.3194 and 1.3114 lows. If the bulls manage to regain the 1.3381 level, then it is better not to rush with short positions. The optimal scenario for selling the pound is when the pair fails to settle above 1.3433. I recommend opening short positions immediately on a rebound from the high of 1.3483, counting on a downward correction of 25-30 points within the day. Since we will not receive any news regarding the UK economy today, focus will shift to Brexit.

The Commitment of Traders (COT) reports for November 24 indicates significant interest in the pound, as many traders hoped that the Brexit deal would be finalized. Long non-commercial positions rose from 30,838 to 37,087. At the same time, short non-commercial positions decreased from 47,968 to 44,986. As a result, the negative non-commercial net position was -7,899 against -17,130 a week earlier. This indicates that sellers of the British pound retain control and it also shows their slight advantage in the current situation, but the market is beginning to gradually come back to risks, and reaching a trade deal will help it in this.

Indicator signals:

Moving averages

Trading is carried out just above 30 and 50 moving averages, which indicates an attempt by the bulls to resume the growth of the British pound.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Growth will be limited by the upper level of the indicator around 1.315. A break of the middle border of the indicator in the 1.3340 area will increase pressure by the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.